Brent: Trump stimulates oil production in the US_29/03/2017

Current dynamics

On Tuesday, Donald Trump signed a decree to repeal measures to protect the environment, which was introduced by Barack Obama. On the one hand, this shows the determination of Trump in pursuing his new economic policy and the desire to return the economy to traditional sources of energy, such as oil and coal. On the other hand, the decree is even more motivating for US oil and gas companies to increase oil production and accelerate the drilling of new wells. Last week, the number of active drilling oil rigs in the US increased by another 21 units to 625 units. The number of active drilling rigs in the US has been increasing since June for several months in a row, doubling after reaching a minimum in May last year.

The active growth in oil production, primarily in the US, negates OPEC's efforts to contain the fall in oil prices against the backdrop of an overabundance of oil supply in the world.

The active growth of oil prices, observed immediately after the signing of this agreement, stalled already at the beginning of this year. Since the beginning of March, there has been a sharp drop in oil prices. Moreover, the price decline occurs against the background of the weakening of the dollar. If the dollar begins to recover its positions in the foreign exchange market, then the fall in oil prices may accelerate.

Presented late last night, the report of the American Petroleum Institute (API) showed that oil reserves in the US for the past week increased by 1.9 million barrels. The official report of the Energy Information Administration of the US Energy Ministry will be published today at 14:30 (GMT). The stock is expected to grow by 1.183 million barrels of crude oil and petroleum products over the past week. Reserves of oil in the US are growing, again reaching a record high over the past 80 years, above 533 million barrels. Oil production in the US has been growing for the fifth consecutive week (up to 9.13 million barrels per day). If the data from the US Energy Ministry, which will be presented today, will be confirmed, then oil prices may continue to fall. The US Energy Ministry expects further growth in oil production in the country. And this means that oil prices, if they do not continue to fall, will not grow actively.

Support and resistance levels

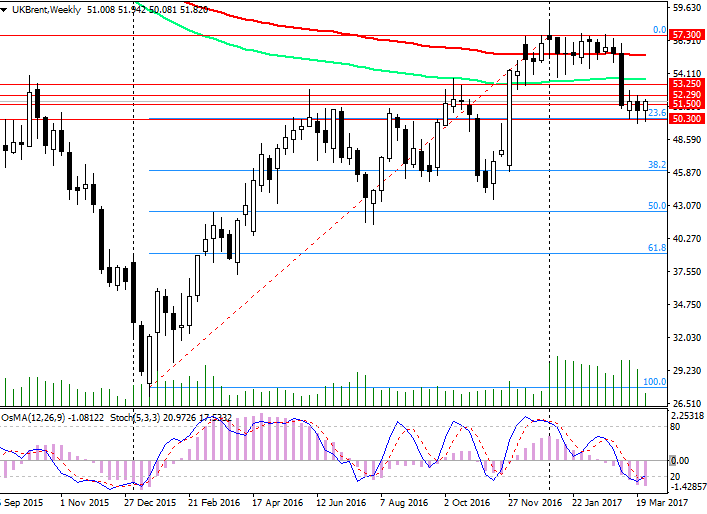

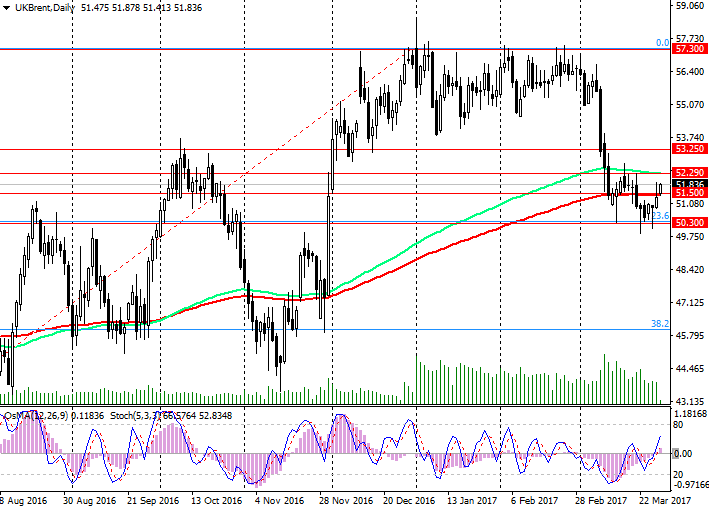

The price of Brent crude oil, having fallen from the maximum annual markings near the level of 57.30, stabilized near key support levels 51.50 (EMA200 on the daily chart), 50.30 (Fibonacci level 23.6% correction to decrease from 65.30 from June 2015 to absolute minimums 2016 Year near the 27.00 mark). To determine the further dynamics of the price, new drivers are needed. The active growth of oil production and the growth of stocks in the US, as well as the Fed's inclination to a slower but gradual increase in the interest rate in the US, put pressure on oil prices.

If OPEC does not extend the agreement on limiting oil production, which ends in June, the price of oil will begin to decline rapidly. Fundamental drivers for the growth of oil prices yet.

In the case of breakdown of the support level of 50.30, the decline in the price of Brent oil may accelerate.

Only when the price returns above the resistance levels of 53.00 (June and October highs), 53.25 (EMA200 on the 4-hour chart), you can again seriously consider long positions.

Support levels: 51.50, 50.70, 50.30, 50.00, 49.00

Resistance levels: 52.29, 53.00, 53.25, 54.50, 55.30, 55.90, 57.30

Trading Scenarios

Sell Stop 51.40. Stop-Loss 51.95. Take-Profit 50.70, 50.30, 50.00, 49.00

Buy Stop 51.95. Stop-Loss 51.40. Take-Profit 52.29, 53.00, 53.25, 54.50, 55.30, 55.90, 57.30