Here's When Economists Expect to See the Next U.S. Subsidence

12 September 2015, 13:23

0

166

A downturn may be likely before the decade is out

Some guidance for President Barack Obama's successor: convey an arrangement to battle the following subsidence.

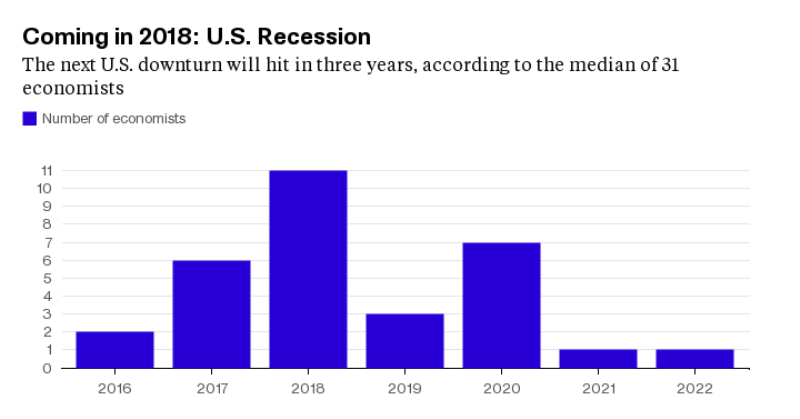

That is one determination made from a review of business analysts Sept. 4-9, where the middle conjecture of 31 respondents has the following downturn happening in 2018.

Accepting the aggregate shrewdness of financial experts is correct—which is a liberal supposition given that foreseeing business cycles isn't precisely a cakewalk—it puts the present extension on track to have a lifespan of around nine years. That is a really decent run, however the honor of the longest extension on record would at present have a place with the decade that finished in March 2001.

The present recuperation has officially beaten the after war normal of just shy of five years, for the most part in light of the fact that change in the economy has been so moderate. Payrolls just began to truly get a year ago, and development, while consistent, hasn't been anything to think of home about. Financial specialists expect the U.S. to extend at a 2.5 percent annualized rate this year, only a tick above a year ago and much slower contrasted and development in different recuperations.

The overview likewise recommends that the following U.S. president will have only one schedule year to get settled before a downturn happens. They may need to request some counsel from Obama, who took office in January 2009, amid the most profound retreat in the post-World War II period.

Financial experts said there's a 10 percent shot of a U.S. retreat inside of the following 12 months, as indicated by the review's middle. While the middle is generally a decent gage on the grounds that it's less affected by exception reactions, the study's normal demonstrated a fascinating uptick. Taking a gander at that metric, the chances of a U.S. subsidence in the following year moved to a normal 13 percent, the most astounding since financial specialists were reviewed in December 2013.

That may have something to do with the unpredictability that has been annoying worldwide markets recently, also the Federal Reserve's first premium rate increment since 2006 coming when one week from now. A few business analysts stress that it's too soon to begin fixing strategy, which conveys the danger of creasing development.

In the mean time China, the world's second-biggest economy, is moderating, and other developing markets, for example, Brazil, South Africa and Russia are additionally battling. Item costs, exchange and expansion are all slow. Furthermore, development in created economies may not be sufficiently solid to help keep the world from slipping into a withdrawal. Every one of that was sufficient to incite Citigroup Inc's. boss business analyst, Willem Buiter, to dole out a 55 percent opportunity to some type of worldwide subsidence in the following couple years.