RSI Scalping Bot

- 专家

- Purvi Dipakbhai Pipaliya

- 版本: 1.0

- 激活: 10

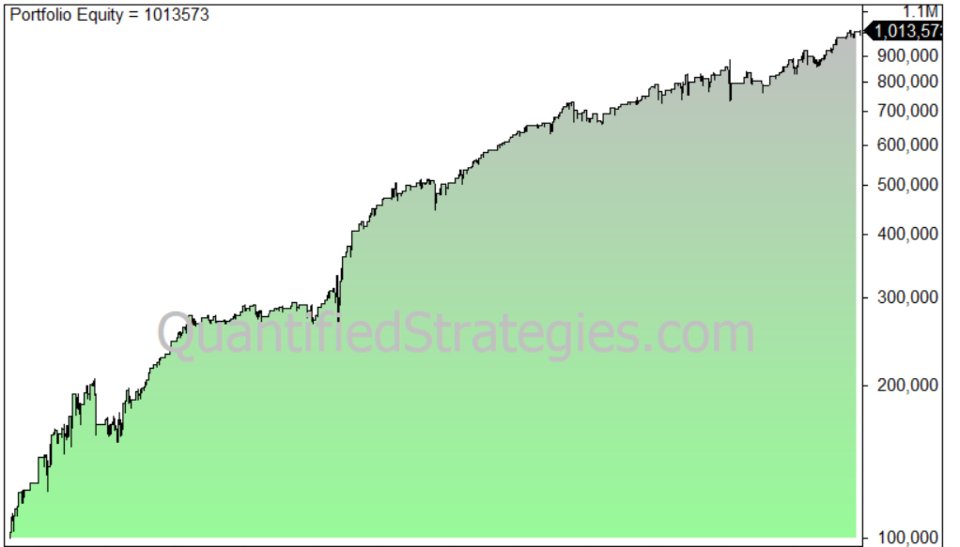

In order to provide accurate entrances and exits in trending markets, the RSI EMA ADX EA is a professionally constructed Expert Advisor that combines the strength of three popular technical indicators: the Average Directional Index (ADX), Exponential Moving Average (EMA), and Relative Strength Index (RSI). For traders looking for high-accuracy, low-risk automation, it is perfect.

Strategy Logic

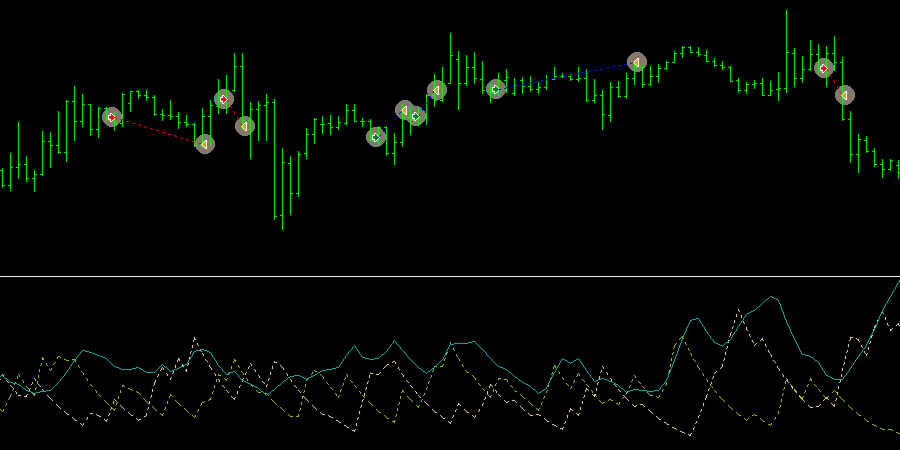

1. RSI (Relative Strength Index):

removes oversold and overbought market circumstances.

ct evidence of trend continuation and reversal.

2. Exponential Moving Average, or EMA:

uses both rapid and slow moving averages to confirm the direction of the trend.

aids in determining if a trade entry is bullish or bearish.

3. Average Directional Index, or ADX:

evaluates the strength of a trend.

filters low ADX levels to prevent trading in range markets.

Trades begin to occur when:

Direction is confirmed by an EMA crossover.

The range of the RSI is valid, and

Since the ADX is above the minimum level, a strong trend is indicated.

Important Features:

✅ Completely automatic trading

✅ Adjustable indicator settings

✅ Works with any forex pair, though trending ones like XAUUSD and GBPJPY are the best.

✅ Flexible across several timeframes

✅ Integrated risk control

✅ Compatible with all brokers (ECN/STP)

✅ Logging and alert options

✅ Protection against slippage and spread

Minimum Requirements

Platform: MetaTrader 5 (MT5)

Account Type: Preferred ECN/STP

Internet Speed: At least 1 Mbps

EA Installation: Attach to single chart only

Suggested Pairs: XAUUSD, GBPJPY, EURUSD

Broker: Any broker with quick execution

Recommendations

Timeframe: M15 or H1 (swing-based or scaling)

Account Type: ECN account with tight spreads

Lot Sizing: Use 0.01 per $100–$200 balance (auto risk)

RSI Period: 14 (adjustable)

EMA Fast/Slow: 9/21 or 20/50

ADX Threshold: 20–25 (filters weak trends)

Minimum Deposit: $100+ (for micro lots)

VPS: Use VPS for round-the-clock operation

📈 Risk Management Configuration

Maximum Spread: Modifiable

Maximum Slippage: Modifiable

Lot Size Variability (depending on balance)

Included are Stop Loss and Take Profit.

Optional Trailing Stop

Ideal Market Situations:

Market trends

Sessions with a high volume (London, NY)

Steer clear of periods of minimal volatility (mid-Asia)