Fundamental outlook for the US dollar index: neutral

Responses euro / US dollar's strong reaction to the report it seems the US non-farm payrolls to show a certain degree of skepticism market figures Home- probably due to seasonal

Why was this version is both good and bad from the outside implicitly in relation to the US dollar? On the one hand, it has been interpreted initial reactions easily: will be considered members of the Federal Reserve very strong headline numbers (+292 thousand) as a reason to maintain the belief that the Federal Reserve will increase interest rates four times during the year 2016 in the world of "The good news is the news bad ", that no evidence of the possibility of tighter Fed policy at a faster pace than those projected Halaa- two increases only this year (according to futures funds FOMC) - as opposed to the rapid deterioration of risk sentiment and news geopolitical extremely negative, it has become as bad a combination of currencies yielding Top of assets and associated risks.

US dollar gains achieved in a climate of risk aversion, but for how long?

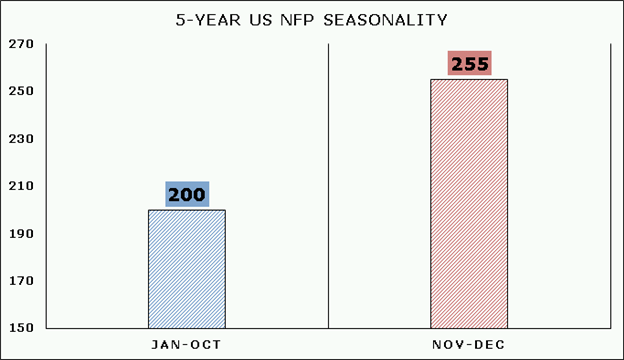

However, on the other hand, it is likely that market participants pay attention to that in December produced a strong reading in recent years. In fact, during the past five years, the average monthly rise in jobs in any month 208.3 thousand. From the year 2011 until the year 2015, from January to October, the average height of a thousand jobs to +200. During the same timeframe, in November and December, the average height of +255 thousand jobs, higher by 27.5% of the months in the period from January to October.

This is the bad side of the report of the US dollar, and why we are questioning the ability of the US dollar to maintain its gains. There are many references to the sliding US economy. To start, according to what is displayed in the last work report, wages low continuous growth: was commended last number wage as one of the best readings in the post-global financial crisis, despite the fact that the reality of their presence at 2.5% on an annual basis is less From arrival to estimates of 2.7% on an annual basis.

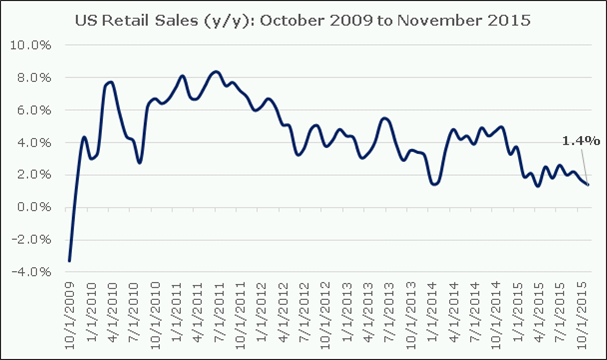

Chart 2: US Retail Sales (YoY): from October 2009 until November 2015

The composition of jobs in itself looks more and more weak, with the formation of the majority of jobs part-time jobs gained during the past year. Shrink industrial production for the first time on an annual basis in not dominated by a recession since 1952 when President Truman nationalized the US steel sector, it was hardly normal economic period. With the presence of retail sales growth at 1.4% on an annual basis, be above the bottom after the registrar-based global financial crisis when 1.3% (November 2009 and April 2015). Housing data is starting to look shaky and has become a strong US dollar is considered more and more as a pretext for multinational companies to justify the bad results of which revenues. The US dollar may be closer to the brink of the abyss, which is the belief in the past.

In relation to the US dollar, it needs economic data to turn the tables so that the market become not only the aspects of the proceeds Top / policy hardline more that support the US dollar in the event of continued Fed to follow the desired path to increase rates, but considering the increases are in the context of non-commit bank secured Federal Reserve any error at the level of policy would push the US economy, the more likely the global economy, to the cliff and into recession. If the decline in the Fed about his expectations, this would be devastating, in particular the US dollar.

Over the medium term, we may be seeing in the process of picking the last breath at this altitude. For the pair such as the euro / US dollar, for example, it may mean the continuation of the broader sideways range. With the entry of crowds retail sale euro / US dollar positions trading, and maintain investor is trading in the futures market to 160.6 thousand from the net sale of euro contracts, there are conflicting direction supports high pair in the near term, especially in the event of continued European stock markets thanks to "the effects of falling re-channel the governor's budget. "

---