Speculators Lose on EU Power Bonds for First Time Since 2006

1 September 2015, 21:09

0

197

Speculators who purchased utility bonds in euros haven't had it this terrible for over 10 years.

Returns are falling in the midst of a vitality value droop that is pressing utilities' profit and slicing income accessible to reimburse obligation, while vitality productivity and quieted financial development are damping interest for power and regular gas. To aggravate matters, bond returns crosswise over Europe are enduring as European Central Bank endeavors to fortify the economy pin getting expenses close record lows.

The securities issued by organizations from Centrica Plc to RWE AG and EON SE

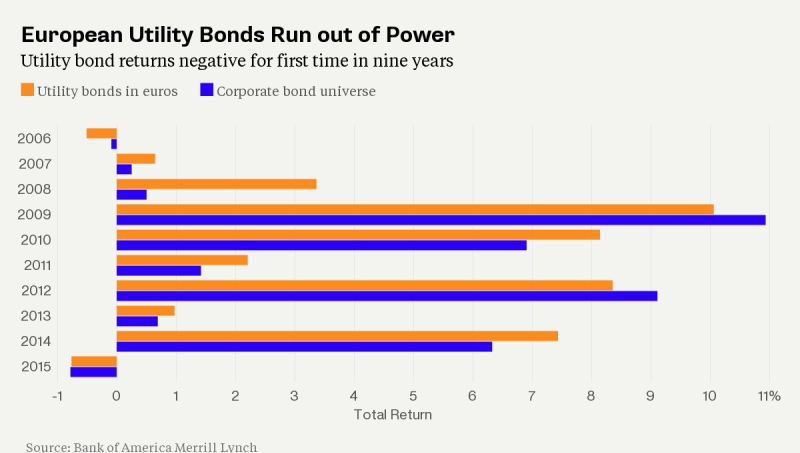

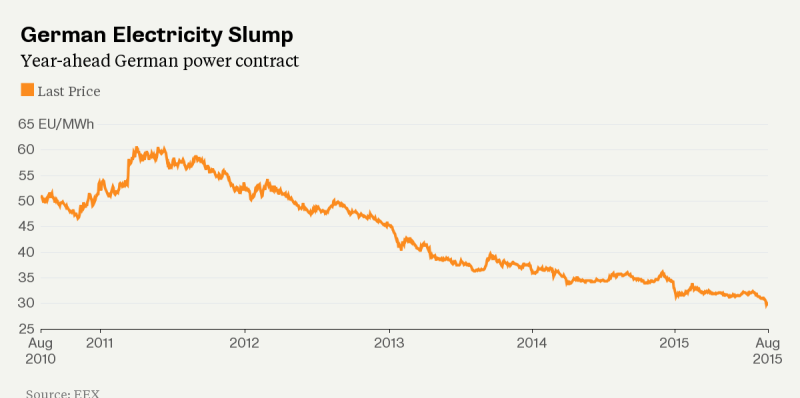

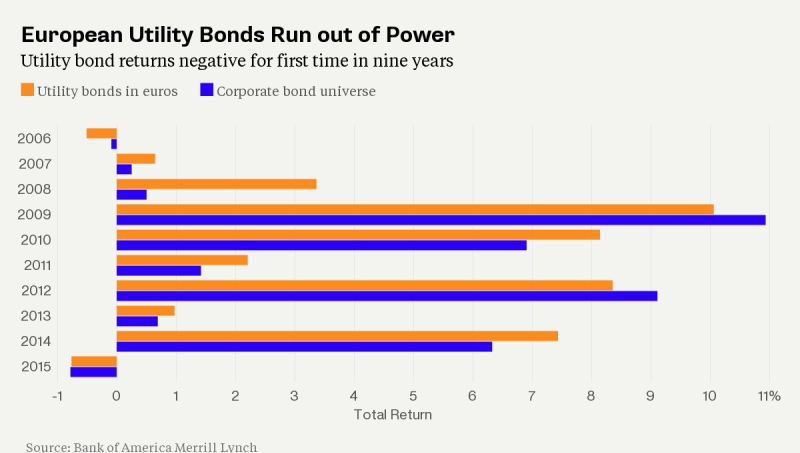

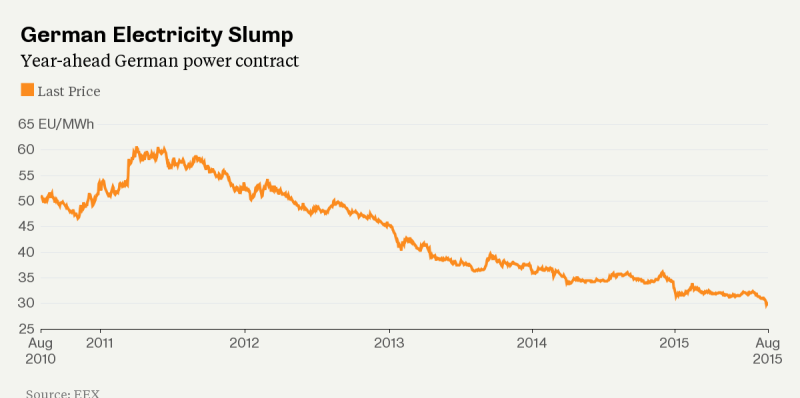

given bondholders a loss of 1.038 percent this year, the first negative returns for the period since 2006 and the most noticeably bad execution in 16 years, as per Bank of America Merrill Lynch record information. The expense of protecting utilities' obligation against default took off pretty much as force costs in Germany drooped to a 12-year low on Aug. 24.

"With force costs going down and utilization additionally going down in Europe, you have a twofold impact: a recuperation is being pushed back consistently," said Nadege Tillier, an Amsterdam-based credit investigator at ING Bank NV. "Speculators need to get used to more vulnerability."

One year from now control in Germany dove to the most reduced subsequent to October 2003 in the midst of Chancellor Angela Merkel's endeavors to push through the greatest switch from fossil energizes to renewable vitality of any created economy. The move is harming utilities as edges at customary coal and gas-let go plants shrink in light of the fact that less expensive green force gets need access to the lattice.

Age and RWE, Germany's biggest utilities, are the current year's most exceedingly bad entertainers on the country's benchmark DAX stock list as falling force costs handicap income. Benefit at Centrica, Britain's greatest family unit vitality supplier, is set to drop for a third year after first-half income from oil and gas creation tumbled 78 percent in the midst of a defeat in thing costs.

RWE's 700 million euros ($788 million) of 2.75 percent mixture bonds due April 2075 fell 0.22 pennies on the euro to 90.1 pennies, the most minimal level subsequent to the notes were sold in April, as indicated by information assembled by Bloomberg.

