As is almost always the case, the gold price got sold down the moment that trading began in New York on Sunday evening, with the low of the day coming shortly after 9:30 a.m BST in London. It rallied a few dollars from there before getting sold down about the same amount going into the London p.m. gold fix. The subsequent rally took it back to almost unchanged by the 5:15 p.m. close of electronic trading in New York.

The high and low ticks, such as they were, were recorded by the CME Group as $1,324.10 and $1,312.10 in the August contract.

Gold finished the Monday trading session at $1,320.00 spot, down 50 cents on the day. Net volume was 101,000 contracts.

The price action in silver was almost identical to gold's---however the rally after the London p.m. gold fix wasn't quite as robust, but still managed to make it back above the $21 spot price mark.

Silver's high and lows were $21.28 and $20.865 in the September contract.

Silver closed yesterday at $21.045 spot, down 10.5 cents from Friday's

close. For such a quiet trading day volume was very high at 42,500

contracts.

Platinum spent most of the day chopping around slightly below the $1,500

spot price mark, hitting its high of the day a few dollars above $1,500

spot, shortly after the Comex open. Then a willing seller took the

price down almost twenty bucks by noon in New York---but the price made

it back to almost unchanged by the close of electronic trading.

Platinum closed down a buck at $1,491.00 spot.

Palladium opened flat---and stayed that way until around 2 p.m. Hong

Kong time before getting sold down to its low at 10 a.m. in Zurich.

From there it rallied back to slightly above unchanged, but was

obviously capped at the $865.00 spot mark---and that's where it closed,

up three bucks on the day.

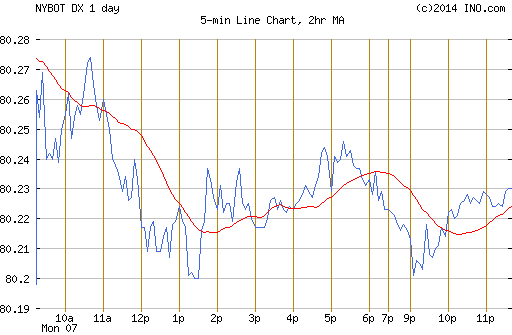

The dollar index closed late on Friday afternoon at 80.27---and didn't

do much during the entire Monday trading session, closing at 80.22.

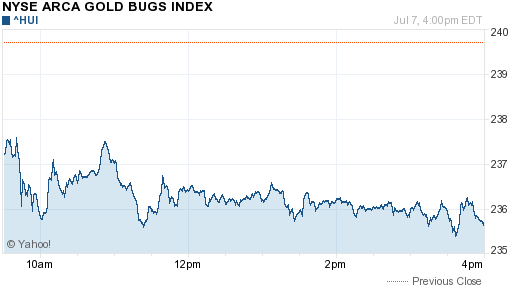

The gold stocks sold off about a percent and a half by the London p.m.

gold fix---and barely moved for the rest of the day. The HUI finished

down 1.67%.

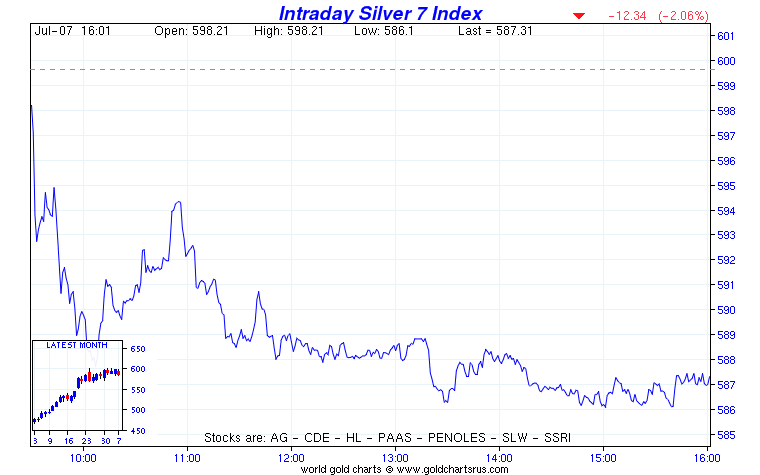

The silver stocks followed a similar pattern, except Nick Laird's Intraday Silver Sentiment Index closed down 2.06%.

