Priority Stability Bot

- Uzman Danışmanlar

- Ivan Simonika

- Sürüm: 3.0

- Etkinleştirmeler: 5

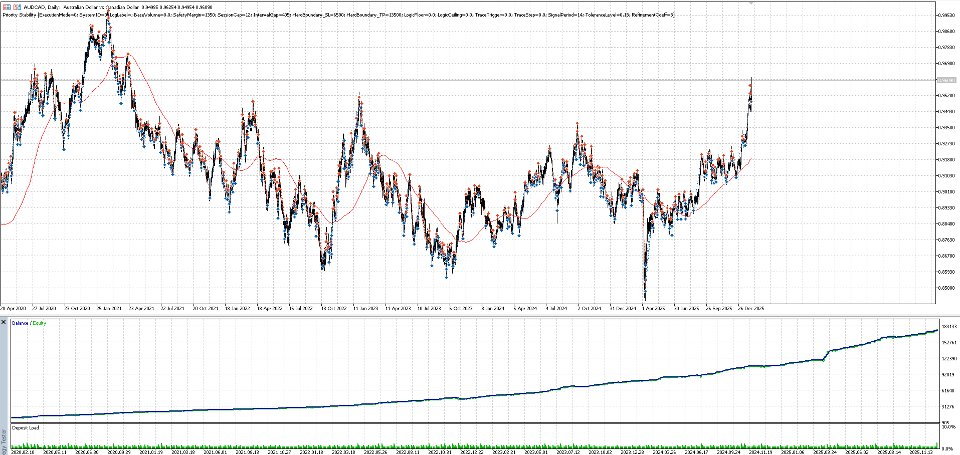

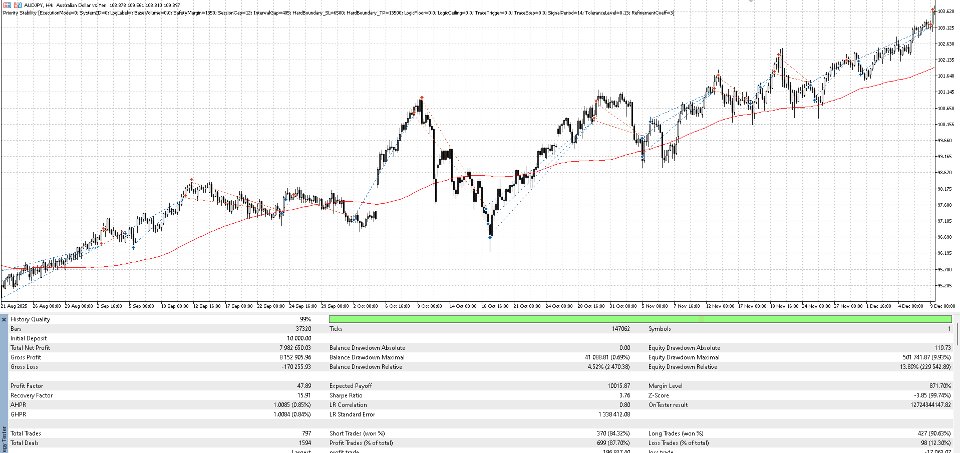

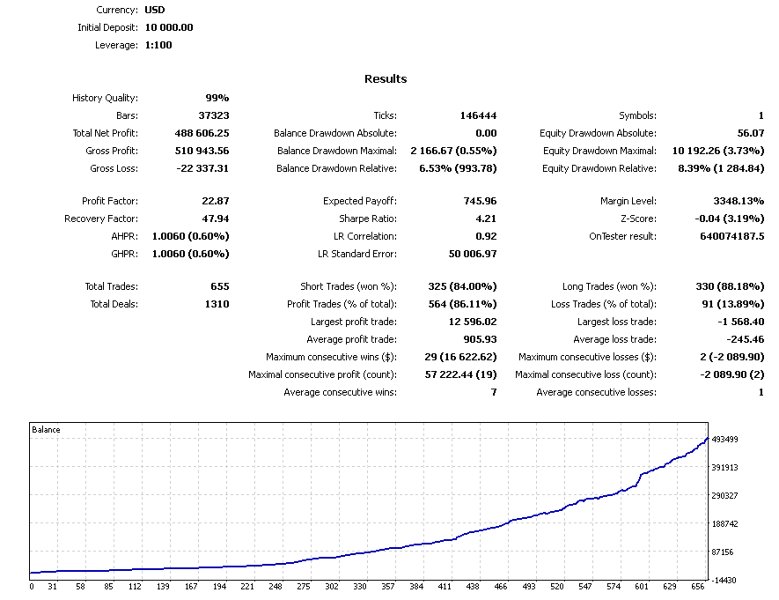

Priority Stability: Intelligent Market Cycle Management System

Priority Stability is a high-end algorithmic solution designed to automate trading processes within the foreign exchange market. The core logic is built upon statistical volatility analysis and mathematical modeling of position distribution. This expert advisor acts as a precision tool for systematizing market operations, eliminating subjective bias from the decision-making process.

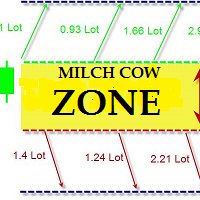

- Non-Geometric Sequencing: A proprietary grid formation algorithm that utilizes calculated coefficients to adjust the distance between operations dynamically.

- Hybrid Execution Protocol: A sophisticated protocol combining immediate execution with a pending order system to optimize entry points based on current market volatility.

- Risk Management Modules: Integrated environmental filters, including spread expansion monitoring and time-based activity constraints.

- Dual Boundary System: A multi-layered result fixation structure that incorporates both server-side hard limits and internal algorithmic triggers.

Technical Operational Standards

- ExecutionMode – Technical configuration for order filling and execution protocols.

- SystemID – A unique digital signature used to differentiate this algorithm's operations.

- LogLabel – A text identifier for internal system logging and tracking.

- BaseVolume – The initial unit of trade load (starting volume).

- SafetyMargin – A calculated parameter for determining load relative to available equity.

- SessionCap – The maximum limit of simultaneous processing cycles.

- IntervalGap – The step value for the grid deployment algorithm.

- HardBoundary_SL / TP – Physical price limits transmitted to the server side.

- LogicFloor / Ceiling – Internal software triggers for algorithmic position closure.

- TraceTrigger – Activation threshold for the dynamic boundary adjustment (Trailing).

- TraceStep – Adjustment step for the vector tracking mode.

- SignalPeriod – The depth of the retrospective data sample used by the core engine.

- ToleranceLevel – A coefficient used for market noise filtration.

- RefinementCoeff – A mathematical constant for fine-tuning the indicator block outputs.

Why Priority Stability?

- Mathematical Determinism: Every action is strictly governed by pre-set parameters and real-time data inputs.

- Technological Adaptability: Flexible configuration options allow the system to be tailored to various market phases by adjusting sensitivity variables.

- Strategy Confidentiality: The use of internal algorithmic levels allows for complex exit scenarios without exposing sensitive data to the public order book.