EUR/USD: the positive dynamics of the pair remains above the level of 1.0800

As the electoral situation in France fades into the background, investors' attention is shifted again to the probability of an early increase in the interest rate in the United States. So, according to the CME Group, the probability of a June interest rate hike is estimated by investors at 88%. Another increase is expected closer to the end of the year. The dollar strengthened against the Japanese yen, the euro and a number of emerging-market currencies. Also, quotes of gold are actively falling.

Published on Friday, a monthly report on employment in the US showed that the number of jobs in April rose again, unemployment steadily kept below 5.0%. This may be another argument in favor of an early rate hike in the US.

Today, the ECB Chairman Mario Draghi is scheduled to deliver a speech at 12:00 (GMT). The surge in volatility in the financial markets is usually observed in the period of his speeches immediately after ECB meetings on monetary policy. Other performances, as a rule, cause less volatility. However, in any case, it is necessary to show increased attention when trading in the foreign exchange market, especially the euro and European indices, during the speech of M. Draghi.

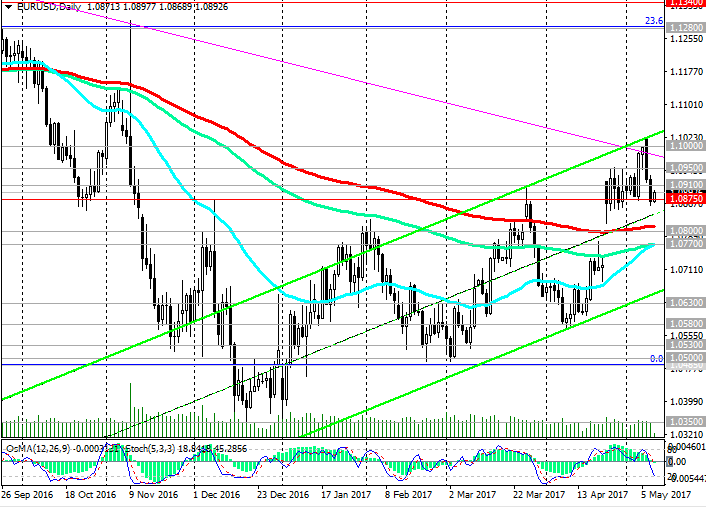

The EUR / USD pair, meanwhile, lost more than 1%, having fallen from the highs reached near the 1.1020 mark just after the results of the elections in France became known.

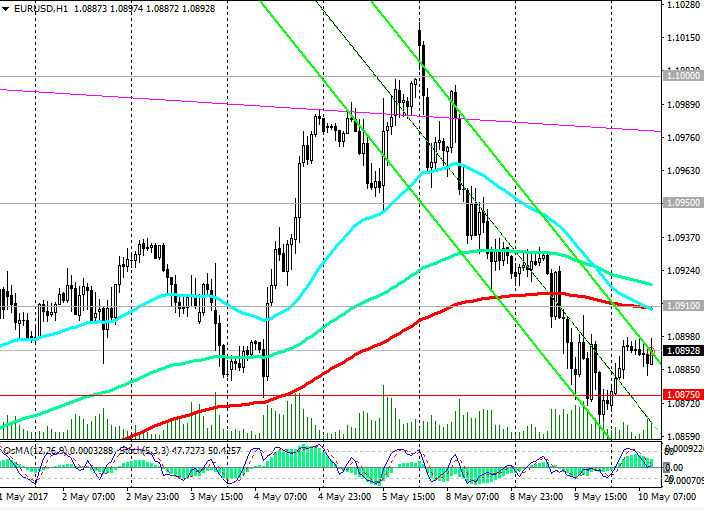

At the beginning of today's European session, the pair EUR / USD is trading near the 1.0890 mark in the descending short-term channel on the 1-hour chart.

Short-term support level 1.0910 (200-period moving average on the 1-hour chart) is punched. In case of further reduction, the target will be the support level 1.0800 (200-period moving average on 4-hour and daily charts), which is key in determining the further medium-term dynamics of the EUR / USD pair.

While the pair EUR / USD is above the level of 1.0800, the positive dynamics of the pair remains.

Support levels: 1.0875, 1.0850, 1.0800, 1.0770, 1.0700, 1.0630, 1.0580, 1.0530, 1.0500

Resistance levels: 1.0910, 1.0950, 1.1000, 1.1200, 1.1280, 1.1340

Trading recommendations

Sell Stop 1.0860. Stop-Loss 1.0915. The objectives are 1.0830, 1.0800, 1.0770, 1.0700, 1.0630, 1.0580, 1.0500

Buy Stop 1.0915. Stop-Loss 1.0860. Objectives 1.0950, 1.1000, 1.1200, 1.1280, 1.1340

https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.