Heiken Ashi RSI Indicator for MT5

- Индикаторы

- Mohammad Taher Halimi Tabrizi

- Версия: 1.0

- Активации: 5

Heikin Ashi RSI Indicator for MT5 (HARSI)

Overview

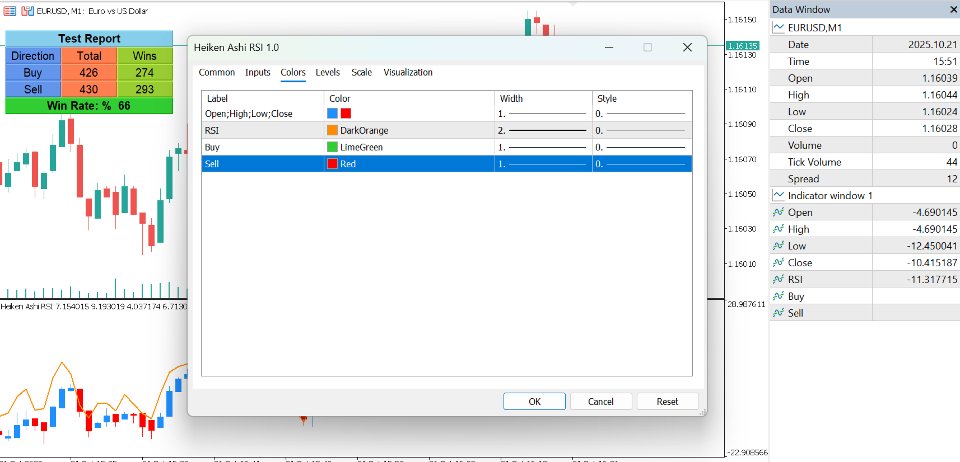

The Heikin Ashi RSI (HARSI) indicator combines Heikin Ashi candle smoothing with RSI momentum analysis, providing a dual-layer view of price action and relative strength. It offers a clear visualization of market direction, RSI-based overbought and oversold conditions, and optional backtesting and alert systems for strategy validation and trade signal automation.

How It Works

The indicator applies RSI values to Heikin Ashi calculations, creating a smoothed representation of RSI-based candles. It plots both Heikin Ashi candles and a traditional RSI line in a separate window, allowing traders to observe directional momentum and candle-based structure simultaneously.

Buy and Sell signals are generated when RSI crosses user-defined overbought or oversold thresholds:

-

Buy signal: RSI crosses above the oversold level.

-

Sell signal: RSI crosses below the overbought level.

Heikin Ashi smoothing parameters allow users to fine-tune responsiveness to price changes, while the RSI logic remains fully adjustable.

Key Features

-

Heikin Ashi RSI candle visualization for smoother trend recognition

-

Standard RSI line overlay for momentum confirmation

-

Adjustable RSI length, source, and smoothing

-

Customizable overbought/oversold levels

-

Built-in tester to simulate trades based on Buy/Sell signals

-

Real-time performance panel showing total trades, wins, and win rate

-

Optional alerts and push notifications for Buy/Sell events

Technical Highlights

-

All calculations are handled via buffers only, with no graphical objects for signals or candles.

-

This design ensures very high-speed performance and makes the indicator EA-friendly, allowing Expert Advisors to access signal data directly from buffers.

-

Includes a lightweight internal tester that can simulate trading results based on RSI signal conditions and display win rate statistics in real time.

Usage

The indicator can be used for:

-

Identifying trend direction with RSI-based Heikin Ashi candles

-

Generating Buy/Sell signals based on RSI crossovers

-

Testing signal performance over historical data

-

Integrating buffer-based signals into automated trading systems