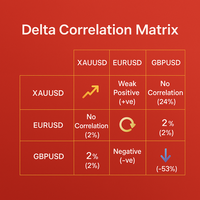

Delta Correlation Matrix

- Индикаторы

- Murtadha Majid Jeyad Al-Khuzaie

- Версия: 3.2

Discover Hidden Market Relationships with Delta Correlation Matrix This indicator is a professional tool designed to measure and visualize the correlation between three different symbols directly on your chart. Instead of relying on static or outdated methods, it dynamically calculates the strength and direction of correlations in real time, helping traders uncover hidden relationships that can influence market moves.

Its goal: to provide instant clarity on whether assets are moving together, diverging, or showing no meaningful connection. With this knowledge, traders can better manage risk, diversify strategies, and spot opportunities that others may miss.

Features

Dynamic Correlation Analysis: Calculates correlations between three symbols of your choice (e.g., XAUUSD, EURUSD, GBPUSD).

Clear Visual Feedback: Results are displayed as easy-to-read text with intuitive labels such as Strong Positive, No Correlation, or Strong Negative.

Percentage Values: Each correlation is shown with a percentage (e.g., +65% or −53%), giving you precise numerical insight.

Latest Deltas: Displays the most recent delta values for each symbol, showing whether the latest pressure is bullish (positive) or bearish (negative).

Customizable Settings: Adjust correlation window size, lookback bars, and timeframe to match your trading style.

Real-Time Updates: Instantly refreshes with each new candle, ensuring you always see the latest market relationships.

Lightweight & Fast: Optimized for smooth performance, even on live accounts with large data sets.

How to Read the Results

Text Labels: Quickly understand the relationship. For example:

Strong Positive (+ve) → Both symbols usually move in the same direction.

Strong Negative (−ve) → Both symbols usually move in opposite directions.

No Correlation → No meaningful relationship.

Percentages (%):

Closer to +100% = strong positive correlation.

Closer to −100% = strong negative correlation.

Near 0% = no correlation.

Latest Deltas: Show the most recent directional pressure for each symbol (positive = buying pressure, negative = selling pressure).

This combination of text, percentages, and deltas gives you both a quick overview and precise details at the same time.

Practical Benefits

Trade Confirmation: Use correlated pairs to confirm signals.

Risk Management: Avoid doubling risk by trading multiple pairs that move together.

Hedging: Balance exposure with negatively correlated pairs.

Opportunity Discovery: Spot unusual or changing correlations that may reveal new setups.

Conclusion

Delta Correlation Matrix is not just another indicator—it’s a smart analytical tool that reveals the hidden connections between markets. By combining accuracy, simplicity, and professional design, it empowers traders to see beyond price action and make more informed decisions.