당사 팬 페이지에 가입하십시오

- 조회수:

- 5583

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

An unorthodox approach to indicator MACD: The EA calculates the indicator's area displayed above and below zero line.

Depending on parameter "Reverse signal", either BUY or SELL positions will be opened.

Inputs:

- Stop Loss (in pips) - stop loss value

- Take Profit (in pips) - take profit value

- Trailing Stop (in pips) - trailing

- Trailing Step (in pips) - trailing step

- Lots (or "Lots">0 and "Risk"==0 or "Lots"==0 and "Risk">0) - lot size is set manually

- Risk (or "Lots">0 and "Risk"==0 or "Lots"==0 and "Risk">0) - lot size is calculated dynamically

- Number of bars to search for the area of the indicators - amount of bars, on which the indicator's area is calculated

- Reverse signal

//--- MACD parameters

- period for Fast average calculation

- period for Slow average calculation

- period for their difference averaging

- type of price

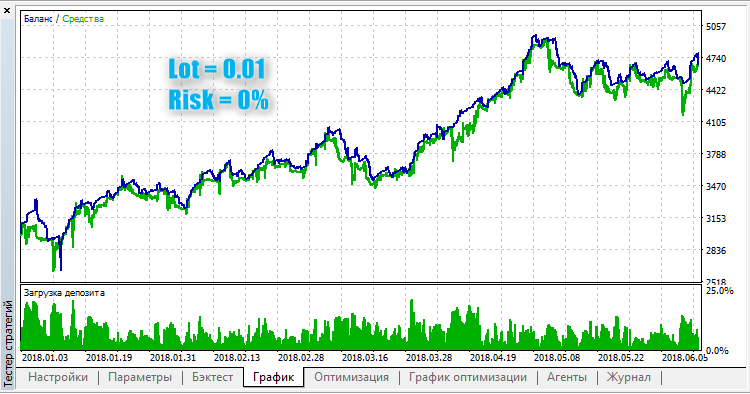

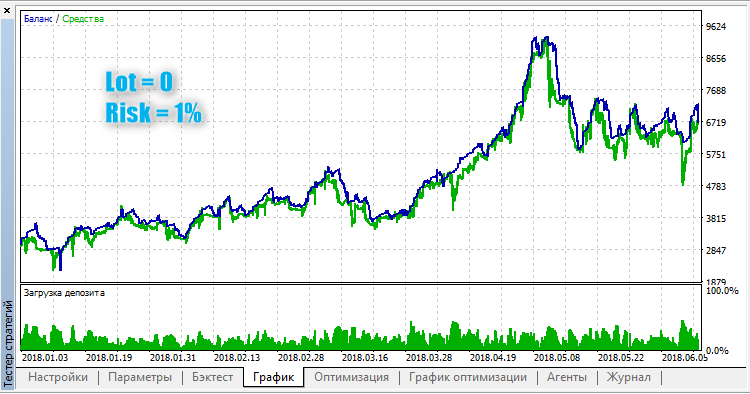

Lot size calculation method impact: Whether the lot size is constant or dynamic

Fig. 1. Constant lot size

Fig. 2. Dynamic lot size

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/21124

Hangseng Trader

Hangseng Trader

A trading system based on object Fibonacci Lines (OBJ_FIBO) and on indicator Resistance & Support

ADX trend smoothed - multi time frame

ADX trend smoothed - multi time frame

ADX trend smoothed - multi time frame

Candle shadows v1

Candle shadows v1

Candlestick size and shadow analysis. In OnTradeTransaction, opening (DEAL_ENTRY_IN) and closing (DEAL_ENTRY_OUT) the positions are intercepted, as well as closing by Stop loss (DEAL_REASON_SL).

VR Atr pro Lite MT5

VR Atr pro Lite MT5

Indicator Atr Lite calculates the average price motion