Trading recommendations

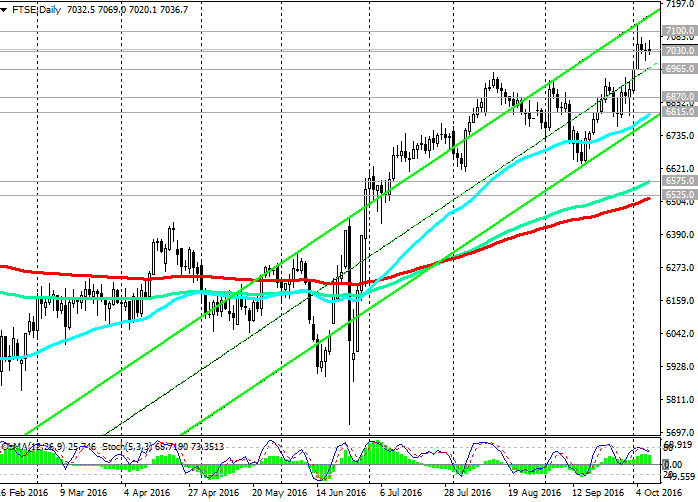

Sell on the market. Stop-Loss 7040.0. Take-Profit 6965.0, 6870.0, 6815.0, 6575.0, 6525.0

Buy Stop 7070.0. Stop-Loss 7030.0. Take-Profit 7100.0, 7180.0, 7200.0

Technical analysis

After the June referendum on the Brexit British FTSE100 stock index rose, completely cutting off the end of June its sharp fall immediately after the publication of the referendum results. FTSE100 index increases in the uplink to the daily and weekly charts, the upper limit of which lies above the level of 7200.0.

Price rose by 9.6% above the level of 6415.0 (highs ahead of the referendum) and the positive dynamics of the index maintained.

Indicators of the OsMA, Stochastic on the weekly, monthly charts are on the buyer’s side, but on the 4-hour and daily chart the indicator turns on short positions. Possible downward correction to the levels of support 6965.0 (EMA50 and the lower boundary of the rising channel on 4-hour chart), 6870.0 (EMA200 on 4-hour chart), 6815.0 (EMA50 and the lower boundary of the rising channel on the daily chart). However, the fundamental background creates the preconditions for further growth of the index.

Growth may continue after the reversal of long position indicators and the end of the short-term downward correction. Growth Objectives - 7100.0 (April highs in 2015 and 2016 highs), 7200.0.

Alternative scenario implies the breakdown level of 6815.0 and a decrease in the level of support 6575.0 (EMA144 on the daily chart, EMA200 on the weekly chart). Only after the price fixates below 6525.0, you can talk about the end of an uptrend. So far, more preferably – are long positions.

Support levels: 6965.0, 6870.0, 6815.0, 6575.0, 6525.0

Resistance levels: 7100.0, 7180.0, 7200.0

Overview and Dynamics

The current collapse of the pound in the early Asian session has not resulted in any significant movement in the same index of the London Stock Exchange FTSE100. Apparently, the current collapse of the pound was provoked by the words of French President Francois Hollande, who in an interview with Sky News has called for tough negotiations on the withdrawal of Great Britain from the EU. Hollande said that the UK should pay a high price for an exit from the EU. At low volumes of trading at the beginning of the Asian session, the pound fell across the foreign exchange market. Such a sharp decrease in the scale could create algorithmic systems that have worked on the breakdown of levels and growing wave of triggered stop orders to sell the pound strengthened drop. GBP / USD pair dropped to a new 31-year low below 1.1200. The fall was almost 8%.

By the beginning of the European session, the pound has recovered somewhat, but is still under pressure. GBP / USD pair is trading near the 1.2460 mark, which is 160 points below the level of the opening of today's trading day.

FTSE100 index is in contrast to other European stock markets traded upward after conducted in late June referendum on Brexit. Exceeding is more than 600 points. At the beginning of today's European session FTSE100 index is close to the level of 7040.0 and the positive dynamics of the index maintained. The focus of the Bank of England policy on the conservation and is likely to gain extra loose monetary policy contributes to the growth of the index.

In early August, the Bank of England lowered its key interest rate to a record low of 0.25%, marking the first decrease in rates since 2009. The interest rate has reached its lowest level in three centuries. Also, the central bank to buy government bonds in the UK involves the sum of 60 billion pounds and corporate bonds in the amount of 10 billion pounds, as well as to give commercial banks cheap loans in the four-year framework of a new model-term financing.

The Bank of England made the most serious in the history of decline in the forecast for economic growth next year. Thus, the Bank of England expects economic growth of only 0.8% in 2017 against 2.3% previously expected.

On the other hand, the collapse of the UK economy to Brexit background did not happen, as evidenced by a number of positive macroeconomic indicators coming from the UK.

The fall of the British pound a negative impact on the purchasing power and consumption inside the country, but a positive effect on the economy and the export of UK. In late September, we presented data on UK GDP for the second quarter.

GDP is considered an indicator of the general state of the British economy. GDP grew by 0.7% (forecast was + 0.6%) and by 2.1% in annual terms (versus + 1.9% in the previous quarter). The country's economy collapsed after the referendum, and it is likely that the Bank of England can go further towards easing its monetary policy.

And it is - a positive factor for the stock market and the British FTSE100 index.

On Friday at 12:30 (GMT) out data on non-farm employment USA - center of attention today traders and a key report that will affect the discussion leaders question the Fed to raise interest rates, as well as the formation of the views of voters about the state of the economy before the presidential election . According to the forecast of economists in September, the number of jobs increased by 172,000 and the unemployment rate remained at 4.9%. If the forecast is confirmed, the dollar will get an additional impetus for growth, although strong strengthening should not wait, because positive data from the labor market in the US have already been laid in price. But the dollar fall sharply on the currency market at the weak data.

At 14:00 published assessment of the NIESR GDP growth - index estimating the rate of growth of the British economy over the past three months. The report is published before the release of official data on GDP, and able to influence the monetary policy of the Bank of England. The report will cause a sharp increase in volatility in the pairs with the pound and FTSE100 index.

Author signals - https://www.mql5.com/en/signals/author/edayprofit