GBPJPY: Long Setup/Short Setup is Appealing, only if... (May 2016)

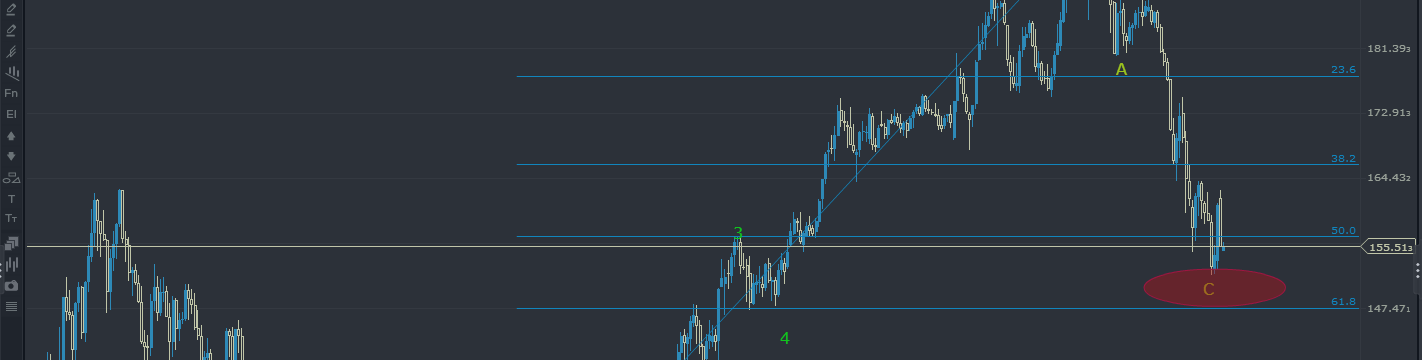

If we have a look at the Weekly chart, we will clearly note an impulsive wave up which started in 2012 and topped in 2015. What followed right after the top was established is a pullback which erased more than 50% of the rally. Up to now the pullback is in the form of a corrective A-B-C, which suggests that a long position in the long run would be the safest one, however there is just one problem.

If we went long on these levels considering the weekly chart, we could not place a logical stop loss order as the pullback might continue up to 0.786 retracement or even lower. In addition, we do not have any indication that this movement in oversold.

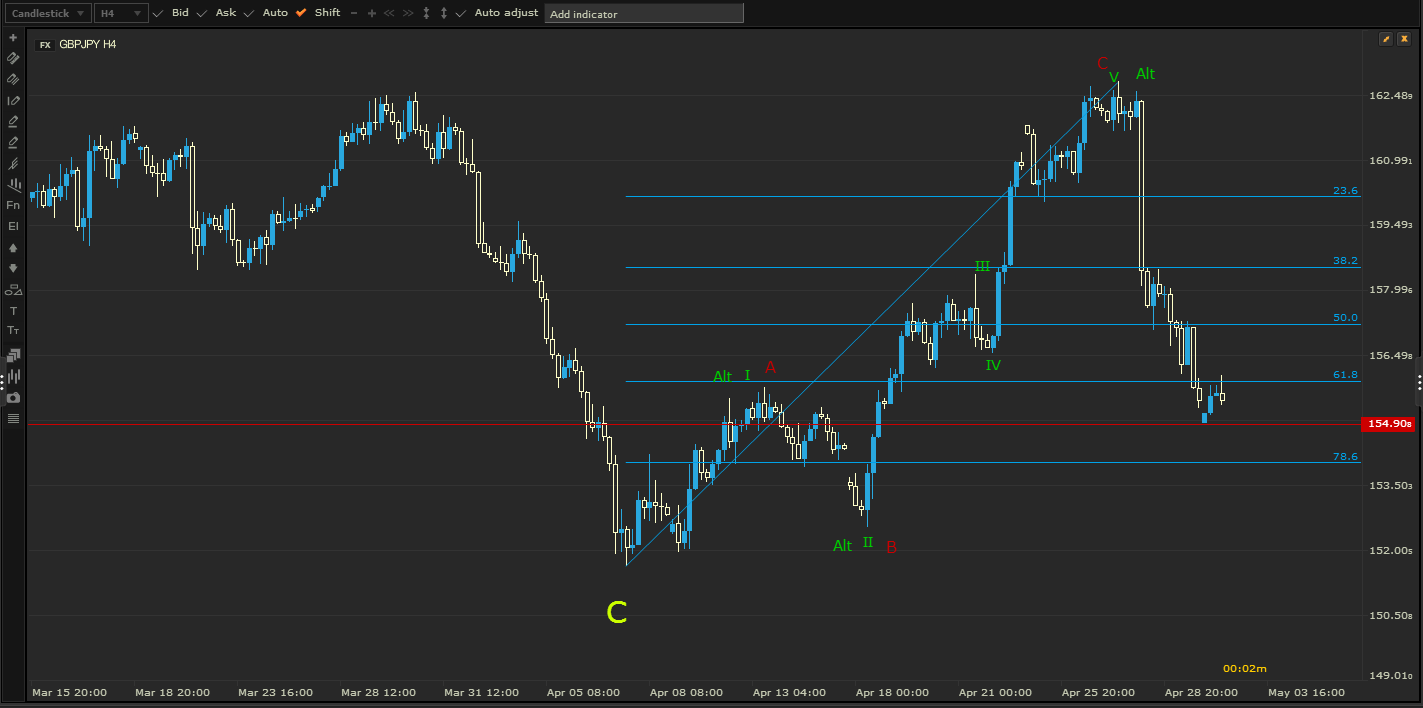

In an expanded H4 chart we can analyse the rally in terms of wave count, however up to now we do not have enough information to go with only 1 scenario thus:

Scenario 1:(Not Favorable-High Risk Trade)

The only bullish case for GBPJPY is in case it breaches 156.00 and 156.250 and at least one H4 candle closes above that level. In that event, Enter long with a stop loss at 155.00. Target for this long is 156.75 and later on 157.

This scenario is not very appealing given the weakness of this pair, however in case an immediate rally starts upon the breach of 156.00 level, we should expect higher levels and that the April rally was an impulsive one.

Scenario 2:

If GBPJY goes deeper below ...Read More