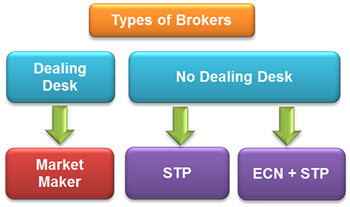

Broker Types - Market Makers, No Dealing Desks (NDD), Dealing Desks (DD), Straight Through Processing (STP), Electronic Communication Network (ECN)

16 September 2014, 21:11

0

1 005

There are two main types of brokers: Dealing Desks (DD) and No Dealing Desks (NDD). Dealing Desk brokers are also called Market Makers, while No Dealing Desks can be further subdivided into Straight Through Processing (STP) and Electronic Communication Network + Straight Through Processing (ECN+STP).

- DD - Dealing Desk: A dealing desk broker is a market maker. Market makers typically offer fixed spreads and may elect to quote above or below actual market prices at any time. Market makers are always the counterparty of the trader, who doesn't trade directly with the liquidity providers. Market makers get paid through the spreads

- NDD - No Dealing Desk: An NDD forex broker provides direct access to the interbank market. It can be an STP or STP+ECN broker.

- STP - Straight Through Processing: In STP mode,

transactions are fully computerised and are immediately processed on the

interbank market without any broker intervention.

- ECN - Electronic Communication Network: ECN brokers provide and display real-time order book information. The orders were processed and the prices offered by banks on the interbank market.

This is small 10 minute education video about the following: the difference between Forex Broker Types - MM, NDD, STP, ECN: