Current trend

On Monday, during the trading session, Brent crude oil lost more than 70 points. The fall was caused by of the sharp fall of the Chinese Shanghai Composite by 8.48%: the market is very sensitive to any weakness in China’s economy, as it is the largest importer of raw materials. Also, "black gold" is falling after the restrictive sanctions against Iran were removed. Moreover, the oil prices are affected by the fear of reduction in energy demand and by the positive US statistics which support the US Dollar.

Yet, a possible US interest rate hike is the main factor of negative influence. The Fed holds its meeting tomorrow, and, if the interest rate is increased, the oil price may hit new lows.

Support and resistance

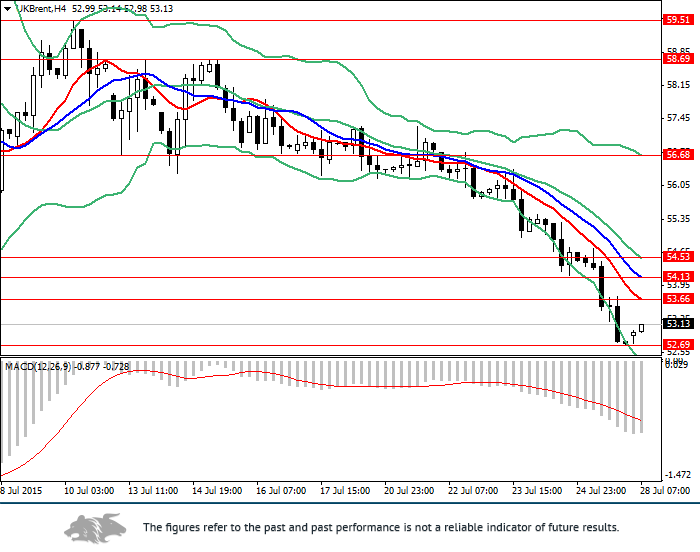

On the 4-hour chart EMA10 EMA20 lines are above the current price and are moving down, indicating the downward trend. MACD is in the negative zone; its volumes are increasing which also is a sign of the descending price movement.

Support levels: 52.69.

Resistance levels: 53.66, 54.13, 54.53, 56.68, 58.69, 59.51.

Trading tips

The pair bounced off the low of 52.69 and, currently, is moving up. In the short term, it is recommended to open long positions from the current levels with the target at 53.60 and stop-loss at 52.75.

The breakdown of 52.69 could be a signal to open short positions with the target at 52.00 and stop-loss at 53.00.