Market Update: Crude Chart

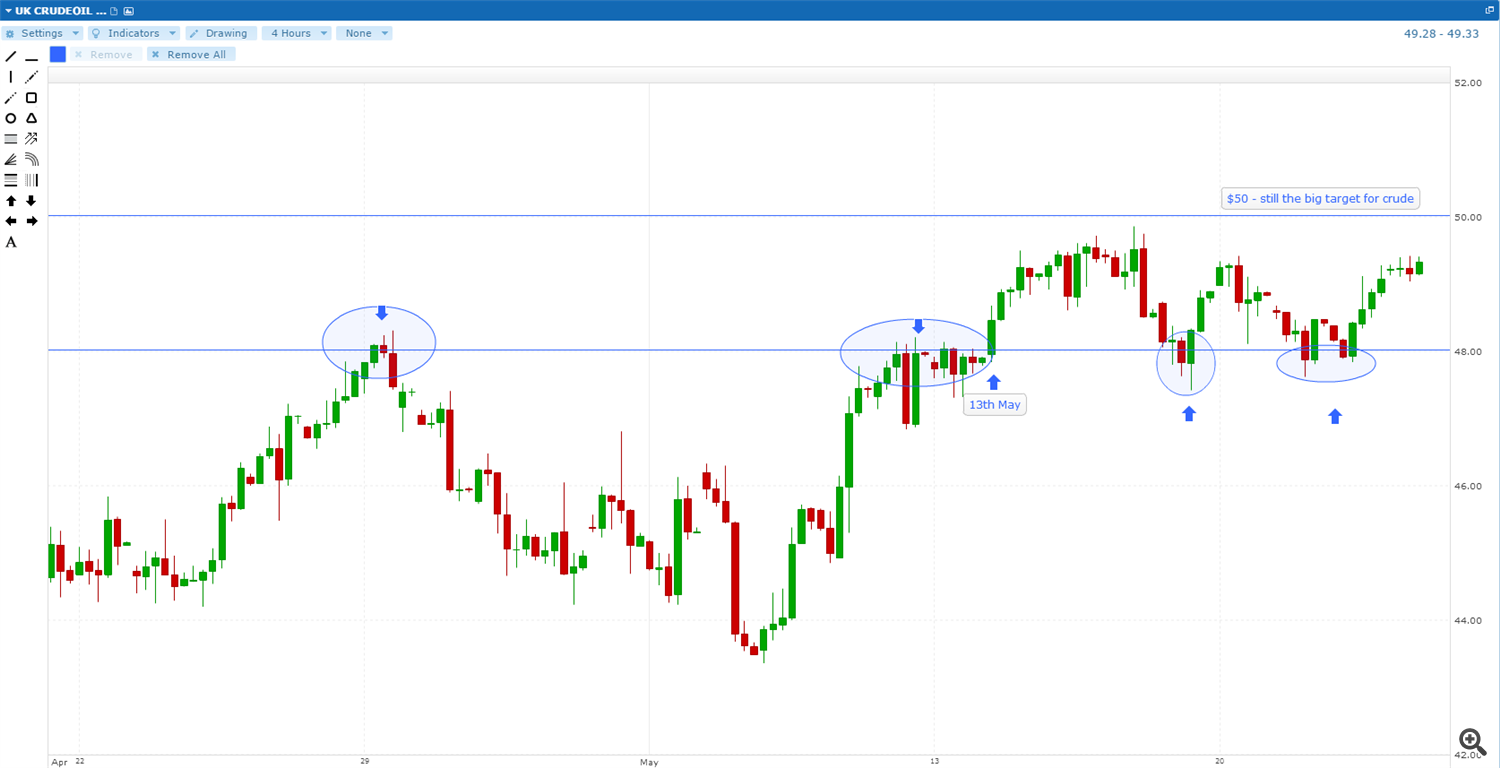

Here’s a 4-hour chart for Brent (UK) crude oil:

The chart shows how significant the area around $48 has been over the

past month. It acted as resistance at the end of April and earlier this

month, then as support over the last week. In fact, if one looks at a

daily chart it shows that the front-month Brent contract last closed

below $48 on 13th May.

Interestingly, the US dollar has strengthened over this period as well.

The EURUSD broke below 1.1400 on 12th May and is now trading around

1.1170 while the Dollar Index broke above resistance around 94.00 on the

same day and is currently hovering around 95.50.

EURUSD – 4-hour chart:

Oil is (mostly) a dollar-denominated commodity. Consequently, it becomes

more expensive for other currency holders to buy as the dollar rises in

value. After all, they have to buy dollars first before they can

purchase dollar-denominated assets. That means we should generally

expect oil to fall when the dollar rises. However, while there is a

strong negative correlation between the dollar and oil over the medium

to long-term, short-term moves are less coordinated. Certainly, the

trading relationship between the dollar and oil is nothing like the one

we can currently observe with gold.

For now the oil price is shrugging off the ongoing dollar rally. But

will it be able to do so if the greenback continues to strengthen? This

is a particular interest as the dollar is getting support now that the

odds have been slashed on the likelihood of a summer rate hike. This

followed last week’s release of minutes from the FOMC’s April meeting

along with a pile of hawkish comments from Federal Reserve members. It

will be interesting to see if fed chairman Janet Yellen is similarly

hawkish during her speech this Friday.

Of course, one of the main drivers for the rally in crude has been the

outlook for supply and demand. Analysts now expect rebalancing to take

place much sooner than was estimated earlier this year. We’ve had a

number of supply disruptions recently (the Canadian wildfires, the

political crisis in Venezuela and hostilities in Nigeria and Libya) and

some bigger-than-expected drawdowns in US inventories. This further dims

the prospect (if any really existed) of OPEC agreeing to an output

freeze when it meets next week. Iran and Iraq continue to increase

production and Saudi Arabia is still determined to increase its market

share. However, the outlook for demand growth is cloudy, particularly

given uncertainties over China’s economic outlook.

David: For now the oil price is shrugging off the ongoing dollar rally.

But will it be able to do so if the greenback continues to strengthen?