Current trend

In the end of last week, the Pound strengthened against the USD and gained back most of the losses of early September.

However, macroeconomic statistics remain ambiguous. In particular, the GBP was pressured by poor data on Industrial Production that in June shrank by 0.4%, while experts forecasted a 0.1% growth.

At the same time, the Pound was supported by the Bank of England statement, in which the regulator expressed its confidence in the strength of the economy leading to a possibility of the official rate increase in the near future. Markets expect the rate to be increased in the first quarter of the next year.

Support and resistance

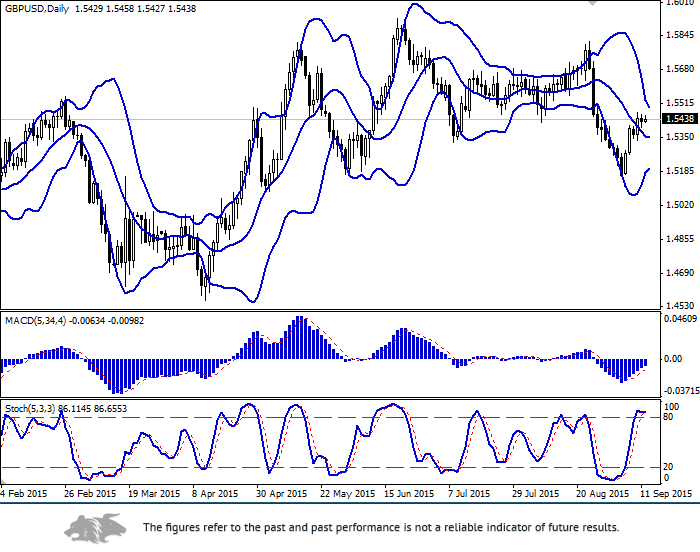

Bollinger Bands on the daily chart is turning horizontally, while the price range is narrowing. MACD is growing and giving a strong buy signal. Stochastic is in the overbought zone and turning horizontally, which can indicate a possibility of a correction.

The indicators recommend considering long positions, or wait for a clearer signal.

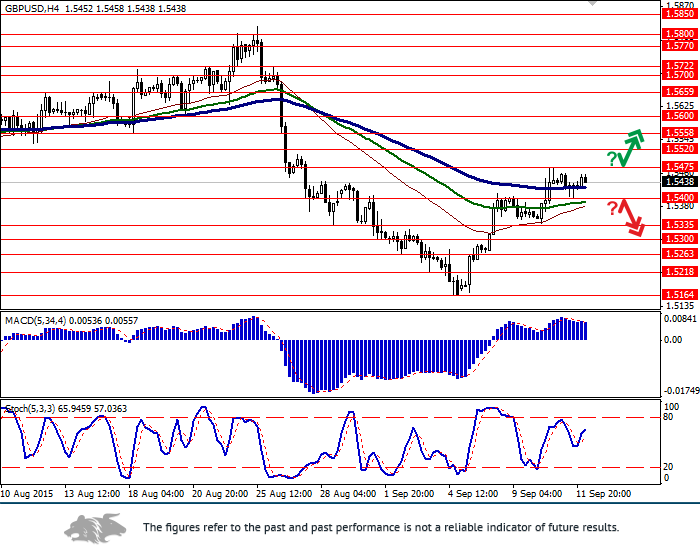

Support levels: 1.5400, 1.5335 (10 September low), 1.5300, 1.5263, 1.5218, 1.5164 (4 September low).

Resistance levels: 1.5475 (10 September high), 1.5520, 1.5558, 1.5600, 1.5659, 1.5700.

Trading tips

Long positions can be opened after the breakout and consolidation above the level of 1.5475 (with the appropriate indicators signals) with the target at 1.5600 and stop-loss at 1.5400.

Short positions can be opened after the breakdown of the level of 1.5400 with the target at 1.5200 and stop-loss at 1.5475.'