Pine script scalping indicator

- 지표

- Andrey Kozak

- 버전: 1.0

- 활성화: 20

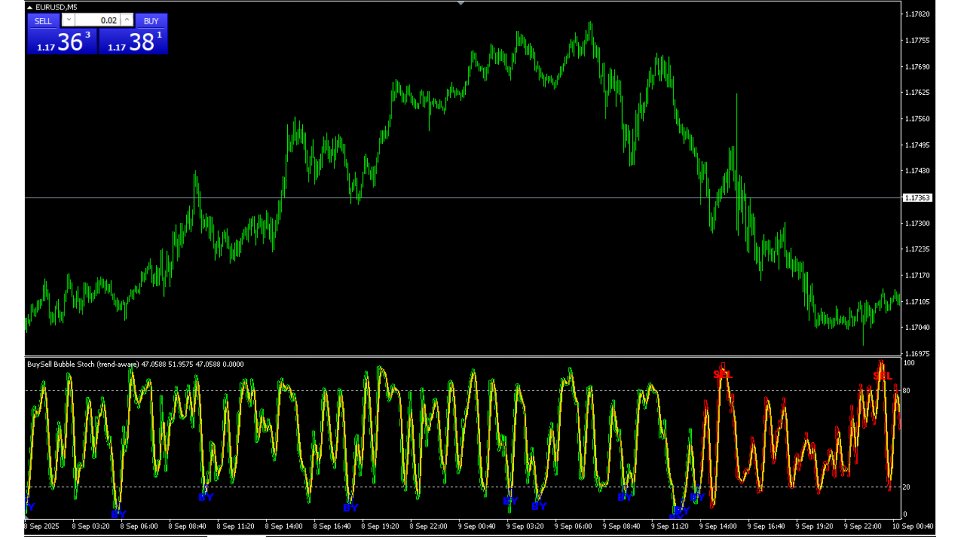

Pine script scalping indicator is a multi-layered analytical system designed for pinpoint interpretation of microstructure price fluctuations under high volatility conditions. At its core lies a complex model of dynamic price series filtration with inter-timeframe projections and nonlinear approximation of trend vectors.

Unlike standard technical analysis tools, this indicator is not limited to a static oscillator approach but instead utilizes a hybrid interpretation of market data streams with multi-stage consistency checks across trend contours. The system implements the concept of “adaptive scalping,” enabling the operator to obtain stable analytical cues even in areas of chaotic noise.

The indicator is installed in a separate terminal window and displays a multi-channel structure of directional analysis with emphasis on momentary zones of extreme probability. Signal clusters are marked with visual labels, ensuring instant interpretation of market states in real time.

Advantages:

-

Adaptive data interpretation based on inter-timeframe filtering.

-

Automatic detection of key zones where the probability of price impulses reaches local maxima.

-

Color-coded dynamic curves depending on the state of the trend.

-

Can be combined with external algorithms to build complex trading systems.

-

High resistance to market noise and false fluctuations.

-

Universal application: intraday trading, scalping, algorithmic strategies.

How to use:

-

Install the indicator on a working chart in MetaTrader 5.

-

Switch to high-frequency timeframes (M1–M15).

-

Interpret the dynamic curve in the context of its color and markers: the color channel direction indicates the phase of the prevailing trend.

-

Use signal labels as reference points for entry or exit in scalping scenarios.

-

For optimal results, combine Pine script scalping indicator with volume filters and liquidity levels.

Input parameters:

-

KPeriod — base calculation period for primary data filtration.

-

DPeriod — signal line period used in cross-analysis.

-

Slowing — smoothing coefficient regulating the inertia of reactions.

-

MAMethod — averaging method (SMA/EMA/SMMA/LWMA) used in the filtering contour.

-

PriceField — type of price sampling (Low/High or Close/Close).

-

LevelOverbought — upper analytical level indicating the overbought zone.

-

LevelOversold — lower analytical level reflecting the oversold zone.

-

ShowLabels — enables visual signal markers on the chart.

-

TextBuy — text label for upward activity clusters.

-

TextSell — text label for downward activity clusters.

-

BuyTextColor — color of the marker for upward scenarios.

-

SellTextColor — color of the marker for downward scenarios.

-

FontSize — font size of the label.

-

LabelYOffset — vertical offset of the label.

-

LabelHalfBars — horizontal width of the signal block in bars.

-

LabelHalfHeight — vertical amplitude of the signal block.

-

ObjPrefix — unique prefix for objects ensuring visualization isolation.

-

TrendTF — higher timeframe used for trend direction analysis.

-

FastMAPeriodHTF — fast moving average period for trend analysis.

-

SlowMAPeriodHTF — slow moving average period for trend analysis.

-

TrendMAMethodHTF — moving average method used on the higher timeframe.

-

MinSlopeHTF — minimum slope of the slow moving average required to confirm the trend.