The CME's Daily Delivery Report showed that one gold

and 15 silver contracts were posted for delivery within the

Comex-approved depositories on Wednesday.

An authorized participant deposited 57,748 troy ounces of gold in GLD yesterday---and as of 5:33 p.m. EDT yesterday afternoon, there were no reported changes in SLV.

The U.S. Mint had a small sales report to start the new week. They sold 500 ounces of gold eagles---500 one-ounce 24K gold buffaloes---and 230,000 silver eagles. It's been a very slow month for mint sales so far.

Over at the Comex-approved depositories on Thursday,

only 3,143 troy ounces of gold were reported received---and none were

shipped out. It was, of course, a different story in silver, as

1,249,484 troy ounces were reported received---and a smallish 61,703

troy ounces were reported shipped out the door.

Well, the Commitment of Traders Report for positions held at the close of Comex trading on Tuesday, July 1, was as ugly [and worse, in some respects] as Ted Butler said it would be. This was his call in his weekly review on Saturday---"It wouldn’t surprise me if the headline number of the total commercial net short position increased by 5,000 to 7,000 contracts in COMEX silver and by 20,000 to 30,000 contracts in COMEX gold in Monday’s report. If this proves to be the case, then in round numbers, this will mean that since June 3, the headline commercial net short position increased by 40,000 contracts in silver on the nearly $2.50 rally and by 100,000 net contracts in COMEX gold on the $90 price rally."

In silver, the Commercial net short position blew out by another 9,058 contracts, as the technical funds covered short positions and went on the long side. The Commercial net short position is up to a staggering 51,955 contracts, or 260 million ounces of silver. Ted says this is the highest Commercial net short position in silver since December 18, 2012!!! At that time, silver was $34 the ounce. Now it's $21/ounce. There was only a thousand contract increase in the short positions of the 'Big 4' shorts---and Ted figures that about 500 contracts of that amount went onto JPMorgan's short position, which he estimates to be around 15,000 contracts, or 75 million ounces.

But the most important change was in the short positions of the '5 through 8' largest traders, as their short position increased 2,300 contracts, and now stands at around 24,400 contracts in total, or about 6,000 contracts apiece. Ted figures that the '5 through 8' now hold their biggest short position in Comex history---and that the short position in silver is now being spread around to more traders to alleviate the grotesque short position that JPMorgan used to hold to keep the silver price suppressed. Ted calls it a "conspiracy" in his Saturday column---and again yesterday.

In gold, the Commercial net short position increased by 28,848 contracts, or 2.88 million troy ounces. That increased the Commercial net short position to 16.05 million troy ounces---the highest since March 2013. Ted said that JPMorgan sold 4,000 contracts of its long position---and their long-side corner in the Comex gold market is down to 26,000 contracts, or 2.6 million ounces.

Of the above 28,848 contract increase in the Commercial net short position, Ted said that about 24,000 of it was the raptors, which includes JPMorgan. The balance of about 5,000 contracts was the '5 through 8' traders increasing their short positions.

In a nutshell, since the rallies began in both gold and silver on June 5, the Commercial net short positions have deteriorated back to where they were 15 to 18 months ago---and are now hugely bearish, a point I've been trying to make for the last ten days, for those who have been listening. Now it's even worse than I imagined.

