Success in trading depends of many factors but one of the most importants is the ability of each trader to maintain calm during and after a cycle of negative operations. An intelligent handling of Risk help us to keep both confident and motivated even in the middle of a cycle of negative operations.The purpose of this article is to transmit to the reader the importance of working with a correct relation risk/profit to maintain consistence in time.

How much to risk?

Build a strategy of positive mathematic expectation to obtain a high rent ability is important but the main goal of the risk handling is to ensure survival.

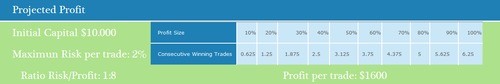

A good number of tests by economists of worldwide prestige have proved that the maximum quantity that a trader can risk in an isolated trade without damaging the expectations in a long term is of 2% of the initial capital. That is to say that if you have $ 10.000 in your trading account, you can not risk more than $200 in only one operation.

It is also proved that all the relations risk/profit where the risk

is higher than the benefit, can work for some time but in the long run

will lead the trading account to bankruptcy.

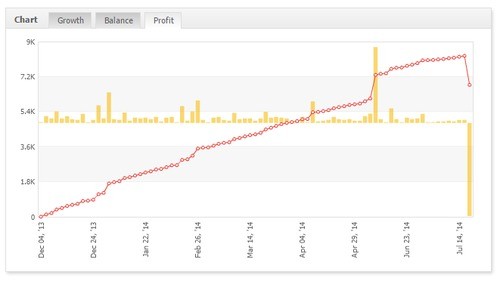

The following chart is an example of how a strategy where’s all profits are obtained with a high risk can work for some time. In this case it worked for 8 months but in only one operation can lose all benefit obtained and leave the account at 0.

Which is the optimal goal?

the majority of traders spend most of time investigating with historical data trading strategies, dedicate some time to monetary strategy but little time to optimize the relation risk/benefit.

One of the most used relations by currency traders is the relation 1:1 which in my opinion is a very conservative relation and after a cycle of negative operations we have the risk of hesitating about our strategy and lose self confidence.

I completely agree with Donald Trump, if you want to obtain big profits you must think in big profits, the question is: how to think in big profits keeping our maximum risk of 2% In each operation the same goal and our same area of joining the market.

The answer is to optimize the relation risk benefit.

In the chart you can see an example of a trading operation. Let us imagine that we have detected our favorite technical guideline in the intersection NZDJPY in daily graphics and we planned our access, stop loss and benefits.

If price drops below the line of trend, suggest the possibility of dropping until the relevance support which rests upon the level of 85,924 , we place order pending of sale in the level 87,53. the stop loss over the previous relevant maximum located in the level 89,13, The goal and stop loss are at the same distance (160 pips) of market entry. This operation has a ratio risk benefit of 1:1 that is to say if in the trading account we have 10.000 Dollars and the maximum we can risk is the 2% of the starting capital we risk 200 dollars for a profit of 200 dollars.

Do you think that Donald Trum would plan this operation with ratio risk/benefit 1:1 ?, I do not think so. He will surely think the great way. Would he think in a ratio 1:2 or 1:3 ?I do not think either. This is to think somewhat more but not the big way. To think in a big way would be something like to plan a ratio risk/benefit of 1:8.

And how is that possible?

By precision, find the best way to join technically.

The best ways to join technically are found after the issue of macro economical data. Than we study which are the most important news that influence the Neozeland dollar and the Yen.

The previous chart is a daily chart, for joining technically we will use minutes graphics. in this case we will use a graphic of 15 minutes. In the following chart of 15 minutes just before the declarations of the Australian Governor we see where is our pending downtrend order which we have placed using the daily graphic.

In the following graphic of 15 minutes we are going to plan our technical joining to optimize the maximum risk/benefit some minutes before the issue of data and considering that our slant initial Is bearish we place a sale order at the 87,96 level, some pips below the preceding minimum and the stop loss over the previous maximum in the 88.71 level. Now we have a risk of 20 pipsInstead of the previous 160 pips. We have converted a risk/benefit ratio 1:1 in a ratio 1:8.

In the following graphic of 4 hours it can be compared the old bearish order y old stop loss with the new pending order and stop loss before the declarations of the Australian Governor.

It is not necessary to change the goal to increase the ratio risk/benefit. It can be obtained optimizing the technical joining, a ratio risk/benefit 1:1 has been changed to 1:8 that is to say instead of obtaining a benefit of 200 dollars we have achieved a benefit of 1.600 dollars. This ratio gives us confidence and help to keep calm and the motivation in a cycle of several negative operations.