Mohammadmahdi Sanei / Perfil

- Informações

|

3 anos

experiência

|

4

produtos

|

1074

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Nos últimos dois anos, testei vários métodos de negociação e dediquei muito tempo e esforço para transformá-los em um Bot de Negociação lucrativo.

Minha principal área de especialização está em algoritmos de inteligência artificial e aprendizado de máquina para prever séries temporais, especialmente nos mercados financeiros.

```html A oferta especial está disponível por 110$ Apenas 1 cópias restantes a esse preço - Próximo preço 135$ Noctra – Visão Geral O **Noctra** é um robô de negociação de ponta meticulosamente projetado para operar especificamente dentro do par de moedas UK100,US500 na faixa de tempo M30. Aproveitando mais de 20 anos de dados de preço extensivos, nosso algoritmo foi desenvolvido e treinado para identificar e capitalizar padrões de negociação altamente eficientes únicos para

Pound Yen Trader – Visão Geral **Pound Yen Trader** é um robô de trading de última geração, meticulosamente projetado para operar especificamente no par de moedas GBPJPY no intervalo de tempo M15. Aproveitando mais de 20 anos de dados de preços extensivos, nosso algoritmo foi desenvolvido e treinado para identificar e capitalizar padrões de trading altamente eficientes e únicos para este par de moedas. Principais Recursos 1. **Sistema Avançado de Reconhecimento de

Apresentamos o Quantum Quotient para traders e aspirantes a PropFirms. Este sistema de negociação automatizado implementa uma estratégia sem táticas MARTINGALE e GRID, meticulosamente construída usando indicadores técnicos e fundamentais proprietários. Essas metodologias foram submetidas a testes rigorosos e refinamento por mais de um ano. A estratégia Quantum Quotient engloba quatro etapas-chave: 1. Análise de Oferta e Demanda: Inicialmente, o sistema calcula os níveis de oferta e demanda para

🔸 Resistance: 2011, 2004, 1997

▪️ Current price: 1991

🔹 Support: 1990, 1985, 1978

✍🏻 Today's most important data includes US retail sales, Philly Fed, and jobless claims. The significance of these data is not as much as primary inflation data, but it seems that their expected release might pave the way for a slight correction in gold. Keep in mind that the US economy has appeared strong, so speeches by Fed members and their perspective on the current situation are important for the market. Strong release of this data can complete the technical pattern for gold and reveal lower levels. Intraday, the range of fluctuations for gold is currently between $1980 and $2000.

(🔸Resistance 🔹Support ▪️Current Price)

#GOLD

🔸 2020

🔸 2011

🔸 2004

▪️ 1992

🔹 1978

🔹 1962

✍🏻 Following the release of strong inflation data in the U.S. (especially in the services sector), we witnessed the dominance of the dollar. Later in the week, secondary retail sales and producer inflation data will also be released. Regarding gold, if we don't see any other significant events and an increase in risk sentiment, lower support levels also have the potential to be touched. However, these trades may not necessarily provide a good risk-to-reward ratio, and another point is not to sell within the current range of 1975. There is also a possibility of a pullback to resistance levels, especially the psychological level of $2000 (only for those who are stuck in gold buys).

(🔸 Resistance 🔹 Support ▪️ Current Price)

#GOLD

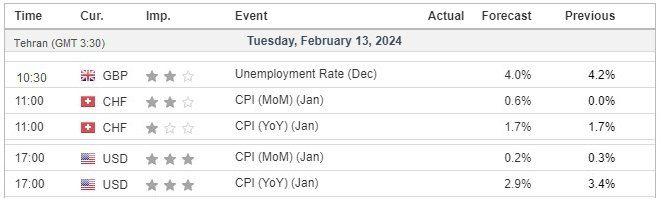

⭐️⭐️ U.K. Unemployment Rate 🇬🇧

This data measures the percentage of the total workforce who have been unemployed and actively seeking employment over the past three months. Given recent data, there is a possibility that the figure may be similar to the previous release.

⭐️⭐️ Switzerland Consumer Price Index (CPI) MoM 🇨🇭

For the CPI data, which examines changes in the prices of goods and services from the consumer's perspective, it is anticipated that it will be higher than the previous figure, potentially having a positive impact on the Swiss Franc.

⭐️⭐️⭐️ U.S. Consumer Price Index (CPI) MoM 🇺🇸

We also have significant CPI data for the U.S. today, and it is expected that the data will be better than the previous figure, potentially having a positive impact on the U.S. dollar.

https://www.mql5.com/en/market/product/112044

Check my blog posts to know about my trading strategy concept and FTMO challenges I passed with this strategy.

https://www.mql5.com/en/users/momasan1990/blog

https://www.mql5.com/en/market/product/112044

Total growth: 6 % in one week.

Initial balance 187.12 $

Profit: 10.48 $

https://www.mql5.com/en/signals/2194637

Price will increase in the next 24 hours

https://www.mql5.com/en/market/product/112044

Check my blog posts to know about my trading strategy concept and FTMO challenges I passed with this strategy.

https://www.mql5.com/en/users/momasan1990/blog

https://www.mql5.com/en/market/product/112044

These LINKS are all the information you need for using the bot.

Introducing Zenith Zone Bot

https://www.mql5.com/en/blogs/post/755971

Input description and back-tests tutorial

https://www.mql5.com/en/blogs/post/755971

Trading strategy concept

https://www.mql5.com/en/blogs/post/755811