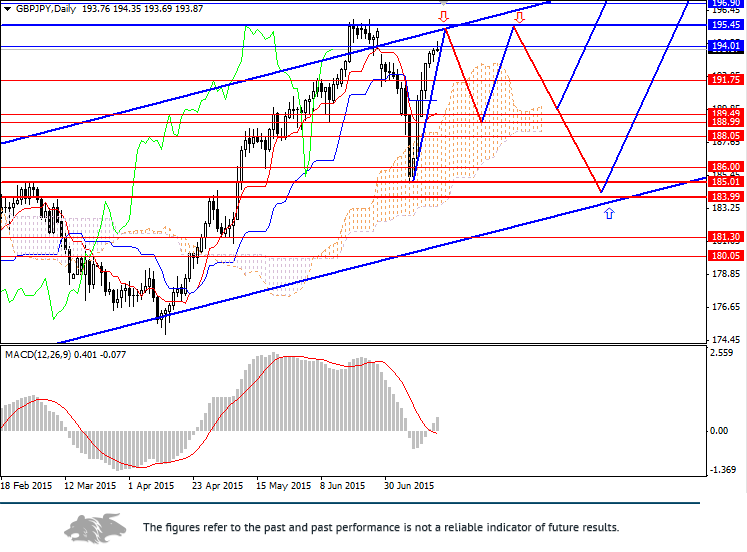

GBP/JPY: long correction from the local high 195.45 expected

Current trend

In our previous forecast, we correctly indicated the uptrend. Since the end of last week, the GBP strengthened significantly against the JPY amid the falling demand for the Japanese currency. At key support levels, investors began to move money from the yen to risky assets.

Over the past 2 weeks an increase in government bond yields supports the pound. While the negative UK Inflation and Labor Market statistics almost did not affect the British currency price.

Support and resistance

Today, no macroeconomic statistics from Japan and the UK are released, so the price should consolidate within the narrow sideways range. The pair may further strengthen towards 195.45 (the end of June local high), which is the key resistance level.

Then, a downward correction to 189.50, 189.00 is expected after which the pound should resume its growth against the yen.

Support levels: 191.75, 189.50, 189.00, 1188.05, 186.00, 185.00, 184.00, 181.30, 180.05.

Resistance Levels: 194.00, 195.45, 196.90, 198.50, 199.80, 200.00.

Trading tips

The pair continues trading within the upward channel, but short positions are more preferable as a long correction from 195.45 is expected.

Open positions below this level, from 195.30, with stop-loss at 195.70 and take-profit at key support levels 189.50, 189.00.

In the medium term, set take-profit at the lower border of the upward channel 186.00, 185.00.