Spain's Strong Economic Growth Held Back By Banking, But Not For Long.

"The issue kid that was Spain has transformed into the dynamo of Europe, with development far overwhelming adversaries," the exploration piece, titled "The Spanish puzzle," focuses out. Checking particular wellbeing gauges, for example, fabricating PMI, a "powerful" 53.6 in July, mechanical generation that was up 4.5 percent as of June and a 17 percent expansion in lodging exchanges is highlighting financial indications of life. Indeed, even the bothering issue, unemployment, is hinting at change. While still over 20 percent, the quantity of employment seekers fell by 347,000 year over year premise July 2015. A pattern is set up, it shows up.

This all deciphers into higher general monetary movement, as measured by Gross Domestic Product, which was up 1 percent in the second quarter. Truth be told the 3.1 percent year-over-year GDP pick up in Spain was just bested by the feature monetary entertainer in the area, Ireland.

How Spain defeated the monetary disquietude

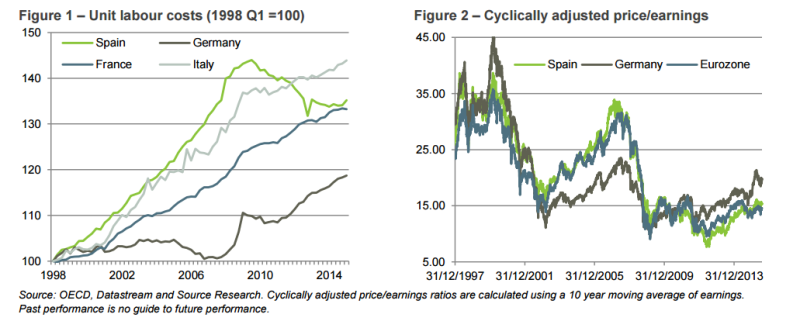

Spain's issues in defeating the subsidence obstacle of 2008-2009 were exacerbated by a few elements the report, composed by Paul Jackson, head of examination, Andras Vig, exploration partner, were multifold. Glancing back at the present record exchange shortage, which came to 10 percent of GDP by 2008, the loss of aggressiveness is obvious. The efficiency of the Spanish laborer, measured by unit work expenses ascended by 40 percent while German work expenses stayed level.

With a typical money in the middle of Spain and Germany there was currently "common" system to offset financial action that a brought down Spanish cash would have settled.

"This loss of aggressiveness intensified the equalization of installments issue brought on by an overheating economy filled by improperly low genuine interest rates set by the ECB in Frankfurt," the report noted. Spain's "street to reclamation" was realized in striking manner by a decrease in unit work costs. This was proficient through high unemployment – up close to 26 percent at a certain point – and in addition government measures to make work more adaptable.

The outcome? Unit work costs in Spain have been dropping while work costs all through the area have been on the ascent. Once the most elevated work cost among the four essential monetary forces in the district, Spain is currently drawing closer a work cost like that of France subsequent to obscuring Italy. Germany is by all accounts walking to its own profitability beat and is almost ten percent lower in expense than Spain and France, making their fare costs less lavish and in this manner more alluring.

Resource costs recount the tale of Spain's recuperation – except for the share trading system

The essential system to benchmark's Spain's financial recuperation, the report noted, is to see advancement in view of the relative estimation of ten year interest rates. What was at one point a 600 premise point higher ten year note in mid-2012 has now returned to a 120 bps spread at this point.

While premium rates reflect less concern and danger in the sovereign country, the Spanish securities exchange, measured by the IBEX value list, just beat the Eurostoxx 50 amid this period 79 to 63 percent. Money markets dissimilarity is surprisingly more terrible when one considers late execution, as the IBEX is up 11 percent in the course of the most recent year while the Eurostoxx50 is up 21 percent and the German DAX record is up 28 percent. (The feature unemployment number still stands close to 20 percent, a figure not dissected to incredible length in the report.)

What is keeping down Spain and its securities exchange from progressing on a relative quality premise?

With monetary quality by and large possessing large amounts of the numbers out of Spain (except for feature unemployment, which is inclining lower) what is keeping down the share trading system?

The report first takes a gander at political contemplations. The unavoidable issue in the locale is: will the Greek political sickness spread to different districts in Europe. Greece's Syrzia party – promising what might as well be called a chicken in each pot – seems to have been ceased at its northern outskirts. Refering to assessment surveys, the Source report says it is improbable that Podemos, the Spanish variant of the Syriza gathering, is liable to increase any more than 70 seats in parliament and is unrealistic to frame an administration that could challenge the EU the norm.

