BEFORE The CLOSURE Of The MARKET REVIEW And OUTLOOK SIGNALS.

European PMIs edge higher, US PMI and new home sales.

Europe's July PMIs for July should show growth, albeit moderate

The US PMI will hit its lowest point since 2013, but at least it will still be positive

US housing is improving, as volumes reach post-crisis highs

As European monetary policy is largely set in stone at the moment, so any signals from the Federal Reserve meeting should begin to dominate trading.

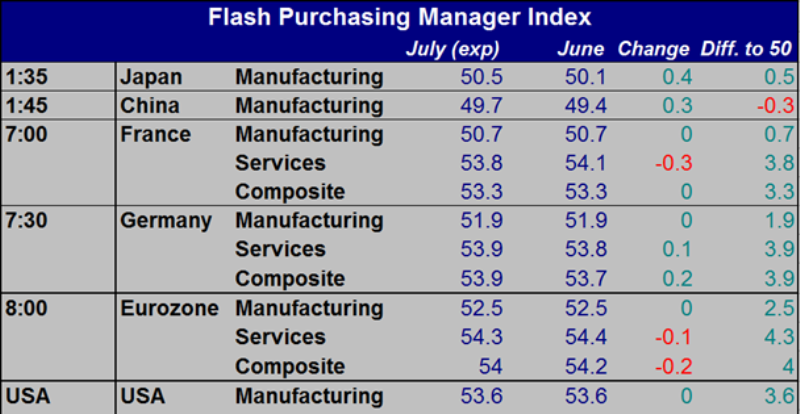

Europe July Flash Purchasing Manager Indices (07:00-08:00 GMT). No big changes are expected from July flash PMIs in Europe, but most indices are at least likely to rise slightly, or stay unchanged from June levels.

Across the board, service and manufacturing indices are clearly above the 50-level for France, Germany and the Eurozone – yes, even French manufacturing PMI, weakest of them all, is above the 50-level. Service indices are expected to remain higher than manufacturing indices.

Eurozone industrial production should soon begin to follow the higher PMI, unless the current optimism proves to be a miscalculation, just as it was in early 2014. The composite PMI suggests that GDP growth should begin to increase toward the end of the year.

High dollar fallout

The US Flash Manufacturing Purchasing Manager Index for July (13:45 GMT) is expected to remain unchanged from June’s 53.6 reading – that was the weakest since October 2013, but it's still clearly above the 50-level. The NAPM Manufacturing PMI bottomed out in April, so this divergence might be something that needs to close out soon. Maybe a positive surprise in flash estimates could increase the odds of a September lift-off for the Fed.

The falling PMI can be blamed on weak exports, which have been hurt by the strong US dollar. In addition to weak exports, investment has also been weak, and the PMI is mostly propped up by buoyant consumer spending.

This makes the EURUSD’s narrow range (that is, 1.05 to 1.15) of the past six months more comprehensible – the lower EURUSD makes the Fed sound more dovish, while the European Central Bank does not like higher levels. This reminds me of what happened in 2014: EURUSD spent a long time within a relatively narrow range until the ECB started to signal its sovereign bond purchase programme.

Growth hits home

Home sales are expected to increase slightly to 550,000 (in annual rate terms) in US June New Home Sales (14:00 GMT). This tells a story of a healthy consumer sentiment and is a good sign for the economy – construction and employment certainly like a booming housing market.

more : https://www.mql5.com/en/signals/120434#!tab=history

European PMIs edge higher, US PMI and new home sales.

Europe's July PMIs for July should show growth, albeit moderate

The US PMI will hit its lowest point since 2013, but at least it will still be positive

US housing is improving, as volumes reach post-crisis highs

As European monetary policy is largely set in stone at the moment, so any signals from the Federal Reserve meeting should begin to dominate trading.

Europe July Flash Purchasing Manager Indices (07:00-08:00 GMT). No big changes are expected from July flash PMIs in Europe, but most indices are at least likely to rise slightly, or stay unchanged from June levels.

Across the board, service and manufacturing indices are clearly above the 50-level for France, Germany and the Eurozone – yes, even French manufacturing PMI, weakest of them all, is above the 50-level. Service indices are expected to remain higher than manufacturing indices.

Eurozone industrial production should soon begin to follow the higher PMI, unless the current optimism proves to be a miscalculation, just as it was in early 2014. The composite PMI suggests that GDP growth should begin to increase toward the end of the year.

Finally, here’s a full chart of the the PMIs. Markit’s press releases will be posted here.

High dollar fallout

The US Flash Manufacturing Purchasing Manager Index for July (13:45 GMT) is expected to remain unchanged from June’s 53.6 reading – that was the weakest since October 2013, but it's still clearly above the 50-level. The NAPM Manufacturing PMI bottomed out in April, so this divergence might be something that needs to close out soon. Maybe a positive surprise in flash estimates could increase the odds of a September lift-off for the Fed.

The falling PMI can be blamed on weak exports, which have been hurt by the strong US dollar. In addition to weak exports, investment has also been weak, and the PMI is mostly propped up by buoyant consumer spending.

This makes the EURUSD’s narrow range (that is, 1.05 to 1.15) of the past six months more comprehensible – the lower EURUSD makes the Fed sound more dovish, while the European Central Bank does not like higher levels. This reminds me of what happened in 2014: EURUSD spent a long time within a relatively narrow range until the ECB started to signal its sovereign bond purchase programme.

Growth hits home

Home sales are expected to increase slightly to 550,000 (in annual rate terms) in US June New Home Sales (14:00 GMT). This tells a story of a healthy consumer sentiment and is a good sign for the economy – construction and employment certainly like a booming housing market.

It is worth pointing out that from the 1960s until the late 1990s, new home sales oscillated between 350,000 and 875,000 units. In the late 1990s, the housing boom started in earnest and home sales peaked in 2005 at 1,389,000 units. So even though we’re past the half-a-million mark and at a post-crisis high, the current level is just the long-term average, historically speaking, and not an extreme level.

Note that while the volume of home sales peaked in July 2005, house prices turned lower after that, toward the end of 2007. It is a well-known pattern that house prices are somewhat inflexible, just as wages are. So the volume tends to lead the price, and following home sales is probably a shrewd way to spot the economy’s next cyclical top.more : https://www.mql5.com/en/signals/120434#!tab=history