Structured Zig Zag

- 지표

- Ihor Herasko

- 버전: 250.605

- 활성화: 5

The indicator identifies ordered trend structures. Each structure consists of at least three waves: the formation of the primary movement, a rollback, and a breakout of the primary movement.

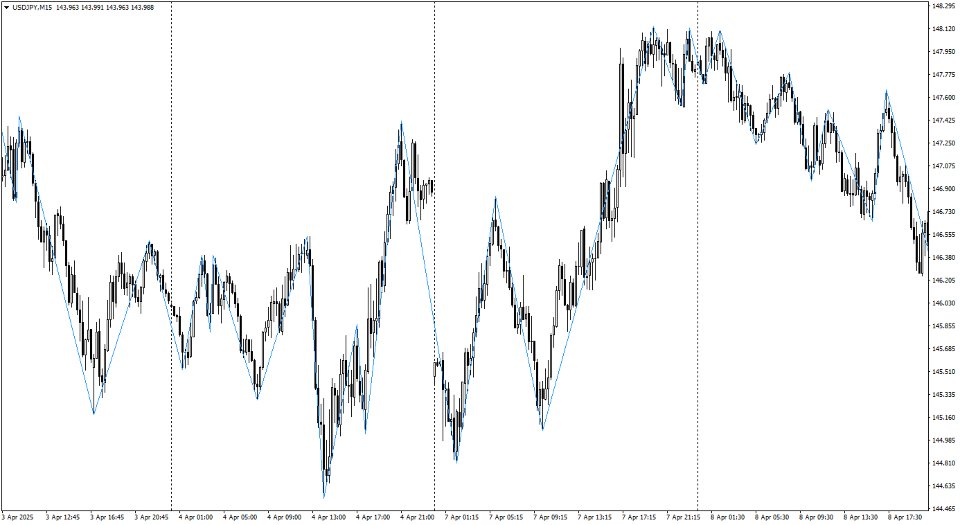

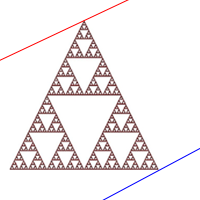

One wave in the structure is considered to be the market movement between opposite price extremes, which corresponded to different positions of the points of the classic Parabolic Support And Reverse (PSAR) indicator relative to the closing prices of the candles: a point below the price - searching for a maximum, a point above the price - searching for a minimum. The connection of opposite waves gives an idea of the market movement in the form of a zigzag, displayed by thin blue lines.

