Here is why time and compound interest are investors' best friends - Stat

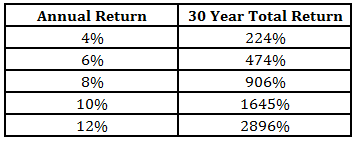

Ben Carlson from "A Wealth of Common Sense" blog has fulfilled some calculations to get really striking statistics. He notes that the worst 30-year total return on the S&P 500 was close to 850%. While the first feeling this figure provokes is doubt, Carlson explains that it was actually an annual return of just over 7.8%.

Here are a few fascinating long-term stock market stats Carlson found while making calculations:

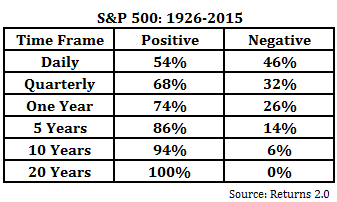

- The worst total return over a 20 year period was 54%. But the worst 30 year total return was 854%.

- The standard deviation of annual returns over 20 and 30 year time frames has been strikingly low — just 1.3% and 2.8%, respectively. The volatility in returns has historically fallen off a cliff as you extend the time horizon in the market.

- Volatility in the stock market during the 1930s was crazy. Not only did the market plunge more than 80% during the Great Depression, but during that period there were two separate quarters that saw stocks rise in excess of 80%.

- In contrast to the large losses seen in 1930s, the bull market of the 1980s and 1990s produced an amazing run of gains for long-term investors. If you would have invested at any point between 1973 and 1985 you would have earned anywhere from 12-18% per year over the following twenty years.

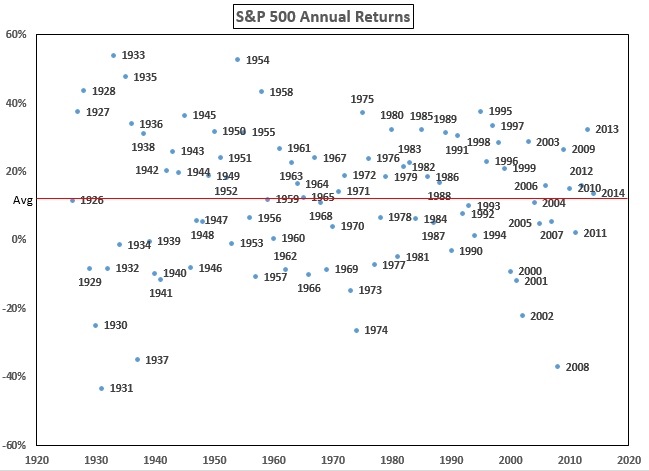

- Annual returns are all over the place and rarely do investors experience average performance in any given year as you can see from this graph:

The reason that some 7.8% turns into 850% is for two simple, yet widely misunderstood reasons:

1) time,

2) compound interest.

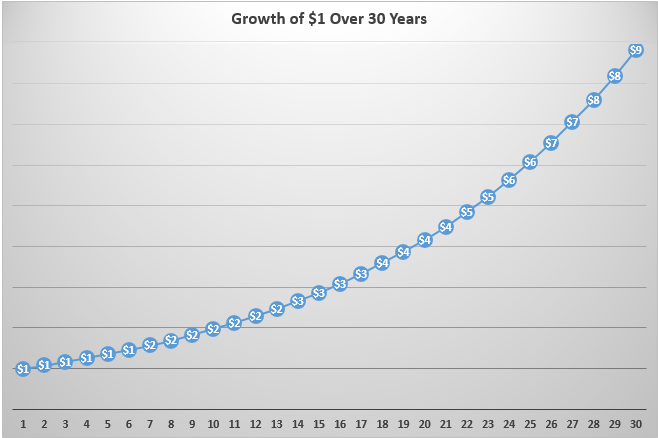

Compound interest is like a snowball rolling downhill. At first, it is slowly picking up speed and size, but it really takes off over the long run as gains accumulate on top of gains. For example, below is the growth of $1 over 30 years at an annual return of 7.8%:

Have a look at what is going on with the dollar after 20 years: it take two decades for the greenback to advance from 1 to 4, and just one decade to rise from 4 to 8. Undoubtedly, the markets don’t edge up as smoothly as this line does. And there’s a very good opportunity that an investor’s tolerance for risk will change as they collect more money in their portfolio, Carlson writes.

He notes, however, that it is a huge mistake to underestimate the potential of compound interest as you look to grow your portfolio. The biggest asset most investors have is time.

Some critics of this model mention that Carlson's calculations do not include the impact of inflation which can be significant over 30 years.

He thus took inflation into account to find out that the worst 30-year total real return was just shy of 240%. While not as impressive as 850%, that’s still 4.1% over the rate of inflation over 30 years.