Current dynamics

On Monday, the dollar fell sharply in the foreign exchange market. On Friday, Republicans withdrew their bill from Congress to abolish Obamacare, as it did not receive support among Congressmen. Among investors, fears have increased that the US president's administration will be able to implement the promised tax cuts and increase infrastructure costs.

The dollar index of the Wall Street Journal, which tracks the value of the US dollar against a basket of 16 currencies, fell 0.6% to 89.65, the lowest level since November 11. Earlier, the dollar actively grew in the market in anticipation that the new administration of the US president will resort to fiscal stimulus measures of the economy, increasing budget expenditures, and creating prerequisites for a faster increase in interest rates.

The growth of uncertainty in the financial markets leads to the withdrawal of investor funds in safer assets, such as government bonds, yen, precious metals. So, on Monday April gold futures rose 0.6% to 1255.70 US dollars per ounce, having finished trading at the maximum level since February 27. However, the spot price for silver rose to $ 18.11 per troy ounce, the highest for the last 3 weeks.

The price of precious metals usually grows during periods of market or political uncertainty.

Moreover, the weakening of the dollar and the appreciation of precious metals is not hampered even by the decision of the Fed to raise the rate this month and verbal intervention by representatives of the Fed on the high probability of a multiple rate increase this year. Representatives of the Federal Reserve have repeatedly signaled that the rate increase this year is likely to continue in connection with the strengthening of the economy and against expectations of an increase in inflation to the target of 2%, as well as an increase in US employment. Nevertheless, the prices for gold and silver are growing, and the dollar is getting cheaper.

Support and resistance levels

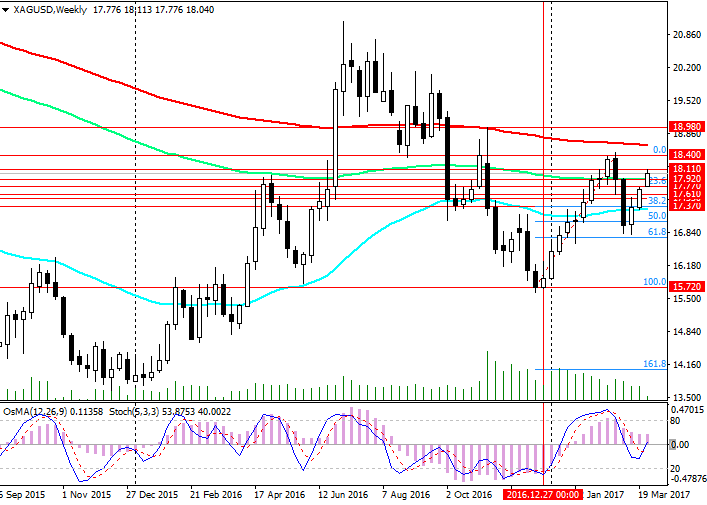

After a sharp decline since the beginning of the month, the pair XAG / USD was able to regain its upward momentum and is growing for the third consecutive week. The pair XAG/USD broke through the important resistance levels 17.37 (EMA200 on the daily chart and the Fibonacci level 38.2% of correction to the pair growth from the end of December 2016 and the level 15.72), 17.53 (EMA200 on the 4-hour chart), 17.77 (Fibonacci level 23,6%) and continues to grow to an important resistance level 18.40 (EMA200 on the weekly chart and the Fibonacci level 0%).

The OsMA and Stochastic indicators on the daily, weekly, monthly charts are on the buyers’ side.

Against the backdrop of a weak dollar, the upward trend in the pair XAG / USD persists. The nearest target is level 18.40.

The reverse scenario implies a breakdown of support levels of 17.70, 17.61, 17.53 and a decline to support level of 17.37. The break of 17.37 level raises the risk of further decline in the pair XAG / USD and its return to the downtrend with a long target of 15.72 (low of 2016).

Support levels: 17.92, 17.77, 17.61, 17.53, 17.37

Resistance levels: 18.11, 18.40, 18.98

Trading Scenarios

Sell Stop 17.97. Stop-Loss 18.10. Take-Profit 17.92, 17.77, 17.61, 17.53, 17.37

Buy Stop 18.10. Stop-Loss 17.97. Take-Profit 18.20, 18.40, 18.98