Trading recommendations

Sell in the market. Stop-Loss 17.10. Take-Profit 16.20, 16.05, 15.80, 14.90, 13.65

Buy Stop 17.10. Stop-Loss 16.90. Take-Profit 17.55, 17.70, 18.10, 18.30, 18.95

Technical analysis

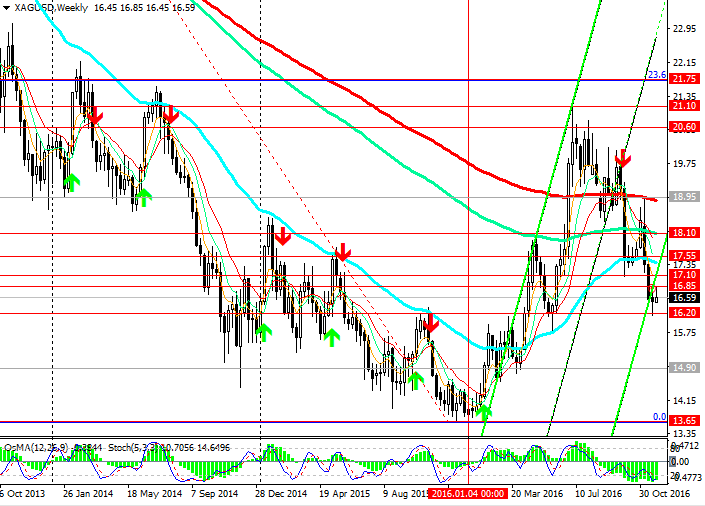

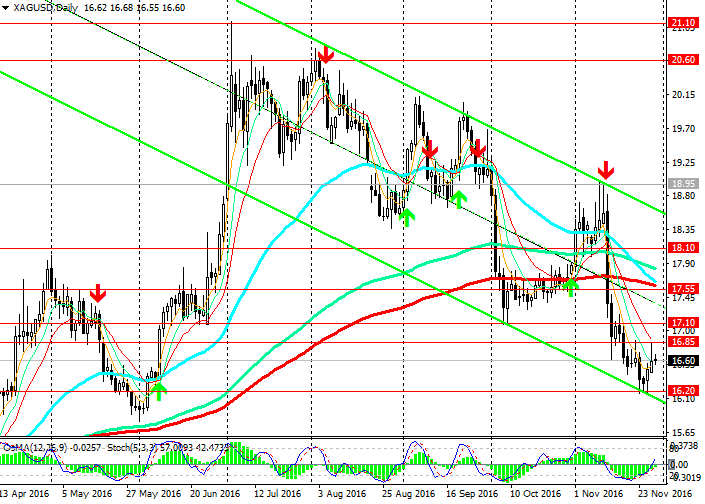

The XAG/USD has broken the important support level of 17.55 (EMA200 on the daily chart) and decreases in the downstream channel on the daily chart. The pair reached last week the mark of 16.20 (EMA200 on the monthly chart and the bottom line of the descending channel on the daily chart).

Repulsed from this level, XAG / USD pair grew the previous two days as a short-term upward correction. However, rising above the level of 16.85 and failed to develop a pair of drops again.

Precious metals showed the strongest decline with the overall strengthening of US dollar in the currency market, which followed shortly after winning Trump in the presidential race in the United States. Couple XAG / USD fell from 18.95 monthly high of almost 17% to the level of 16.20. Overall, since the beginning of July reached highs near the mark of 21.10 the pair XAG / USD lost nearly 30% so far and trading at the beginning of today's European session near the 16.60 mark.

Reducing the XAG / USD pair is developing within the descending channel on the daily chart with the lower boundary, passing near the 16.05 level. Negative dynamics preserved.

The breakdown of the most important support level of 16.20 could trigger further decline with the immediate goal near the level of 13.65 (at least one year).

Important market participants are now turning to the December meeting of the Fed, which is expected, the Fed will raise interest rates. If the Fed will confirm the direction of the further tightening of its monetary policy, the prices of precious metals will accelerate the decline.

Otherwise likely to rebound and corrective recovery to levels of 17.55, 18.00, since the December interest rate cut is already largely priced in.

On the weekly, monthly charts indicators OsMA and Stochastic are on the side of the sellers.

However, on the 4-hour and daily chart indicators turned on long positions, signaling a likely upward correction to the short-term goals 16.85, 17.10 (low of October).

In any case, until Friday, when will be published November data from the labor market in the US, XAG / USD pair is likely to remain in the range between the levels of 16.85, 16.20.

The next levels of support in the event of a downward movement will become the levels of 15.80 (May lows), 14.90, 13.65 (lows of January and 2016).

Alternative scenario – is the weakening dollar, the growth of quotations of prices for precious metals. Break of the resistance level 17.55, 18.10 the pair will return XAG / USD positive dynamics.

And in the case of breakdown of resistance levels 21.10, 21.75 (Fibonacci level of 23.6% upward correction to the global reduction pair XAG / USD since May 2011 from the level of 47.90 to a level near the level 13.65) increase pair XAG / USD resumes in the rising channel on the weekly chart with the upper limit, the level of 26.70 (38.2% Fibonacci level) above passing.

A further objective in the case of rising prices - are the level of 35.00 (highs of 2012 and 61.8% Fibonacci level).

Support levels: 16.20, 16.05, 15.80, 14.90, 13.65

Resistance levels: 16.85, 17.10, 17.55, 18.10, 18.30, 18.95, 19.15, 20.00, 20.60, 21.10, 21.75

Overview and Dynamics

Several important events planned for this week, many investors took a wait and see attitude.

On Wednesday a meeting of OPEC on Friday will be published data from the labor market in the US, and on Sunday held an Italian referendum.

Wall Street Journal dollar index, which reflects the US currency against a basket of 16 major currencies, was up 0.09% to 91.53. The upward momentum of the dollar is a little weak. However, its bullish trend persists.

Prices of precious metals have fallen sharply since the beginning of the month after the US presidential election. President-elect Donald Trump has promised to expand fiscal stimulus, as well as to remove restrictions on the production of energy in the United States. Investor confidence has increased in relation to the prospects of higher interest rates on the back of positive macro data coming recently from the United States. Economic data released after the November meeting of the Fed, were strong. Official data on employment, retail sales and the housing market, as a whole, referred to the strengthening of the US economy.

According to futures on the interest rate the Fed, investors assess the probability of a December tightening of monetary policy in the 98%.

Raising Fed leads to falling prices for precious metals, including silver, because they do not generate interest income and can not compete with the bearing assets such income, such as government bonds.

Previously, growth in risk appetite, and withdrawal of funds from safe-haven assets has led to a massive strengthening of the dollar and precious metals sales.

Dollar traded in a narrow range with the opening of today's trading session. Prices for silver again reduced after the two-day correction.

Last week, the price of silver has fallen to its lowest level (16.16 dollars per ounce) since June. Spot price of silver at the opening of the European session on Tuesday is near the level of 16.60 dollars per troy ounce.

Expectations of increasing rates in the US are pushing price quotes for precious metals down, despite continuing political and economic instability in the world.

Although rising interest rates makes precious metals that do not generate interest income, less attractive to investors, but it is probably already reflected in current prices. And after some decline immediately after the Fed's meeting on 13-14 December the price of silver and other precious metals can begin to recover, with a chance of a fairly active growth of quotations. It is also likely that the prices of precious metals have reached the bottom, and you must be extremely careful when opening short positions.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.