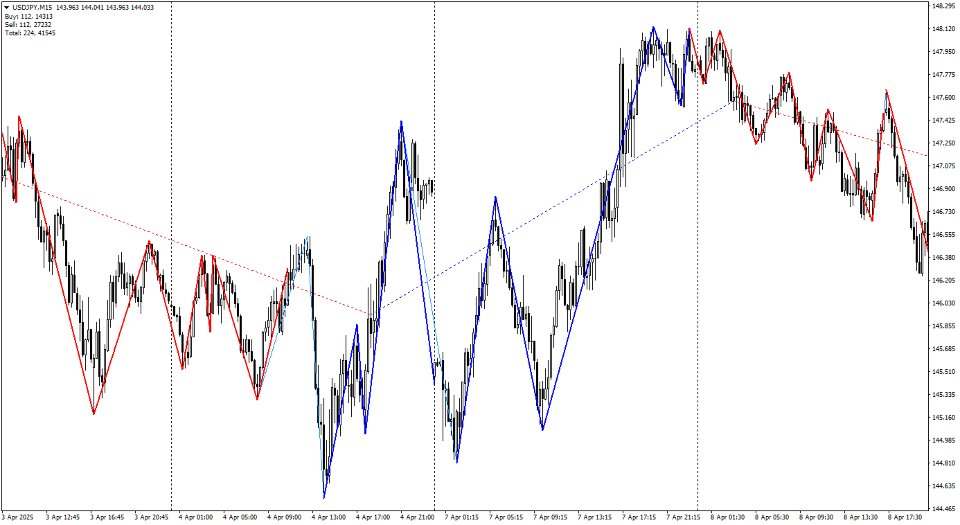

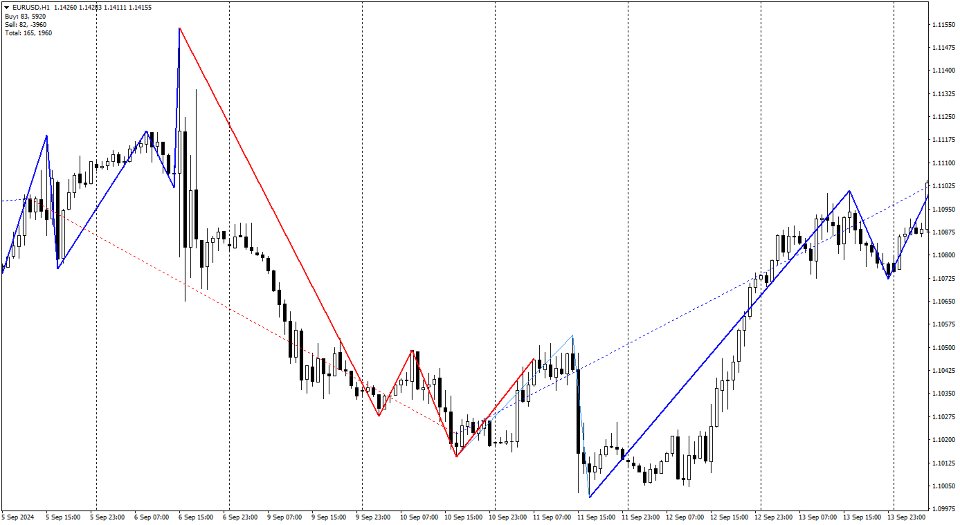

From the resulting zigzag, the indicator identifies upward and downward structures. For a downward structure, each new minimum should be lower than the previous minimum, and each new maximum - lower than the previous maximum. Accordingly, for an upward structure, each new minimum should be higher than the previous minimum, and the new maximum should be higher than the previous maximum. Downward structures are displayed with bold red lines, and upward ones - with blue lines. At the moment of structure detection, a sound signal is given with the display of a text description of the trading signal.

The simplest use of the indicator readings is to open a deal at the moment of structure detection in the direction indicated by the structure. Accordingly, it is convenient to close a deal at the moment of the opposite signal. In order to assess the prospects of such tactics for the current timeframe of the selected financial instrument, the indicator provides a service for maintaining statistics of the results of virtual trading for the available depth of the quotes history. One deal is considered to be the interval between the moments of detection of opposite structures, that is, two or more structures in a row of the same direction do not lead to the virtual closure of one deal and the opening of the next. Long deals are displayed as a dotted blue line, and short ones are red. The result of virtual trading is displayed in the upper left corner of the chart in points with a division into short and long deals. The result takes into account the spread (specified by the user), but does not take into account swaps and commissions.

Parameters

- PSAR step - the parameter of the PSAR indicator of the same name.

- PSAR max - the parameter of the PSAR indicator of the same name.

- Show structures - control the display of wave structures. If disabled, the indicator will not be able to notify about trading signals and keep statistics of virtual trading.

- Alert on signal - manage notifications about trading signals.

- Collect statistic - manage the service for collecting statistics of virtual trading. If disabled, the dotted lines of trades and the result of virtual trading in the upper left corner of the chart are not displayed.

- Spread, pts. - the spread value in points, which is taken into account when keeping statistics and displaying trade lines.

- Use reverse - keeping statistics in the opposite direction. If enabled, then when registering an upward structure, a short deal will be virtually opened, and when registering a downward one, a long one.

- Number of bars to display (0 - all) - the number of bars processed by all the indicator's functionality. The value 0 indicates that data is processed in the full depth of the existing quote history.

- Color of upward trend - the color of upward structures and lines of long trades.

- Color of downward trend - the color of downward structures and lines of short trades.