One U.S. Investor Is Ready to Raise His Rates, With or Without the Fed.

15 September 2015, 16:52

0

275

- Vehicle parts creator sees conceivable log jam with higher rates.

- Obligated retirees on altered wages may be harmed by an increment.

On the off chance that the Federal Reserve doesn't raise interest rates this week, Bill Loving may need to do it without anyone's help.

The president and CEO of Pendleton Community Bank, headquartered in Franklin, West Virginia, says he sees "expanding credit request" that will warmth up if the national bank keeps its record boost set up. At that point he'll need to help his store rates to draw in more finances to loan.

"Clients feel more sure," Loving says in a meeting at O'Neill's eatery on North Main Street in Moorefield, West Virginia, around 130 miles west of Fed home office in Washington. "They are feeling better about where things are."

Adoring is a nation financier. Pendleton, an auxiliary of Allegheny Bancshares Inc., has five branches scattered among valley towns like Moorefield and Harrisonburg, Virginia. Customers incorporate home-credit borrowers, retailers, evaluation school understudies who bring pots of coins into a branch to open their first record, and dairy cattle and poultry agriculturists attempting to develop the group or put weight on a winged creature.

Some of the time his advance guarantee is on the foot. Cherishing's credit examiners are from homestead families and know how to exchange stock - the kind with four legs. The bank at times purchases prize-winning sheep or pigs at fairs to help nearby 4-H kids, then it offers the creatures at closeout.

Cherishing says the economy in his general vicinity is grabbing, reflected in the "assist needed" with marking before bureau producer American Woodmark Corp's. plant up the street.

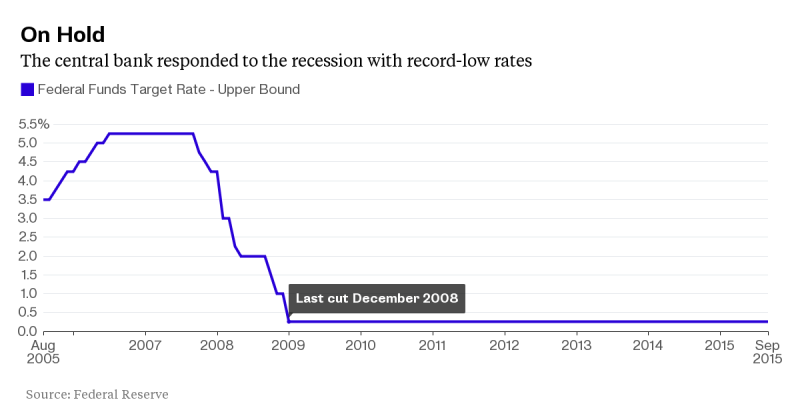

Group banks depend generously on stores to reserve advances, so an offering war could emit among Loving and his associates as interest gets. The Fed has held its benchmark rate close to zero following December 2008, and in the event that it stays low, that will "affect our edges, constraining rivalry on the advance side and rivalry on the store side," Loving says. So it's the ideal opportunity for the national bank to act, he trusts, despite the fact that Wall Street brokers see an under 33% likelihood of that occurrence when Fed authorities meet this week.

With Pendleton's fundamental bank accounts right now yielding 0.05 percent and an one-year testament of store at 0.2 percent, retirees and different investors are clamoring for higher returns. He stresses his customers will begin to move into unsafe arrangements.

Pendleton's managing an account business would be exceptionally recognizable to Carter Glass, the Virginia legislator who guided the Federal Reserve Act into law in 1913 incompletely to help balance out the tidal streams of cash from the ranch economy to money related focuses in New York and back.

While the Fed and the saving money framework have developed, there is one consistent: Changes in the rate of premium set by the national bank at twentieth Street and Constitution Avenue in Washington still are felt over the mountains and down in valleys like this one.

Low rates are "bad for savers, and we have a more seasoned populace here that live on their enthusiasm," Loving says. "I think the time has come" for the Fed to move.

Car Parts Maker Worries About Pace of Increases

You can hear the force of the Fed's record-low intrigue rate approach on the floor of Cascade Die Casting Group Inc's. plant in High Point, North Carolina.

Automated arms spoon liquid aluminum into molds, making parts for Jeeps, Nissan Altimas and Ford F-arrangement pickups. As the pieces descend the line, they are cleaned, brushed and measured in a beat of murmuring and buzzing that sets the pace through two 10-hour moves, four days a week.

