당사 팬 페이지에 가입하십시오

Oscillator Notis% V measures the market volatility, based on the difference between the intraday High and Low.

Volatility is high, when the difference between lines Plus and Minus is large; volatility is low, when the difference is small.

The indicator can work in two modes of calculating and data providing:

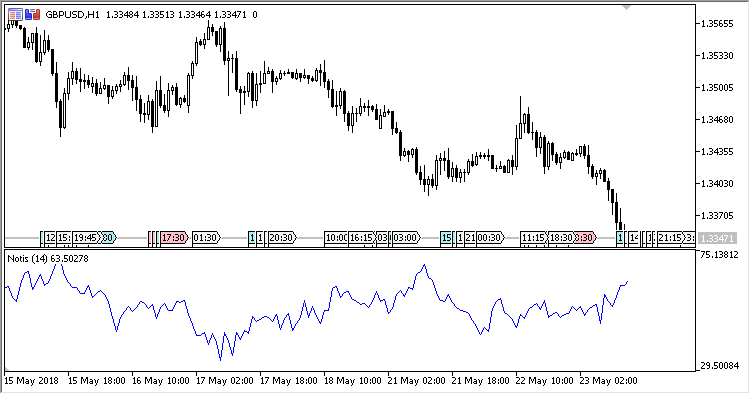

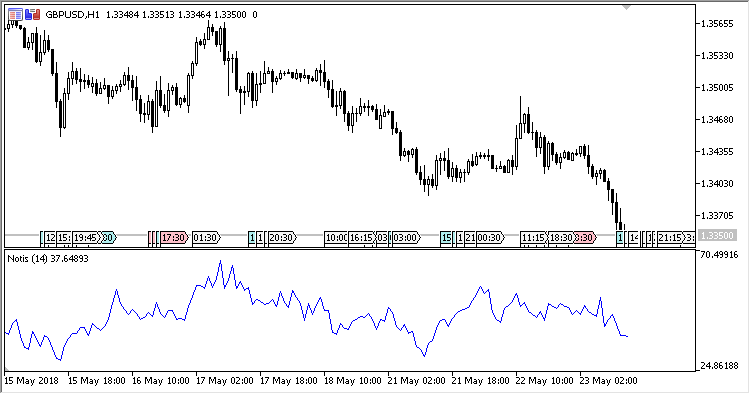

- Cumulative mode. In this mode, the indicator behaves as a normal oscillator having one line. In this mode, the indicator chart can also be inverted.

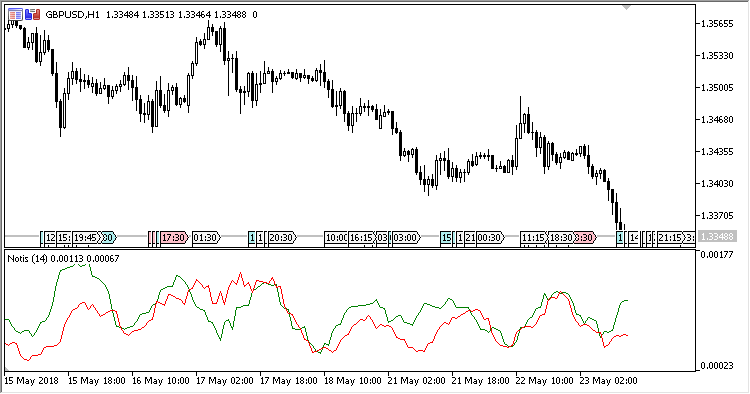

- Non-cumulative mode (by default). In this mode, the indicator shows two line: Plus and Minus. The difference between the lines points to the volatility level of the market. Crossing - direction.

The indicator has four input parameters:

- Period - calculation period;

- Method - averaging method;

- Cumulative mode - cumulative mode (switch Yes/No);

- Inverse in cumulative mode - inverting the indicator chart in cumulative mode (switch Yes/No).

Calculations:

NOTIS[i] = 100*Plus[i] / (Plus[i] + Minus[i])

where:

Plus = Moving Average(P, Period, Method) Minus = Moving average(M, Period, Method) P[i] = High[i] - Close[i] M[i] = Close[i] - Low[i]

Fig.1. mode by default

Fig.2. Cumulative mode without inverting

Fig.3. Cumulative mode with inverting

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/20861

TradingBoxing

TradingBoxing

Trading panel based on class CDialog.

MACD_Squeeze

MACD_Squeeze

Oscillator MACD Squeeze similar to indicator Trade The Markets Squeeze, but based on MACD.

PDO

PDO

Indicator PDO (Percent Difference Oscillator).

AnalysisOnBars

AnalysisOnBars

Informational indicator AnalysisOnBars shows bars without considering the price. Bars are shown in points.