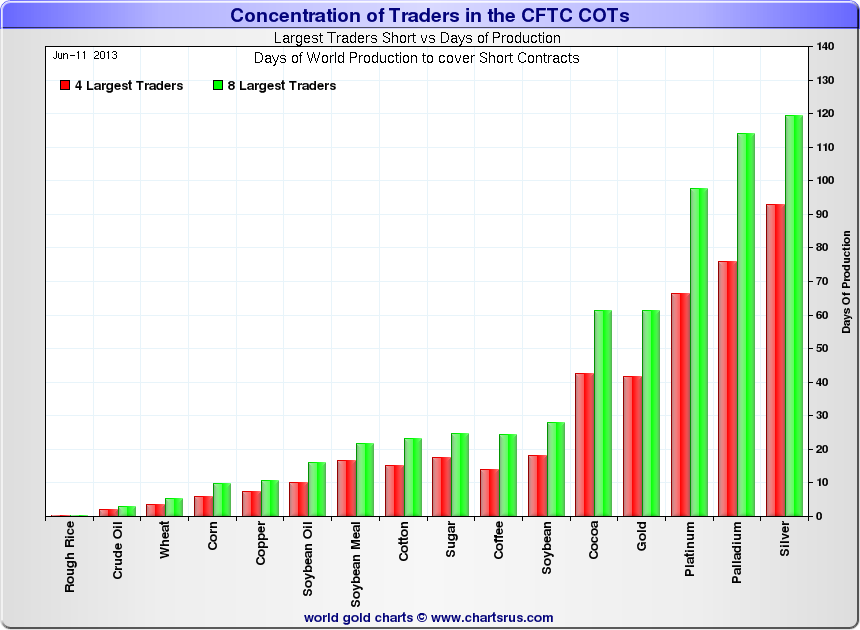

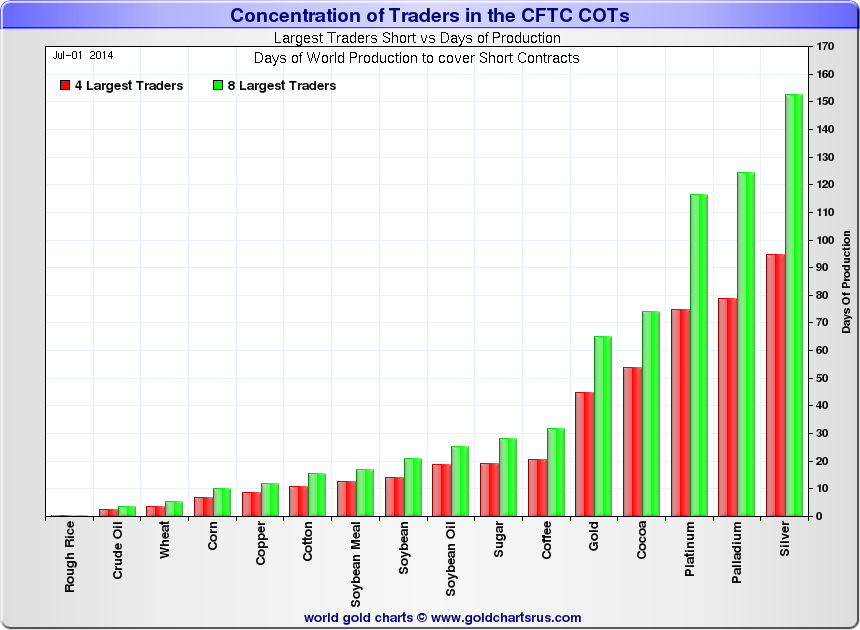

Ted mentioned the huge increases in the short positions of the '5

through 8' traders in silver---and here's all the proof you could want.

Here's the "Days of World Production to Cover Short Positions" chart from the COT Report of June 11, 2013.

Carefully note the tiny short positions held by the '5 through 8'

traders in silver. It's only about 16 days of world production.

Now here's the same chart updated with the data from the above COT

Report for positions held at the close of trading on July 1, 2014. Now

the short position of the '5 through 8' traders is up to 58 days of

world silver production.

The other take-away is that the short position of the 'Big 4' Comex short holders in silver is basically unchanged from one chart to the other---just over 90 days. The price management scheme is now being spread out between more traders to take the heat off JPMorgan and the others in the Big 4 category, as JPM's short position as a percentage of the Big 8 shorts is now pretty low, only about 33 days of world silver production on these charts.