With governmental issues not a purpose behind Spanish stocks to be kept down, the issue is with the banks, the report says. What's more, this is situated to change. "The way that home loan credits were up 15% y-o-y in May in Spain could be uplifting news – the monetary restoration is boosting bread and margarine saving money business," the report watched. Having an extensive managing an account segment, which was an issue for its securities exchange, could soon be favorable position. "Joyfully for speculators in Spain, positive input circles in the middle of economies and banks will work https://www.mql5.com/en/signals/120434#!tab=history

Watch out Europe, Spain, once considered a harried monetary area soiled somewhere down under water and unemployment, has turned into a relative powerhouse. While numerous financial markers, most particularly unit work expenses, have prompted relative thriving, one pointer of monetary success slacks: its securities exchange stays stagnant, an institutional multi-resource examination piece from Source focuses out. On the other hand, this could change in light of the fact that the area keeping down stock costs is prone to get a lift.

Spain

"The issue kid that was Spain has transformed into the dynamo of Europe, with development far overwhelming adversaries," the exploration piece, titled "The Spanish puzzle," focuses out. Checking particular wellbeing gauges, for example, fabricating PMI, a "powerful" 53.6 in July, mechanical generation that was up 4.5 percent as of June and a 17 percent expansion in lodging exchanges is highlighting financial indications of life. Indeed, even the bothering issue, unemployment, is hinting at change. While still over 20 percent, the quantity of employment seekers fell by 347,000 year over year premise July 2015. A pattern is set up, it shows up.

This all deciphers into higher general monetary movement, as measured by Gross Domestic Product, which was up 1 percent in the second quarter. Truth be told the 3.1 percent year-over-year GDP pick up in Spain was just bested by the feature monetary entertainer in the area, Ireland.

How Spain defeated the monetary disquietude

Spain's issues in defeating the subsidence obstacle of 2008-2009 were exacerbated by a few elements the report, composed by Paul Jackson, head of examination, Andras Vig, exploration partner, were multifold. Glancing back at the present record exchange shortage, which came to 10 percent of GDP by 2008, the loss of aggressiveness is obvious. The efficiency of the Spanish laborer, measured by unit work expenses ascended by 40 percent while German work expenses stayed level.

With a typical money in the middle of Spain and Germany there was currently "common" system to offset financial action that a brought down Spanish cash would have settled.

"This loss of aggressiveness intensified the equalization of installments issue brought on by an overheating economy filled by improperly low genuine interest rates set by the ECB in Frankfurt," the report noted. Spain's "street to reclamation" was realized in striking manner by a decrease in unit work costs. This was proficient through high unemployment – up close to 26 percent at a certain point – and in addition government measures to make work more adaptable.

The outcome? Unit work costs in Spain have been dropping while work costs all through the area have been on the ascent. Once the most elevated work cost among the four essential monetary forces in the district, Spain is currently drawing closer a work cost like that of France subsequent to obscuring Italy. Germany is by all accounts walking to its own profitability beat and is almost ten percent lower in expense than Spain and France, making their fare costs less lavish and in this manner more alluring.

Resource costs recount the tale of Spain's recuperation – except for the share trading system

The essential system to benchmark's Spain's financial recuperation, the report noted, is to see advancement in view of the relative estimation of ten year interest rates. What was at one point a 600 premise point higher ten year note in mid-2012 has now returned to a 120 bps spread at this point.

While premium rates reflect less concern and danger in the sovereign country, the Spanish securities exchange, measured by the IBEX value list, just beat the Eurostoxx 50 amid this period 79 to 63 percent. Money markets dissimilarity is surprisingly more terrible when one considers late execution, as the IBEX is up 11 percent in the course of the most recent year while the Eurostoxx50 is up 21 percent and the German DAX record is up 28 percent. (The feature unemployment number still stands close to 20 percent, a figure not dissected to incredible length in the report.)

What is keeping down Spain and its securities exchange from progressing on a relative quality premise?

With monetary quality by and large possessing large amounts of the numbers out of Spain (except for feature unemployment, which is inclining lower) what is keeping down the share trading system?

The report first takes a gander at political contemplations. The unavoidable issue in the locale is: will the Greek political sickness spread to different districts in Europe. Greece's Syrzia party – promising what might as well be called a chicken in each pot – seems to have been ceased at its northern outskirts. Refering to assessment surveys, the Source report says it is improbable that Podemos, the Spanish variant of the Syriza gathering, is liable to increase any more than 70 seats in parliament and is unrealistic to frame an administration that could challenge the EU the norm.

With governmental issues not a purpose behind Spanish stocks to be kept down, the issue is with the banks, the report says. What's more, this is situated to change. "The way that home loan credits were up 15% y-o-y in May in Spain could be uplifting news – the monetary restoration is boosting bread and margarine saving money business," the report watched. Having an extensive managing an account segment, which was an issue for its securities exchange, could soon be favorable position. "Joyfully for speculators in Spain, positive input circles in the middle of economies and banks will work https://www.mql5.com/en/signals/120434#!tab=history