FxWirePro: AUD/USD Calendar Spread Setup to Bridge Gap Between Call Premiums and IVs

FxWirePro: AUD/USD Calendar Spread Setup to Bridge Gap Between Call Premiums and IVs

Before we begin, let's glance over something called implied volatility, we consider 1W IVs of 12.95% at spot FX 0.7718 levels and 12.45% for 1M tenors.

ATM call premiums are trading 22.88% more than Net Present Value of these instruments.

Contemplating this huge disparity between option pricing and reducing IVs in long run, and AUDUSD from last couple of months gaining strength against USD can be sustainable if Fed keeps deferring its policy decision.

We expect the RBA to remain on hold for some time, while leveraged accounts remained bullish on commodity currencies, led by the AUD. They raised their net AUD longs by USD0.8bn to USD3.4bn, the highest since Sep 14.

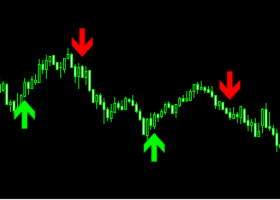

Subsequently, the Calendar Spread is advocated to hedge puzzling swings in both short term and long term, so please monitor the following Calendar Setup:

Go Short in next month (1%) OTM Call at US$642.06 Go Long in Far month (1%) ITM Call at US$1945.22

Thereby, net debit is reduced to US$ 1303.16, and the implied volatility as a function of moneyness for a fixed time to maturity is generally referred to as the smile. The volatility smile is the crucial object in pricing and risk management procedures since it is used to price vanilla, as well as exotic option books.

OTM strikes, rely solely on extrinsic value and have a low Delta, Theta, and Vega. But a move towards the OTM territory increases the ATM Vega, Gamma and Delta which boosts premiums.

The degree of moneyness of an option can be corresponded to the strike or any linear or non-linear transformation of the strike. (Forward-moneyness, spot-moneyness, delta).

The material has been provided by InstaForex Company - www.instaforex.com