Analystics technical EUR - USD 09/05/2016

EURUSD last week's experience with volatile price movements downside channel (Bearish)

for 4 days in a row (since Tuesday, 5/3) until the closing of Long

Ledge Doji New York Friday, 05.06.

Bearish where the movement started since Tuesday, 03.05.2016 from 1.1530

level with a week intraday high level also in the same day at 1.1615 (03 // 05)

to the New York close on Friday (05/06/2016) at the level of 1.1402

with Intraday low levels of the week at the level of 1.1384 (Thursday, 5/5).

Range weekly the week yesterday by 231 pips

(10 pips lower from previous weekly range 25/04/16 - 04/29/16 were as much as 241 pips).

Fundamentally, watching the movement of the euro exchange rate in forex

trading the European session on Friday (6/05)

was observed to rise against the US dollar after three consecutive days

experienced selling pressure.

The weakening dollar going to respond to the attitude of some market participants

are pessimistic about the NFP report by the Department of Labor (06/05) New York session,

that whereas from the economic data Friday, 06.05 Euro region is less encouraging.

Markit announced the data of the survey on the business performance of the retail sector

in the Euro area retail PMI indicator showed a decline in performance in April.

The index dropped to a score of 47.9 after the previous month's score of 49.2.

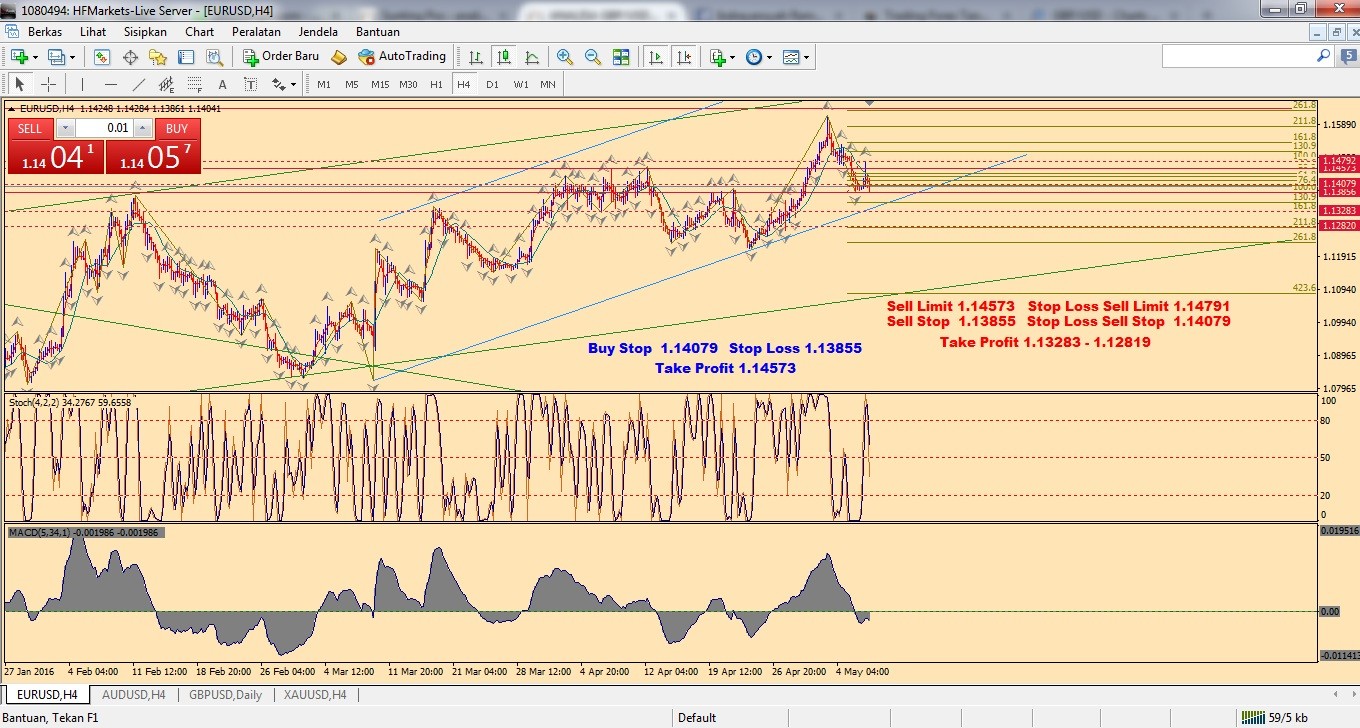

Technically, for the next week,

EURUSD weakness may still be continued based on weekly candlestick formation.

Nevertheless, you still need to watch the intraday bullish

correction might take place in the Daily timeframe.

If next week Bullish breakout occurs at the level of 1.1474,

the price will likely go back to the level of 1.1535 - 1.1611 - 1.1685. On the contrary,

if the breakout bearish at 1.1382 level, then the price will likely continue

the trend of decline back to the 1.1316 level area - 1.1252 - 1.1186.

Scenario

Recommendation Sell Limit / Sell Stop

Entry Point 1.14573( Sell Limit )/ 1.13855( Sell Stop )

Stop Loss 1.14791 ( Sell Limit ) / 1.14079 ( Sell Stop )

Take Profit 1.13283 - 1.12819

Alternative Scenario

Recommendation Buy Stop

Entry Point 1.14079

Stop Loss 1.13855

Take Profit 1.14573

NB : for investors who want to cooperate or the capital entrusted to us to manage

can contact us on +6281269002724

Warning : We do not guarantee that any signal or position

trading that we provide will always be correct and will always

profitable. In fact in a trading,

losses may occur , incorrect positioning can occur and

all are part of the reality of trading and back again

to discipline and trading strategies of each individual trader.

Therefore , make our forex signal as a reference and

Combine with technical and fundamental analysis as well as

the trading strategy you have. We are not responsible

for damages in any context whether it is material or

non-material caused by partial or total information

listed on the blog