As the financial and geopolitical tensions in the world decrease (the elections in France, the election of a new president in South Korea, which prioritizes the establishment of relations with the northern neighbor), the monetary policy of the Fed is again on the forefront, aimed at its gradual tightening.

Increase in the propensity of investors to risk is caused by the sale of assets-shelters, such as gold, yen, as well as US government bonds. On Tuesday, the yield of 10-year US government bonds rose to the highest level in more than a month. The index of the dollar WSJ (reflecting the value of the US dollar against the basket of 16 other currencies) increased by 0.3%, to 90.52.

Investors again focus their attention on the high probability of an interest rate increase in the US already in June. The probability of such an increase, according to the CME Group, is approximately 88%.

As the president of the Federal Reserve Bank of Dallas Robert Kaplan stated yesterday, the basic scenario of the Fed envisages three higher interest rates this year. According to Kaplan, raising rates should continue "gradually and patiently." The president of the Federal Reserve Bank of Cleveland, Loretta Mester, also said yesterday that the Fed should not lag behind the schedule for raising interest rates.

With an increase in interest rates, the US dollar becomes more attractive to investors seeking profitability. Now, because of the rapid increase in rates and the possible reduction in the Fed's balance among investors, there is concern that this year there may be a shortage of the US currency.

Concern over Trump's policy and the presidential elections in France is gradually dying out, and strong US macroeconomic data is helping the US dollar recover in the foreign exchange market.

After positive data from the US labor market published on Friday, it is worth paying attention to important data on retail sales and inflation in the US, which are published this Friday at 12:30 (GMT). These data will help the Fed better understand the state of the country's economy. A moderate increase in inflation is expected in April, which will positively affect the US dollar.

Against the backdrop of the strengthening of the "hawkish" position of the Fed on the monetary policy in the US, other major world central banks demonstrate a tendency to pursue a soft monetary policy. In late April, the Bank of Japan kept its monetary policy unchanged. Despite the fact that, according to the bank, the outlook for the economy has improved, inflation still lags behind the forecasts. The bank lowered the inflation forecast for this fiscal year to 1.4% against 1.5% earlier. The forecast for the next financial year remained unchanged at 1.7%.

The Board of the Bank of Japan voted for the preservation of the target level of 10-year government bonds at a zero mark, for maintaining the key rate at the level of -0.1%, and confirmed that the bank will continue to purchase government bonds worth 80 trillion yen per year. The Bank of Japan filed a clear signal that the possibility of raising rates was not yet being considered and that he would continue to pursue an extra soft monetary policy.

Most economists believe that the Bank of Japan will not take any action during the entire fiscal year 2017. The manager of the Bank of Japan Kuroda said today that the weak yen is a plus for capital spending, employment in Japan.

Thus, there is a clear divergence in the direction of the monetary policies of the Bank of Japan and the Fed, which will be the main driver of the pair USD / JPY for the near future.

Technical analysis

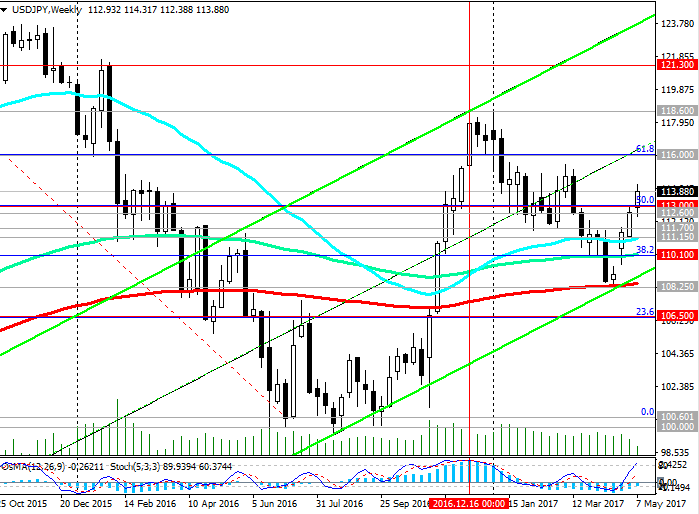

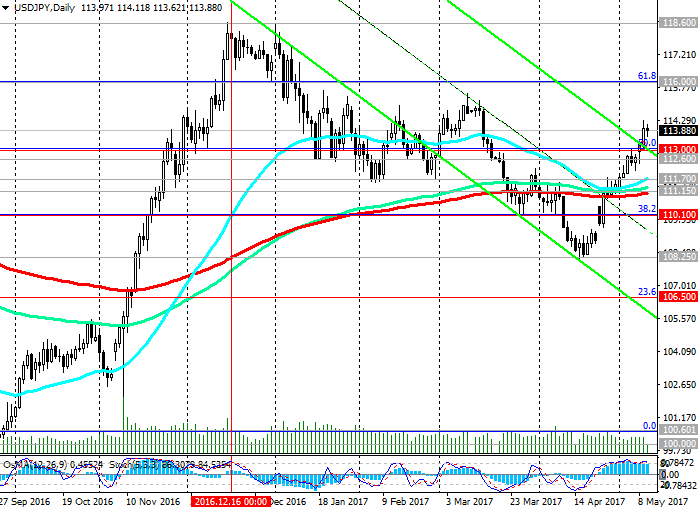

At the beginning of the month, the pair USD / JPY pushed back from the support level of 111.15 (EMA200 on the daily chart), and having broken through an important resistance level of 113.00 (Fibonacci level of 50% correction to the pair growth since August of last year and the level of 99.90, as well as the upper limit of the downward channel on Day chart), develops an upward trend.

On the weekly chart, a new ascending channel was formed, with the upper boundary passing near the level of 125.65 (highs of June 2015). If the growth continues, the level of 125.65 will be a long-term target for the pair USD / JPY. Medium-term goals within this upward channel are 116.00 (Fibonacci level 61.8%), 118.60 (December and January highs), 121.30 (February and November highs).

The alternative scenario will be associated with the breakdown of the support level 113.00 and the return of the pair USD / JPY in the downward channel on the daily chart. The objectives of the decline are levels 111.70 (EMA200 on the 4-hour chart), 111.15 (EMA200 on the daily chart). In case of breakdown of the support level 110.10 (Fibonacci level 38.2%), the negative dynamics of the pair USD / JPY will increase. The closest targets in this case will be the levels of 108.25 (EMA200 on the weekly chart and April lows), 106.50 (the Fibonacci level of 23.6%), the breakdown of which will finally return the pair USD / JPY in a downtrend.

So far, the positive dynamics of the pair USD / JPY is dominating. Preferred are the long positions.

Support levels: 113.00, 112.60, 111.70, 111.15, 110.90, 110.10, 109.00, 108.25, 106.50

Resistance levels: 114.00, 115.00, 116.00

Trading recommendations

Buy Stop 114.35. Stop Loss 113.60. Take-Profit 115.00, 116.00, 117.00, 118.60

Sell Stop 113.60. Stop Loss 114.35. Take-Profit 113.00, 112.60, 111.70, 111.15, 110.90, 110.10, 109.00, 108.25, 106.50

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics