Introduction

When I started trading, I was thinking that, to be successful in that endeavor, I had to find (or create) the best strategy/techniques/approach...The Holy Grail!! I was so focus on the "system" that I forgot several important things, like Risk Management, Psychology, Trading Plan, and so on...

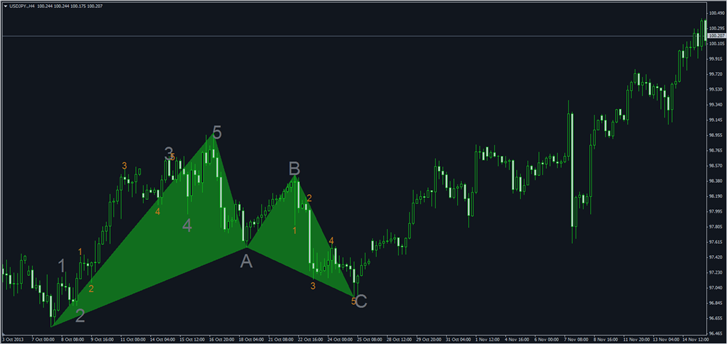

I noticed all kind of patterns based on price charts, Fibonacci levels, Harmonics, Elliott wave, etc... I focused on the successful ones and ignored the failed ones, and thought "If I trade those patterns, I will make money!" That was so far from the truth!

In this article, I will try to explain why we need so much more than patterns to trade, the structure behind it and the proper view to have when trading those patterns. I will demonstrate that in trading, the mains changes have to be made in our "minds", and not so much on the "system".

Everything can happen in the Markets

That is one of the most important things, in my opinion, that can NEVER be forgotten!? From that point, all the expectations, all the newsletters, forecasts, advices, tips, fundamentals/technical analysis...can fail, all of them! That’s why, trading without stop-loss is the best way to bankruptcy, whatever trading strategy you are using!

So what drive prices? Of course the supply & demand, but more precisely, trading decisions made by traders! Prices change from their behavior! What we trying to do when trading, is to anticipate what they will do in the future, nothing more, nothing less. That's why I don't pay attention to anything but my own analysis, because nobody can predict what people behavior will be tomorrow... It's unpredictable!?

If you agree with that, you know then that all we can do, as a trader, is guessing with the probability, sometimes we are right, and sometimes we are wrong, and we need to deal with that reality.

What chart pattern can do for us?

So, with all that in mind, we really need to have the proper view of what really is a chart pattern, and is nothing like "trying to predict the future".

A pattern is really only a "guess" of how other traders will behave in the future, and that's when the probability game comes in the place!

For example, if I buy because a pattern I use tell me to, all that means is I expect others traders to buy at a higher price than me to make my trade profitable! But if those traders don't behave the way I expect, the trade is done! And there is nothing to think about!

Trough charts history, we have come to notice that some patterns seems to repeat over and over...But NOT ALL THE TIME!! And some of the patterns seems to be wrong more often than right! So we need to adjust the Risk/Reward ratio to "transform" those patterns into profits!

Example:

Bullish pattern working only 30% of the time

To transform this pattern into a profitable one in the long run,

We will need to only enter trades that have a minimum of R/R ratio of 3 and ignore the rest.

That seems simple like this (and it is) but what became difficult is the discipline to stick with that plan, to not take-profits too soon, to apply the stop-losses, etc... And that's where the entire psychology thing comes into place!

What we need to do to be profitable as a pattern trader

We need, first, to create a trading plan that fits our own personality!

We need to choose:

what to trade,

wich time frame,

wich patterns,

wich trigger,

our risk/money management strategy,

our trade management strategy,

and everything else according to the fact that " everything can happen in the Markets"

Marco ESLAIT BRAND

From Trading an Edge