"We have been recipients of those low rates," says Patrick Greene, president of Cascade, which additionally has plants in Sparta and Grand Rapids, Michigan.

The Fed's zero rate and quantitative facilitating helped restore the American car industry in the retreat's repercussions. Presently, with rates ready to rise, administrators at Cascade stress over a loss of force.

A noteworthy increment "will adversely influence auto deals," Philip Torchio, Cascade's boss working officer, says on the shop floor. "I think you will see it in the mood of work here."

Offers of new autos and light-obligation trucks dove to a 9 million occasionally balanced yearly rate in February 2009 in the midst of more tightly credit and higher unemployment, contrasted and 16.6 million in December 2006, as per Wards Automotive Group.

Resolved to restore credit-touchy commercial enterprises after the money related emergency, U.S. national brokers cut the rate on overnight credits among banks and afterward pushed down longer-term rates with direct buys of Treasury and lodging organization obligation. Normal financing expenses for another auto were 4.71 percent in the first quarter of this current year, down from 6.94 percent in the first quarter of 2008, as indicated by information from Experian Plc. By a month ago, vehicle deals had recuperated to a 17.7 million yearly rate, the most astounding subsequent to 2005.

The subsidence hit Cascade head-on. Income fell 40 percent at the low point; the organization needed to lay off less-talented staff and advised others to set aside time off without pay.

"We said, 'On the off chance that you need to make a go at chasing for a month, go,"' Greene said. "We began curtailing hours. We needed to lessen compensation. It was a hard."

Course spent not exactly $100,000 on capital consumptions in 2009, small for a business in light of overwhelming machining.

"We truly halted and said, 'We simply don't know where this finishes; we have to save money,"' Greene said.

When automobile deals bounced back, Cascade employed back a laborers' portion it laid off and extended in Michigan, including 50 occupations. It now wants to extend at High Point, as well, adding upwards of 25 to 30 occupations. The organization utilizes around 475 individuals, split equitably in the middle of Michigan and North Carolina.

A half-rate point support in the Fed's benchmark could lessen U.S. automobile deals by as much as 150,000 units a year, gauges John Humphrey, general administrator of J.D. Power & Associates' worldwide car operations in Westlake Village, California.

A little increment most likely won't influence business excessively, Torchio says. "In any case, there will without a doubt be a point where the force will change if rates keep on going up."

Retiree Paladino Says Yellen Should Wait

Ralph Paladino is a resigned cop in Utica, New York. He and his wife of 44 years watch the businesses and business news consistently - and trust Fed Chair Janet Yellen doesn't raise interest rates.

"Stroll in my shoes," says the 68-year-old. "We don't have filet mignon consistently."

He has Mastercard obligation of $4,700 with a 9 percent interest rate and a home-value credit at around 6 percent. His wage is Social Security and a state annuity.

Paladino would not like to be paying off debtors in retirement. Be that as it may, life has a method for changing the best of arrangements. His little girl, Deanna, passed on of tumor at age 41 last year, and his 17-year-old granddaughter moved to his home. He spent some of his cash on remodels.

"We needed to have a genuine decent space for her," he says.

He has another little girl, additionally a cop, who lives with them and assists with family charges.

"I don't recognize what we would manage without her," he says.

At the point when inquired as to whether Yellen ought to consider raising interest rates, Paladino says "by no means" and "no, no, no."

A move of even a quarter rate point may not appear like much, but rather it will build acquiring expenses for a huge number of Americans conveying obligation that conforms with changes in rates. That is on the grounds that a support in the Fed's benchmark triggers an ascent in the prime giving rate, which banks frequently use as the base for Visas and home-value advances.

Higher obligation expenses can be a zero-entirety computation for the Paladinos and others in light of the fact that expansion is low, only 0.3 percent for the year finishing July. The previous policeman says typical cost for basic items alterations on his retirement salary have been scarcely enough "to part a banana split."

Compensation for occupation holders haven't been jogging ahead either, expanding a normal 2 percent a year since the monetary extension started in June 2009.

"Keeping that prime rate low truly matters to us," Paladino says.

At around 2 p.m. Sept. 17, when Fed authorities discharge their approach articulation, Paladino will be watching sites and TV for the news. At this moment, he has certainty the Fed's first female seat will settle on the right choice.

"Yellen has been making a tremendous showing," he says. "I think she does see the 10,000 foot view."https://www.mql5.com/en/signals/111434#!tab=history