The unconditional center of attention of investors today is the publication of data from the US labor market scheduled for 12:30 (GMT) for April. It is expected that unemployment in April rose by 0.1% to 4.6%, the number of new jobs created outside agricultural production increased by 185 000 (after rising by 98 000 in March). At the same time, the average hourly wage increased by 0.3% (against + 0.2% in March). In general, the data can be called positive. On them, the US dollar, subject to confirmation of the forecast, can receive an additional impetus for growth. Positive data will also give more credibility and confidence to Fed Chairman Janet Yellen, who will begin her speech today in the second half of the US trading session.

As you know, on Wednesday the Fed kept interest rates in the range of 0.75% - 1.0%. The Fed noted that despite the slowdown in US economic growth since the beginning of the year, annual inflation "is close to the target level of 2%," job growth is "strong," and the labor market situation continues to improve. Thus, short-term risks for the economic outlook, in the opinion of the leaders of the Fed, are "generally balanced." Although no new statements have been made about the balance, the Fed is still planning to continue a gradual rate hike.

So far, everything is in favor of the US dollar and against commodity prices, which are denominated in US dollars, as well as against commodity currencies, including the Canadian dollar.

In recent days, there has been a sharp drop in commodity prices. On the Chinese Commodity Exchange, the price of iron ore fell by 8%, and nickel prices retreated to almost a 1-year low in London, copper prices in the US also fell sharply. But most striking is the sharp drop in the price of oil, which has declined by 13% since mid-April.

Speaking in Mexico City yesterday, the chairman of the Bank of Canada Poloz said that US trade policy is a "significant problem" in drawing up economic plans. Apparently, he also had in mind the recent decision by the US to introduce import duties on wood from Canada. "It's no surprise that when there is a threat of trade protectionism, companies do not want to invest in expansion," Poloz said. The risk of protectionism in the US "limits economic growth."

Today, along with the publication of data from the labor market in the United States at 12:30 (GMT) will be published data on the labor market in Canada for April. It is expected that unemployment remained at the same level of 6.7%, and the number of employed increased by 10 000 people. And at 14:00, the Ivey Business Activity Index (PMI), which is an important indicator of the Canadian market and economy, will be published. The figure above the value of 50 is considered a positive factor for CAD. The previous value of the indicator is 61.1, the forecast is 62.3.

In the conditions of a sharp fall in oil prices, it is not necessary to speak about the growth of quotations of the Canadian dollar, which has a correlation with the oil price of about 92%.

The dynamics of the pair USD / CAD today will depend wholly on the dynamics of the US dollar, which has recently strengthened significantly against commodity currencies.

It is not superfluous, perhaps, to recall the sharp increase in volatility during the American trading session, especially at 12:30 (GMT).

Support and resistance levels

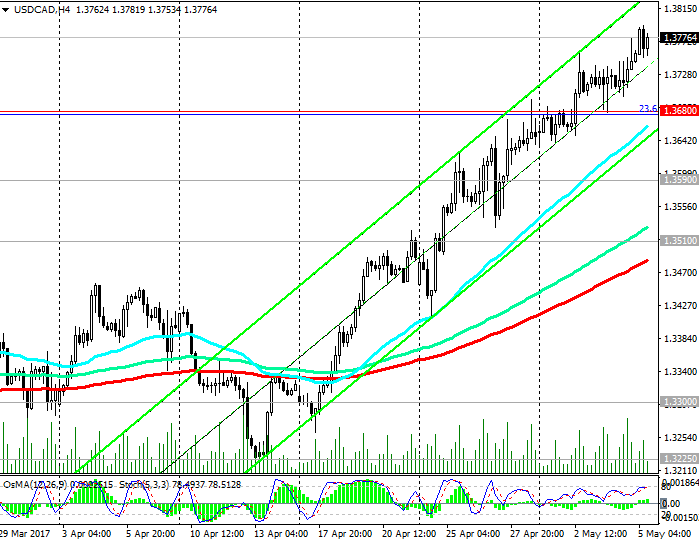

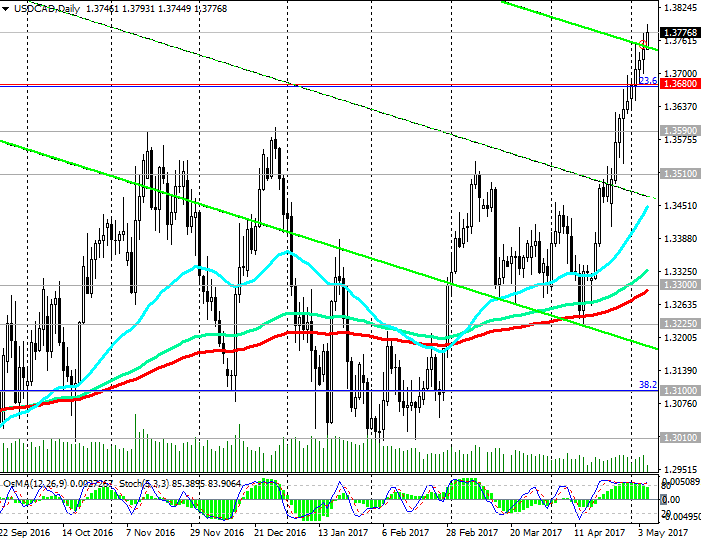

Pushed back in the middle of last month from the support level 1.3225 (EMA200 on the daily chart at that time), the pair USD / CAD is growing rapidly in the upward short-term channel on the 4-hour chart. Indicators OsMA and Stochastics on the monthly, weekly, daily, 4-hour charts recommend long positions and signal a strong upward impulse.

An important resistance level 1.3680 (Fibonacci level of 23.6% of the downward correction to the pair's growth since the beginning of July 2014 and the level of 1.0650) is breached. The pair USD / CAD is growing positive dynamics.

There are all the prerequisites of a fundamental nature for the further growth of the US dollar against commodity currencies, including against the Canadian dollar.

The medium-term growth prospect opens up to the level of 1.4600 (highs of 2016 and the last global wave of pair growth since July 2014).

An alternative scenario for a decline in the medium term will only be relevant if the pair USD / CAD is returned to the zone below the support level 1.3300 (the current position of EMA200 on the daily chart).

Much in the dynamics of the pair USD / CAD in the medium term will depend, first of all, on the dynamics of the US dollar and oil prices, which are likely to continue to decline until the OPEC meeting on May 25, at which the issue of extending the agreement for the next half year On the reduction of oil production.

Support levels: 1.3680, 1.3590, 1.3510, 1.3300, 1.3225, 1.3100, 1.3010

Resistance levels: 1.3800, 1.3940, 1.4000

Trading Scenarios

Buy Stop 1.3795. Stop-Loss 1.3745. Take-Profit 1.3850, 1.3900, 1.3940, 1.04000

Sell Stop 1.3745. Stop-Loss 1.3795. Take-Profit 1.3680, 1.3590, 1.3510, 1.3300

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics