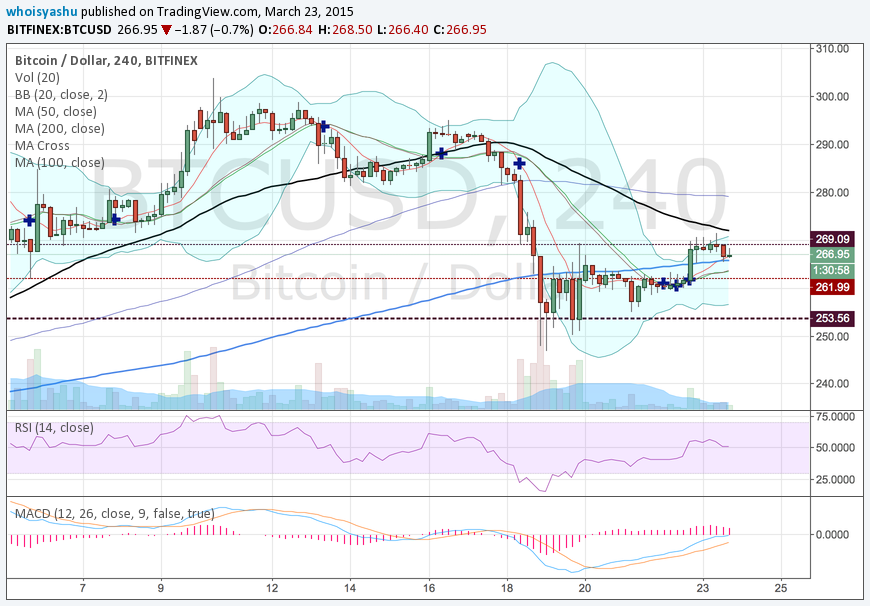

As you can see the chart above, the Bitcoin price currently sighting to

cross above the Bollinger Band limit, while testing its 50H MA in the

process. The temporary support has definitely shifted near 261, the

point which marked the previous short upside correction. The RSI

meanwhile has managed to float above 50 whole day, giving market a

neutral position. And the MACD has almost aligned with the signal line,

indicating yet another countdown towards moving into a positive

territory. These indicators together indicate a neutral scenario in the

Bitcoin market.

Things are looking smoother than the last few days. But it doesn’t mean

it will remain to be. An overlong consolidation will ensure an equally

vibrant breakout so traders should be ready to set their risk management

plans. Let’s discuss the scenarios then.

The 269-seems to an ultimate resistance point as per the current price

movements. Therefore, setting your exit points near 263 will ensure a

timely exit in case the retest succeeds. However, in case the price

extends above the resistance line, the pressure would likely fall on the

50H MA curve (at present it is around 271). Setting your long positions

near this point would ensure a decent profit takeout. Make sure to set

you long positions only when price breaks above 269. Do not go long

towards until the 271 upside risk is breached.