Utility bonds lost 0.85 percent in August, as per Bank of America's Euro Utility Index of 294 venture grade securities. The obligation gave back 1.33 percent in the same period a year prior and more than 10 percent for the greater part of 2014.

Utilities are changing in accordance with the harder atmosphere. Age and RWE are contracting capital spending and offering resources for decrease costs. Centrica uncovered for the current month 1.5 billion pounds ($2.3 billion) of cuts in its investigation and creation business to help support income. Centrica, RWE and EON all declined to remark on the execution of their obligation.

"There is obviously some vulnerability yet a large number of them are still exceedingly appraised organizations that have acted to protect credit quality," said Neil Griffiths-Lambeth, partner overseeing executive of venture and foundation account at Moody's Investors Service. He sees wholesale power costs staying frail through 2020.

Speculators now request enthusiasm of 1.21 rate focuses, or 121 premise focuses, more than benchmark government obligation to purchase venture grade utility securities in euros, near the greatest premium in over a year and up from 87 premise focuses in February, Bank of America records show. Still, current expenses are lower than the 233 premise point crest in December 2008.

Obligation Insurance

The expense of protecting RWE's obligation against default climbed 36 percent this month, coming to 108 premise focuses on Aug. 26, the most noteworthy since June 2013, as per information supplier CMA. Credit-default swaps on EON came to a 18-month top of 80 premise focuses a week ago. That contrasts and 75 premise focuses for the Markit iTraxx Europe file of 125 venture grade organizations.

Appraisals organizations have doled out negative credit standpoints to 28 percent of Europe's biggest traded on an open market power generators, as indicated by Bloomberg Intelligence. Minimizations put extra strain on the capacity of utilities to get the best rates when raising cash.

Standard & Poor's minimized RWE's obligation one stage to BBB, two levels above garbage, on Aug. 27, refering to discouraged force costs and an "antagonistic political environment" in its home market. Vera Buecker, a representative for RWE, said there was little RWE could do in the transient to change those variables.

