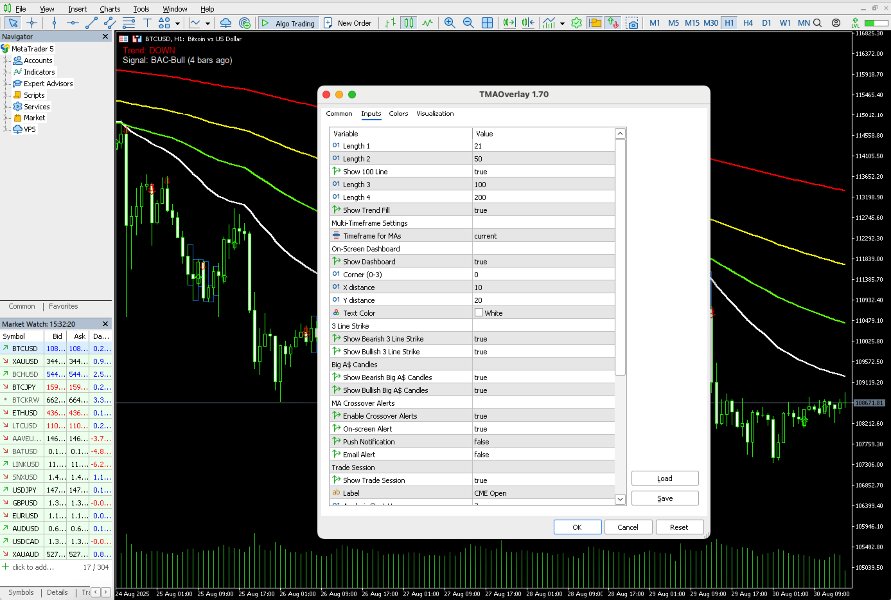

TMA Overlay

- Indicadores

- Quang Huy Quach

- Versão: 1.70

1. Introduction

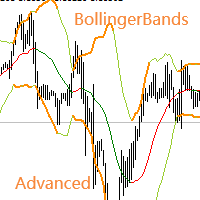

TMA Overlay is a versatile technical analysis indicator for the MetaTrader 5 platform. The indicator's goal is to provide traders with a comprehensive overview of the trend, potential entry signals, and key trading sessions, all integrated into a single chart.

This is not just a tool for drawing moving averages, but a complete trading system to help you make more informed decisions.

2. Core Indicator Components

The indicator consists of multiple components, each of which can be enabled/disabled and customized in the settings.

a. Smoothed Moving Averages (SMMA)

- SMMA 21 (White): A short-term MA that follows the price closely to indicate the immediate trend.

- SMMA 50 (Green): A medium-term MA, often used as a dynamic support/resistance level.

- SMMA 100 (Yellow): A medium-to-long-term MA.

- SMMA 200 (Red): A long-term MA, considered an important indicator for defining the main market trend.

- If the price is above the SMMA 200, the market is in an uptrend.

- If the price is below the SMMA 200, the market is in a downtrend.

b. Trend Fill

- A colored area filled between the EMA(2) and the SMMA(200).

- Green Fill: Indicates bullish momentum.

- Red Fill: Indicates bearish momentum.

c. Signal Arrows

The indicator automatically detects key candlestick patterns and trading signals, marking them with arrows on the chart:

- 3 Line Strike (3s-Bull/3s-Bear): A powerful reversal pattern. A 3s-Bull arrow suggests a potential bullish reversal, and vice-versa.

- Engulfing Candle (BAC-Bull/BAC-Bear): An arrow appears on a bullish or bearish engulfing candle, a classic reversal signal.

- MA Crossover: This signal alerts when the SMMA(21) and SMMA(50) cross, which can be a potential trend confirmation.

d. Trading Session Highlighter

- This feature draws a colored background to highlight a specific trading session during the day (e.g., London, New York session). This helps traders focus on periods of higher market activity.

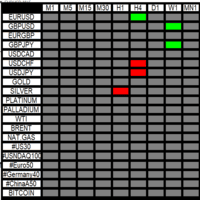

e. On-Screen Dashboard

- A small information panel in the corner of the chart, providing at-a-glance information:

- Trend: The main trend (UP/DOWN/SIDEWAYS) based on the price vs. the SMMA 200.

- Signal: The most recent trading signal detected and how many bars ago it occurred.

3. Application in Trading (Strategy Ideas)

IMPORTANT RISK AND PERFORMANCE DISCLAIMER: Trading foreign exchange, stocks, and cryptocurrencies on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results. No indicator or trading system can guarantee profits. The strategies below are suggestions for reference and for you to develop your own system. Always backtest thoroughly before trading with real money.

Trend Following Strategy

This is a common approach for using this indicator.

-

Identify the Main Trend:

- Look at the Dashboard or the price's position relative to the SMMA 200 line.

- If the Trend is UP, consider looking for BUY opportunities.

- If the Trend is DOWN, consider looking for SELL opportunities.

-

Find a Potential Entry Point:

- In an UPTREND: One possible strategy is to wait for the price to pull back to the SMMA 21 or 50 lines. When the price touches these MAs, look for a confirming signal, for example:

- A Bullish Engulfing arrow (BAC-Bull) appears.

- A 3 Line Strike Bull arrow (3s-Bull) appears.

- A bullish MA Crossover has just occurred.

- In a DOWNTREND: The opposite may be applied. Wait for the price to retrace to the SMAs and look for sell signals (red arrows).

- In an UPTREND: One possible strategy is to wait for the price to pull back to the SMMA 21 or 50 lines. When the price touches these MAs, look for a confirming signal, for example:

-

Manage Exits:

- Place a stop-loss below the nearest swing low (for a buy trade) or above the nearest swing high (for a sell trade).

- Take profit can be set at a key support/resistance level, or when a strong reversal signal in the opposite direction appears.

Combining with Trading Sessions

- To increase the probability of success, you can choose to only take signals that appear during the Trading Session you have highlighted. For example, if you trade EURUSD, you might focus on signals during the London and New York sessions.

4. Settings Guide (Inputs)

- Smoothed MA Inputs: Customize the periods for the MA lines.

- Multi-Timeframe Settings:

- Timeframe for MAs : An extremely powerful option. Allows you to view MAs from a higher timeframe (e.g., H4) directly on a lower timeframe chart (e.g., M15).

- On-Screen Dashboard:

- Show Dashboard : Enable/disable the dashboard.

- Corner : Choose the corner (0=Top-Left, 1=Top-Right, 2=Bottom-Left, 3=Bottom-Right).

- X/Y distance : Distance from the chart edges.

- 3 Line Strike / Engulfing Candles: Enable/disable the display of these signal arrows.

- MA Crossover Alerts:

- Enable Crossover Alerts : Enable/disable alerts for the 21/50 MA cross.

- On-screen Alert : Enables the native MT5 alert box.

- Push Notification : Sends a push notification to your phone (requires configuring MetaQuotes ID in MT5).

- Email Alert : Sends an alert via email (requires configuring SMTP in MT5).

- Trade Session: Customize the start/end time, and days of the week for highlighting the trading session background.

This guide is for informational purposes only and does not constitute investment advice.