How far will the pound fall (and other currencies)

SocGen sees 1.20-1.25

We continue to look for GBP/USD to trade around a 1.30-1.35 range for now (i.e. a little lower than here) and eventually, towards 1.20-1.25.

EUR/GBP will rise further and indeed has already risen faster than our initial estimates, but we don't expect a move to 0.90 (from 0.83 now).

The yen has gained across the board and is the only major currency to have risen against the US dollar, which has rallied by over 2 ½% on a trade weighted basis. But concern about the economic fall-out in Europe is likely to see the Euro fall further in the weeks ahead too - it's actually held up rather better than I for one expected but a drop to 1.06 in EUR/USD seems likely. Political fallout has already seen Scandinavian and CEE currencies fall on concerns about what this means for the EU and it's far too early to fade those move.

Deutsche Bank sees 1.15

Over the coming days, we see 1.30 and 0.85 as a realistic level for GBP/USD and EUR/GBP to clear respectively, with risks skewed to the downside. While the initial gap lower has been largely driven by market positioning and liquidity, however, the medium term implications of Brexit on sterling have yet to be felt. The UK's record current account deficit means the currency is the in the worst possible position for the severe slowdown in capital inflows that will result from uncertainty generated by the result today. This will be exacerbated by further Bank of England easing, as forecast by our UK chief economist, and a sharp slowdown in growth. We see GBP/USD at 1.15 by year end.

We felt that the upward momentum in the JPY would remain strong for at least the coming months regardless of the referendum results due to the sluggishness in the US economy and receding expectations of a Fed rate hike. The markets were already nervous as to whether the USD/JPY would halt at 100, and the Brexit vote will put additional upward pressure on the JPY against the GBP and EUR as well. Unless the US economy soon improves to a point where multiple Fed rate hikes can be justified, the USD/JPY could shift its range to the level below 100.

NAB sees a fall 'possibly' through 1.30 and looks at other currencies too

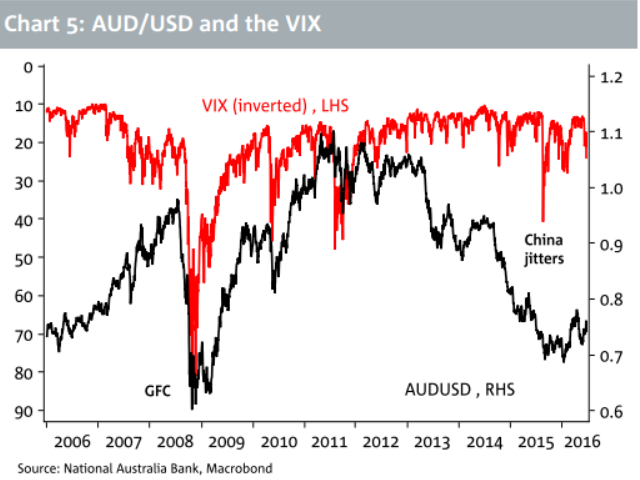

If global equity markets remain under extreme pressure and measures of market volatility/risk aversion remain elevated, the Australian dollar is like to weaken further in coming days, implying risk that the 2015/2016 year-to-date lows just above 68 US cents are retested. The Australian's dollar's negative correlation with increased global market risk aversion is time-tested. The August 2015 and January 2016 cycle lows in the AUD/USD rate coincided with two periods of (initially China-related) global market stresses that saw the VIX measure of US stock market volatility trade at elevated levels. Under circumstances where concerns about the existential risk to the EU/Eurozone come to the fore, we would envisage similar pressures across global stock markets and a response in the currency similar to the August 2015/early 2016 experience.

If instead global market fall-out from today's referendum is contained and risk sentiment stabilises, the Australian dollar is similarly likely to stabilise - above 70 cents - while likely remaining contained below the 75 cents level. Comparable volatility is to be expected in the New Zealand dollar. For the British Pound, there has been some modest reversal of the sharp overnight losses which has seen GBP/USD regain nearly 8 cents of the 17c which it lost in the space of just 5 tumultuous hours. We expect this pair to remain pressured as the shifting sands of UK politics seem a poor foundation upon which to build a sustainable rally.

Once the dust settles after the weekend inquests, we look for GBP/USD to trade down to and possibly through 1.30. Amongst other major currencies, a larger fall in the Euro than seen so far on Friday is to be expected in circumstances where expectations for a broader fracturing of the EU and doubts about the long term survival of the single currency become more prominent.

This would suggest the EUR/USD rate falling into the 1.00-1.05 area. This in turn suggests that the US dollar will be supported more broadly, even though markets have quickly responded to Friday's events by pricing out any risk of the Fed lifting interest rates again anytime soon. The prospects for the Japanese Yen materially weakening in coming weeks and months are also diminished.