S&P slice Centrica one level to BBB+ on Aug. 6, while EON was downsized by Moody's in March.

"I expect that there could be more downsizes to come," said Elchin Mammadov, an utilities investigator at BI.https://www.mql5.com/en/signals/111434#!tab=history

Returns are falling in the midst of a vitality value droop that is pressing utilities' profit and slicing income accessible to reimburse obligation, while vitality productivity and quieted financial development are damping interest for power and regular gas. To aggravate matters, bond returns crosswise over Europe are enduring as European Central Bank endeavors to fortify the economy pin getting expenses close record lows.

The securities issued by organizations from Centrica Plc to RWE AG and EON SE

given bondholders a loss of 1.038 percent this year, the first negative returns for the period since 2006 and the most noticeably bad execution in 16 years, as per Bank of America Merrill Lynch record information. The expense of protecting utilities' obligation against default took off pretty much as force costs in Germany drooped to a 12-year low on Aug. 24.

"With force costs going down and utilization additionally going down in Europe, you have a twofold impact: a recuperation is being pushed back consistently," said Nadege Tillier, an Amsterdam-based credit investigator at ING Bank NV. "Speculators need to get used to more vulnerability."

One year from now control in Germany dove to the most reduced subsequent to October 2003 in the midst of Chancellor Angela Merkel's endeavors to push through the greatest switch from fossil energizes to renewable vitality of any created economy. The move is harming utilities as edges at customary coal and gas-let go plants shrink in light of the fact that less expensive green force gets need access to the lattice.

Age and RWE, Germany's biggest utilities, are the current year's most exceedingly bad entertainers on the country's benchmark DAX stock list as falling force costs handicap income. Benefit at Centrica, Britain's greatest family unit vitality supplier, is set to drop for a third year after first-half income from oil and gas creation tumbled 78 percent in the midst of a defeat in thing costs.

RWE's 700 million euros ($788 million) of 2.75 percent mixture bonds due April 2075 fell 0.22 pennies on the euro to 90.1 pennies, the most minimal level subsequent to the notes were sold in April, as indicated by information assembled by Bloomberg.

Utility bonds lost 0.85 percent in August, as per Bank of America's Euro Utility Index of 294 venture grade securities. The obligation gave back 1.33 percent in the same period a year prior and more than 10 percent for the greater part of 2014.

Utilities are changing in accordance with the harder atmosphere. Age and RWE are contracting capital spending and offering resources for decrease costs. Centrica uncovered for the current month 1.5 billion pounds ($2.3 billion) of cuts in its investigation and creation business to help support income. Centrica, RWE and EON all declined to remark on the execution of their obligation.

"There is obviously some vulnerability yet a large number of them are still exceedingly appraised organizations that have acted to protect credit quality," said Neil Griffiths-Lambeth, partner overseeing executive of venture and foundation account at Moody's Investors Service. He sees wholesale power costs staying frail through 2020.

Speculators now request enthusiasm of 1.21 rate focuses, or 121 premise focuses, more than benchmark government obligation to purchase venture grade utility securities in euros, near the greatest premium in over a year and up from 87 premise focuses in February, Bank of America records show. Still, current expenses are lower than the 233 premise point crest in December 2008.

Obligation Insurance

The expense of protecting RWE's obligation against default climbed 36 percent this month, coming to 108 premise focuses on Aug. 26, the most noteworthy since June 2013, as per information supplier CMA. Credit-default swaps on EON came to a 18-month top of 80 premise focuses a week ago. That contrasts and 75 premise focuses for the Markit iTraxx Europe file of 125 venture grade organizations.

Appraisals organizations have doled out negative credit standpoints to 28 percent of Europe's biggest traded on an open market power generators, as indicated by Bloomberg Intelligence. Minimizations put extra strain on the capacity of utilities to get the best rates when raising cash.

Standard & Poor's minimized RWE's obligation one stage to BBB, two levels above garbage, on Aug. 27, refering to discouraged force costs and an "antagonistic political environment" in its home market. Vera Buecker, a representative for RWE, said there was little RWE could do in the transient to change those variables.

S&P slice Centrica one level to BBB+ on Aug. 6, while EON was downsized by Moody's in March.

"I expect that there could be more downsizes to come," said Elchin Mammadov, an utilities investigator at BI.https://www.mql5.com/en/signals/111434#!tab=history