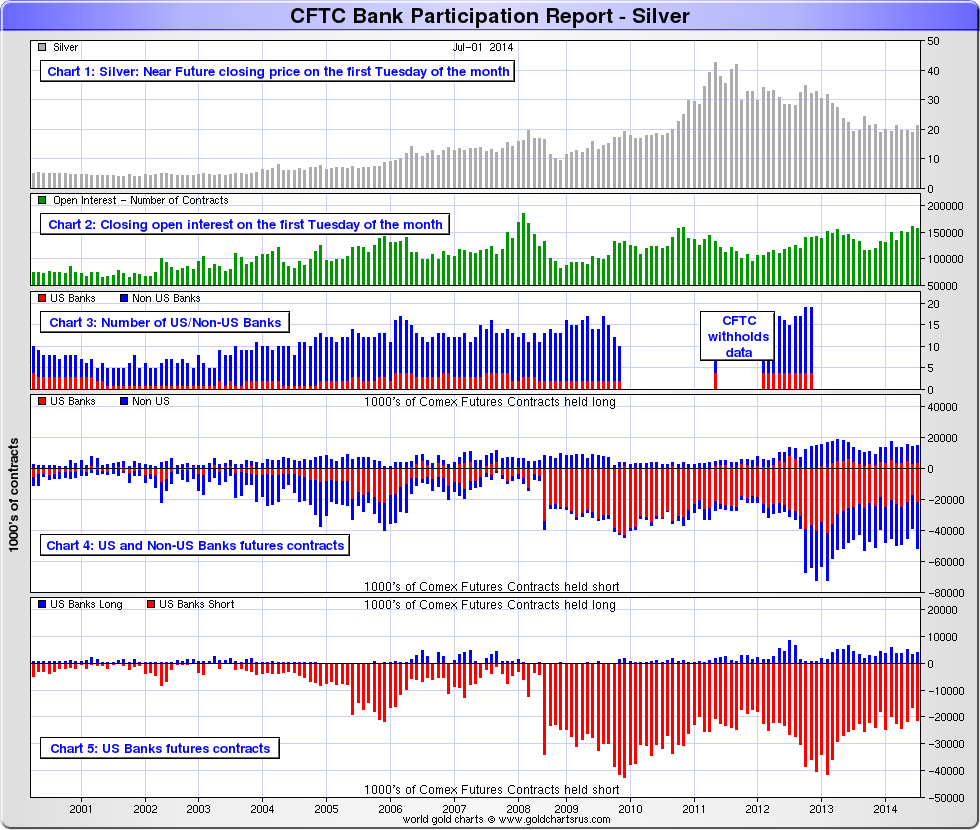

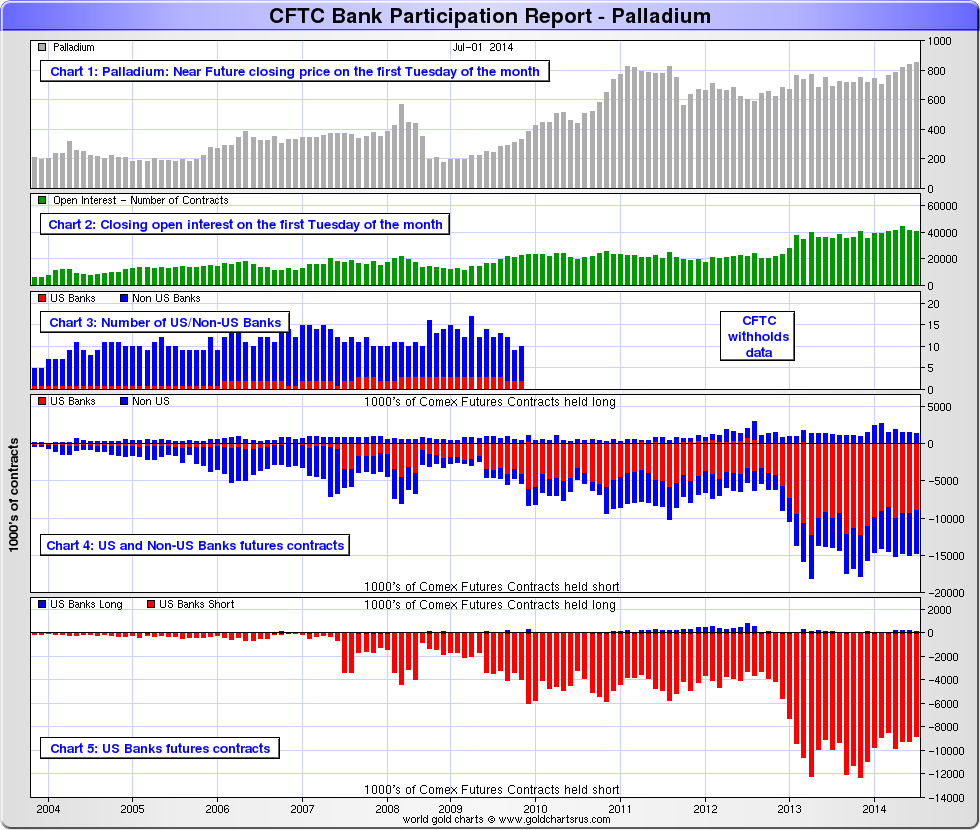

Of course, along with an ugly COT Report, comes an equally ugly July Bank Participation Report. As I say every month, the data in this BPR is extracted directly from the latest COT data---and shows what the banks of the world are up to in the Comex futures markets in the precious metals---with all the other traders stripped out. And there were some ugly surprises in here as well.

In gold, '3 or less' U.S. banks were net long 12,334 Comex gold contracts---and that's an increase of 3,352 contracts since the June BPR. Since Ted Butler says that JPMorgan is long 26,000 Comex contracts, that means that the one or two remaining U.S. banks [probably HSBC USA and Citigroup] have to be net short about 14,000 contracts to make the math work.

Also in gold, '21 or less' non-U.S. banks were net short 62,099 Comex contracts. These same non-U.S. banks were only short 32,818 Comex contracts in the June BPR, so their net short position has blown out by a gargantuan 89 percent in just one month! One has to wonder which bank/country was the culprit. This monster change stands out like the proverbial sore thumb that it is on the chart below. The 'click to enlarge' feature helps here. Charts 3, 4 and 5 are the important ones.

In silver, '3 or less' U.S. banks were net short 17,360 Comex silver contracts, an increase of 4,036 contracts from the June BPR. Since Ted pegs JPMorgan as being short 15,000 Comex silver contracts, this means that the remaining one or two U.S. banks [probably HSBC USA and Citigroup as well] are short an additional 2,400 contracts between them.

Also in silver, '12 or more' non-U.S. banks are net

short 19,505 Comex silver contracts. The same banks were net short

13,324 contracts in the June BPR so, like gold, some bank/country [and

