AUD/USD to Eye November High on Upbeat RBA Outlook

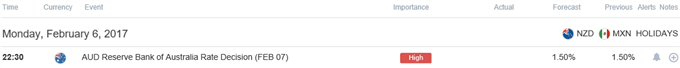

- Reserve Bank of Australia (RBA) to Keep Official Cash Rate at Record-Low of 1.50%.

- Has the RBA Hit the End of Its Easing-Cycle?

More of the same from the Reserve Bank of Australia (RBA) may produce another limited reaction in AUD/USD, but a shift in the monetary policy outlook may fuel the near-term advance in the aussie-dollar exchange rate should Governor Philip Lowe and Co. show a greater willingness to gradually move away from the accommodative policy stance.

What’s Expected:

Why Is This Event Important:

After delivering two rate-cuts in 2016, the RBA may continue to soften its dovish tone as higher commodity prices are ‘providing a boost to national income’ and improves Australia’s terms of trade. In turn, the fresh batch of central bank rhetoric may heighten the appeal of the aussie should Governor Lowe curb speculation for additional monetary support, but the first interest rate decision for 2017 may generate a lackluster response should the RBA keep the door open to further insulate the real economy.

Expectations: BullishArgument/Scenario

Release | Expected | Actual |

Trade Balance (AUD) (DEC) | $2.000B | $3.511B |

Consumer Price Index- Trimmed Mean (YoY) (4Q) | 1.6% | 1.6% |

Employment Change (DEC) | 10.0K | 13.5K |

Signs of sticky price growth paired with therecord trade surplusmay encourage the RBA to adopt an improved outlook for the region, and the Australian dollar may extend the advance from earlier this year should the central bank talk down expectations for additional monetary support.

Risk:BearishArgument/Scenario

Release | Expected | Actual |

Retail Sales (MoM) (DEC) | 0.3% | -0.1% |

Building Approvals (YoY) (DEC) | -10.8% | -11.4% |

Gross Domestic Product s.a. (QoQ) (3Q) | -0.1% | -0.5% |

Nevertheless, the slowdown in private-sector consumption accompanied by the economic contraction in the third-quarter of 2016 may push Governor Lowe to sound more cautious this time around, and the aussie-dollar may struggle to hold its ground going should the RBA keep the door open to implement lower borrowing-costs.

For More Updates, JoinDailyFX Currency Analyst David Song for LIVE Analysis!

How To Trade This Event Risk(Video)

Bullish AUDTrade:RBA Continues to Drop Dovish Outlook for Monetary Policy

- Need green, five-minute candle following the rate-decision for a long AUD/USD trade.

- If market reaction favors a bullish aussie position, buy AUD/USD with two separate lots.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUDTrade:Governor Lowe Clings to Easing-Cycle

- Need red, five-minute candle to consider a short aussie position.

- Carry out the same setup as the bullish AUD trade, just in reverse.

Potential Price Targets For The Release

AUD/USD Daily

Chart - Created Using Trading View

- The near-term outlook for AUD/USD remains constructive as the pair breaks out of bull-flag formation, with the pair at risk of making a run at the November high (0.7778) as it appears to be coiling in a near-term wedge/triangle.

- Need to keep a close eye on the Relative Strength Index (RSI) as it struggles to push into overbought territory, with the oscillator coming up against trendline support; bearish RSI trigger may highlight a continuation of the 2016 range as market participants weigh the outlook for monetary policy.

- Interim Resistance: 0.7730 (61.8% retracement) to 0.7770 (61.8% expansion)

- Interim Support: 0.7150 (161.8% expansion) to 0.7180 (61.8% retracement)

Impact thattheRBA interest rate decision hashad on AUD/USDduring theprevious meeting

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

DEC 2016 | 12/06/2016 03:30 GMT | 1.50% | 1.50% | +5 | +6 |

December 2016 Reserve Bank of Australia (RBA) Interest Rate Decision

AUD/USD10-Minute

After reducing the official cash rate to a record-low of 1.50% in August, the Reserve Bank of Australia (RBA) continued to endorse a wait-and-see approach at its last interest rate decision for 2016 as ‘the Board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.’ At the same time, the RBA appears to be softening its dovish tone as Governor Philip Lowe and Co. argue ‘globally, the outlook for inflation is more balanced than it has been for some time,’ but it seems as though the central bank is in no rush to move away from its easing-cycle as inflation is expected to remain low for some time, before returning to more normal levels.’ More of the same from the RBA generated a limited market reaction, with AUD/USD consolidating throughout the day to close at 0.7461.