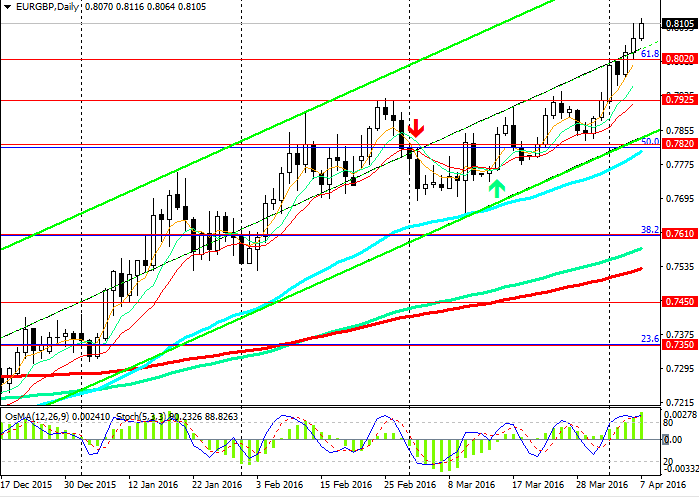

EUR/GBP: The Pair is Overbought

The pair EUR/GBP failed continuing downward movement rebounding from strong resistance level of 0.7820 (ЕМА200 on the weekly chart and Fibonacci 50% to the last wave of decline from the highs of August 2013). The pair fell by 1800 points from the level of 0.8700 to the lows of 2015.

The price broke the level of 0.7820 and starting from the mid-March the pair EUR/GBP has been going up. The pair is under pressure from two fundamental factors. The first one is the decline in the European stock indices and the rise in Euro. The second factor is the decline in price of the Pound in advance of the referendum in the UK on the exit of the UK from the EU.

The pair EUR/GBP is significantly overbought; however, the rise in the pair continues on the strong upward impetus. 0.8250.

The pair is rising in the upward channel on the daily chart with the upper limit near the level of

On the daily, weekly and monthly charts the indicators OsMA and Stochastic give signals for long positions.

In this situation the decline in the pair can be considered as the possibility of the increase or opening of the long positions.

Short positions can be opened in the medium-term if the price goes back below the level of 0.7820.

Support levels: 0.8020, 0.7925, 0.7820 and 0.7610.

Resistance levels: 0.8100, 0.8125, 0.8200 and 0.8250.

Trading tips

Buy Stop: 0.8110. Stop-Loss: 0.8070. Take-Profit: 0.8150, 0.8200 and 0.8250.

Sell Stop: 0.8060. Stop-Loss: 0.8090. Take-Profit: 0.8020, 0.7925 and 0.7820.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com