What is a fools game? – Trying to Catch A Falling Knife. Knife cuts people and that is where this phrase came about in Forex trading. It is the act of trying to predict where the price of a currency pair will stop falling. Understandably, every trader wants to feel like a superior trader that can predict or think ahead of the market by anticipating price direction and of course catch market bottom or top. However, good and brilliant that may sound and most importantly the feeling of being ahead of others with trade profits for catching market price top/bottom, yet experience has shown that there are very few forex trading situations where prices fall and immediately reverse. Rather, prices fall further and faster than anyone could predict.

I am compelled to write on this subject because the preceding week between Monday the 31st of August 2015 to Friday the 4th of September 2014, we witnessed loses felt in the market even by experienced traders on the Traders Contest. Thorough assessment shows that many fell victim trying to catch a falling knife situation.

Illustration 1.0

Benefits of Catching A Trade Bottom Or The Top

- Technically, entering a trade exactly at the price the currency pair bottomed or topped puts you at the beginning of the Trend that could last for days, weeks, months and even years.

- Having your trade on the market bottom or top will relatively put your trades outside the price range where market correction, bounce and pullback may rarely affect.

- Both for intraday traders, but especially for Longtime traders, your trade entry on the market price bottom or top will ease you of any trade emotion as you watch your trade accumulate profit pips given that the market continuous on your predicted direction.

Why You Shouldn’t Try It

- It is a proven fact that trying to catch a trade bottom is a fools game because it is the first step in bankrupting your account. The more you try to buy the dip in that currency pair hoping to catch a quick profit from a bounce or pullback, you will keep getting your fingers cut – that’s what knifes do.

- If you lack the necessary training and tested technical tools to predict where the currency pair market price move will go. It is true that majority of traders will simply think of market reversal when the current market price moves above the recent swing high for an Uptrend reversing or market price moves below the recent swing low for a Downtrend reversing, but it could be very very tricky and your capital is at stake here – NOT EVERY REVERSAL WILL GIVE SIGNAL IN THIS ORDER.

- Lastly, you should know from the information above that trends have regular pullbacks, meaning you need specific pair of occurrences in order to have a realistic proof that the trend is indeed reversing or else you will get lots of losing trades. I have seen traders who were once lucky picking a trade bottom, narrate how they lost their entire equity other times as they tried catching a bottom/top.

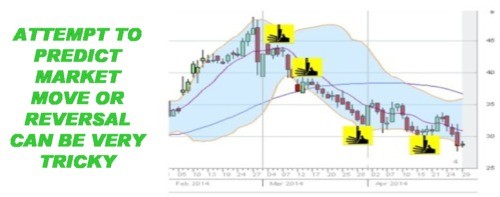

Chart 1.0 Above chat shows how in four multiple times an FX trader had attempted to predict

market reversal but lost, showing how tricky those pullback turned out.

SUMMARY

- Trying to pick an intraday top or a bottom in a market can be very dangerous. Yet many traders are obsessed with trying to get in right at the bottom and out at the top. Throwing out orders and hoping to be in the vicinity of a top or bottom is statistically losing strategy.

- Getting the right technical assessment of the series of pullbacks will help you enter and exit trades at good prices and you will also know your risks right beforehand with a solid information that the market has already turned.

- Patience is also required when there occur a volatility dip on a currency pair. You need to wait for the market to stop falling or rising and give you an indication (strong proof), not simple pullbacks that it is reversing.

Chart 2.0

Above chat on the far right shows market low at 10.32 with a yellow

dash, then the next bar goes green (bullish) from 10.33 to 10.42, but

yet another bar returns bearish to 10.34 as we place another yellow

dash, again we circle it as a good sign to for market reversal but not

strong enough. Finally, seeing that it goes bullish once more on another

bar and rise above the recent high of 10.42, hence our prediction that

its now a strong reversal signal turned well, following also our

fundamentals and technical assessment. Remember, Patience and waiting for the market signals were key.

See beyond failure, for there lies success.

Enjoy your day!

Sheriff