guaranteed to be the same ones] has increased their short position by a

monstrous amount in just one month---in this case 82 percent.

In platinum, 4 U.S. banks were net short 9,639 Comex contracts, a decrease of 2,001 contracts from the June BPR.

Also in platinum, 13 non-U.S. banks were short 8,880

Comex contracts, an increase of 1,564 contracts from the previous

month. Overall, there wasn't much change in platinum, as part of the

short positions was shifted from U.S. banks to foreign banks.

In palladium, '3 or less' U.S. banks were net short 8,654 Comex contracts, a decrease of 399 contracts from June's report.

Also in palladium, '13 or less' non-U.S. banks were

short 4,694 Comex contracts, an increase of 270 contracts from the prior

month. Like platinum, there wasn't much change in the overall

structure of the short positions held by the world's banks as a group.

Well, the huge deterioration in the Bank Participation Report in both gold and silver showed up mostly in the non-U.S. bank category in both metals---especially in gold---so it's obvious that there are one or more new banks on the scene, or banks that already hold Comex short positions that have greatly expanded their presence in the precious metal market on the short side. Up until this point it was easy for me to say that the precious metal price management scheme was 100 percent "Made in the U.S.A.---with a little help from Canada's Scotiabank in silver." That's still true, up to a point---but one or more foreign banks have now sprung to their aid. And if it isn't one of "the usual suspects"---I'm not exactly sure which banks they might be.

As I said in my Friday missive, my Tuesday column was going to be a big read---and if you regularly read my offerings of the day, then you certainly have your work cut out for you.