According to data provided yesterday by the US Department of Energy, commercial oil reserves in the US fell by 5.247 million barrels in the week of April 29-May 5. Oil reserves in the US declined for the fifth week in a row, and this is the largest weekly decline this year. The forecast assumed a drop in inventories of 1.786 million barrels. The prices for oil in response to this message reacted with a sharp increase.

Commodity currencies, and above all, the Canadian dollar, have been supported by rising oil prices. The pair USD / CAD lost 40 points at the time of publication of this data, and the end of yesterday's trading day was already near the mark of 1.3650, which is almost 0.5% lower than the level of yesterday's trading day opening. At the beginning of today's trading day, the pair USD / CAD again rose, largely recouping yesterday's decline.

According to analysts of the oil market, the surplus of oil reserves in the world is still high. As expected, OPEC should extend or agree on a stronger production cut on May 25. If such an agreement is reached, then oil prices, and together with them, commodity currencies (including the Canadian dollar) will receive strong support. The expected OPEC agreement on the extension of agreements to reduce oil production is a strong "bearish" factor for the pair USD / CAD. The expected increase in the June Fed meeting (June 13-14) of the interest rate in the US is a strong “bullish” factor for the pair USD / CAD. As stated yesterday by the president of the Federal Reserve Bank of Boston, Eric Rosengren, "three increases in rates are justified during the current year, provided that the economy will grow in line with the forecasts".

Thus, the pair USD / CAD is on a kind of "balance of weights", and much will depend both on the decisions of the Fed and OPEC, as well as on accompanying statements. To determine the direction of further movement, the pair needs fundamental drivers.

From the news for today we are waiting for data from the USA and Canada. At 12:30 (GMT) will be presented:

• US data - Producer Price Index (PPI), which estimates the average change in wholesale prices determined by manufacturers at all stages of manufacturing. A high result strengthens the US dollar, low - weakens. Forecast: in April the index rose to 0.2% (against -0.1% in March); A weekly report from the US Department of Labor, containing data on the number of initial applications for unemployment benefits. The result above the expected indicates a weak labor market, which has a negative impact on the US dollar. The forecast is expected to increase to 245,000 versus 238,000 for the previous period, which should negatively affect the dollar;

• data for Canada - the price index for new housing for March. The high value of the indicator is a positive factor for CAD, and a low value is negative. Forecast: prices in March rose by 0.2%. At 14:30 (GMT) the quarterly report from the Bank of Canada is published, containing information on the state of the Canadian economy and the bank's policy.

Thus, during the publication of data (12:30 and 14:30 GMT), volatility in the USD / CAD pair is expected to grow.

Support and resistance levels

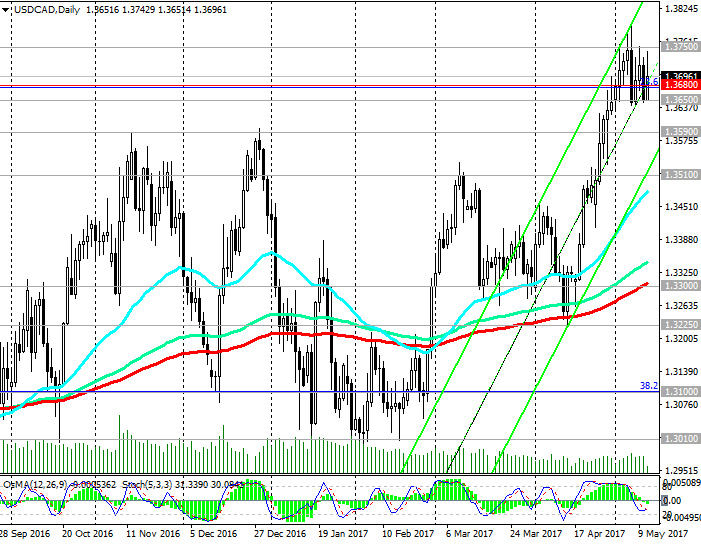

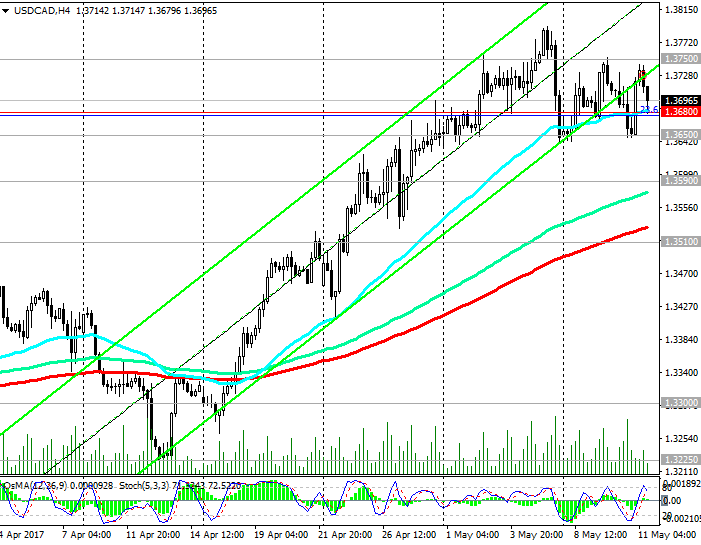

Since the beginning of the month, the pair USD / CAD is trading, basically, in the range between the levels 1.3750, 1.3650. Through the 1.3680 mark, at which the pair USD / CAD is trading in the middle of today's European session, the Fibonacci level is 23.6% (the downward correction for the pair's growth since early July 2014 and the 1.0650 mark) and EMA200 on the 1-hour chart.

Indicators OsMA and Stochastics on the 1-hour, 4-hour, daily charts were deployed to short positions.

In the event of a breakdown of the support level of 1.3680, the downside target will be support levels 1.3650, 1.3590 (November highs, December highs).

Nevertheless, there are all the prerequisites of a fundamental nature for the further growth of the US dollar against commodity currencies, including against the Canadian dollar.

The pair USD / CAD remains significantly above the key support level 1.3300 (EMA200 on the daily chart) in the uplink on the daily chart, the upper limit of which is near the 1.3900 level.

Much in the dynamics of the pair USD / CAD in the medium term will depend, first of all, on the dynamics of the US dollar and oil prices.

Support levels: 1.3680, 1.3650, 1.3590, 1.3510, 1.3300

Resistance levels: 1.3700, 1.3750, 1.3800, 1.3900, 1.3940, 1.4000

Trading Scenarios

Buy Stop 1.3715. Stop-Loss 1.3670. Take-Profit 1.3750, 1.3800, 1.3850, 1.3900, 1.3940

Sell Stop 1.3670. Stop-Loss 1.3715. Take-Profit 1.3590, 1.3510, 1.3300

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics