Trading recommendations

Sell in the market. Stop-Loss 0.7030. Take-Profit 0.6975, 0.6940, 0.6900, 0.6860, 0.6800

Buy Stop 0.7030. Stop-Loss 0.6990. Take-Profit 0.7050, 0.7075, 0.7110

Overview and Dynamics

On today received positive data from China Pacific currencies grew, including the New Zealand dollar. In December, consumer price growth slowed in China and ex-works prices growth accelerated more than expected. However, in general, consumer prices and producer prices in China in December in annual terms rose by 2.1% and 5.5% respectively. The data supported the commodity currencies and currencies Pacific. China is the largest trading partner of New Zealand and the buyer of its commodities, including dairy products. Today the head of the National Commission for Development and Reform Commission of China Xu Shaoshi said that in 2016 China's GDP probably grew by 6.7%. The pace of China's GDP growth fell slightly, but still remains impressive. The growth of the second largest economy in the world, which is the Chinese economy, has beneficial effects on the development of the economies of China's partner countries, including New Zealand. And this in turn helps to strengthen the national currency of New Zealand.

New Zealand's currency also found support from rising prices for dairy products, and strong data on GDP of New Zealand, which grew in Q3 by 1.1% (vs. + 0.9% and + 0.7% in Q2) and 3 , 5% on an annualized basis. Thus, New Zealand's economy is growing faster than almost all other developed economies.

Past previous auctions of dairy products reported an increase in world prices for dairy products. The main export article of the country is just milk. Higher prices for dairy products to improve the terms of trade for New Zealand, and therefore will continue to support the New Zealand currency.

At the same time, investors are a little nervous before the scheduled for Wednesday's press conference, Donald Trump, which causes a decrease in the US dollar in the foreign exchange market due to profit taking. However, the main focus will still be focused on Trump's inaugural speech of 20 January. After winning Trump in the elections, the dollar index rose by 3.8%, and there are fears that the president-elect will be against a large-scale strengthening of the dollar. They should also be more clearly understood policy details of President-elect Donald Trump, in particular with regard to reducing taxes and increase budget expenditures. In this regard, it increases the risk that the dollar could remain under pressure until 20 January.

On the other hand, the US dollar will remain the favorite in the currency market in anticipation of more rate rises in the US this year. And it will be one of the main fundamental drivers after the inauguration of Donald Trump on January 20 and in the coming months.

Technical analysis

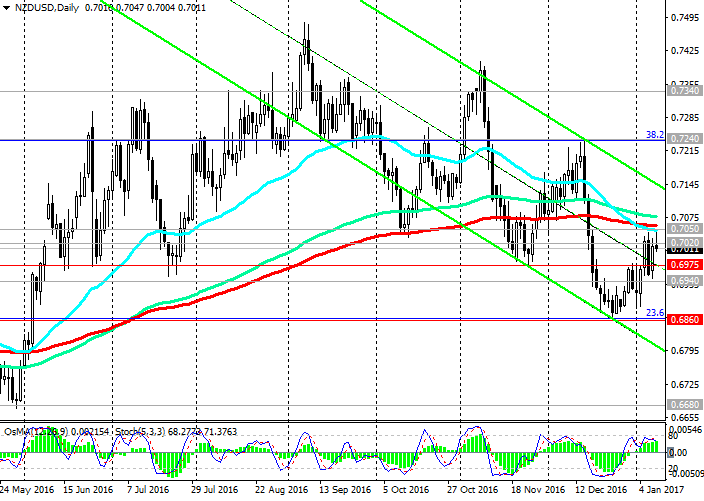

Despite the growth in the Asian session on the back of positive macro data, received from China by the end of today's Asian session the NZD / USD pair resumed its decline. At the beginning of the European session, the pair NZD / USD is trading near the mark of 0.7010, just below the opening of today's trading day.

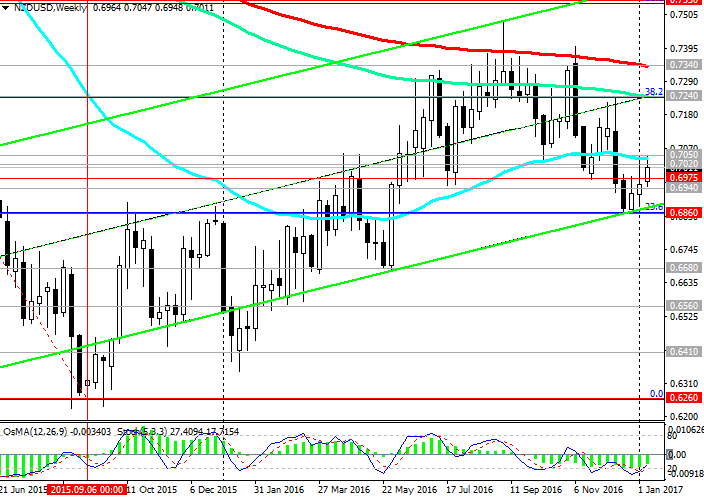

Indicators OsMA and Stochastic on the weekly, monthly charts are on the side of the sellers. On the daily and 4-hour charts indicators are also unfolding in short positions, signaling a possible upward correction completion.

The pair NZD / USD rebounded from the resistance level 0.7050 (the upper boundary of the rising channel on 4-hour chart, EMA200, EMA50 daily chart). The pair NZD/USD remains within the descending channel on the daily chart.

The US dollar continues to dominate on the foreign exchange market in the light of the Fed's plans to tighten monetary policy in the United States. And it will be the main fundamental driver in the financial markets at the beginning of 2017 and after the inauguration of Donald Trump on January 20.

The lower boundary of the channel on the daily chart is held near the level of 0.6860 (Fibonacci level of 23.6% upward correction to the global wave of decrease in pair with the level of 0.8800, which began in July 2014). This level 0.6860 will be immediate goal for the pair NZD / USD.

Only in the case of fixing prices above the level 0.7050 (EMA200 day, EMA50 on the weekly chart), 0.7100 is possible to revert to the medium-long positions for the pair NZD / USD.

The negative dynamics of the pair NZD / USD against the background of a strengthening of the US dollar on a large scale yet saved. Short positions still seem preferable.

Support levels: 0.6975, 0.6940, 0.6900, 0.6860, 0.6800

Resistance levels: 0.7020, 0.7050, 0.7075, 0.7100, 0.7210, 0.7240

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.