Conor Mcnamara / プロファイル

- 情報

|

2 年

経験

|

8

製品

|

4

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

I started learning C programming in 2010. From there I picked up many languages.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

Conor Mcnamara

testing my "statistical zigzag" on bitcoin, it's essentially a breakout indicator based on standard deviation volatility

Conor Mcnamara

パブリッシュされたコードStatistical Zigzag

これは、ボラティリティのしきい値を通過することに基づいて、新しいジグザグの転換点を作成するジグザグです。

ソーシャルネットワーク上でシェアする

89

420

Conor Mcnamara

"Until you do what you believe in, you don't know whether you believe it or not."

- Leo Tolstoy

- Leo Tolstoy

Conor Mcnamara

パブリッシュされたプロダクト

Imagine flying a real aircraft without ever stepping into a flight simulator. That's what trading is like. You have to simulate your strategy before you can take it to a live market. It is good if you can simulate things speedily before even stepping into any live market, or before coming up with an automated system. People don't have all day to stare at a higher timeframe chart until the entry signal finally arrives. That's why I built this so that you can simulate your strategy with

Conor Mcnamara

The manual trading simulator is completed, I have nothing more to do on it. It is good I asked in the forum if it was possible to make buttons work in the EA tester...because sometimes there is a solution found by someone, and it saves you from thinking that it might not be possible.

Conor Mcnamara

Keep this is mind when it comes to automated trading:

- An EA that was designed for a particular market style (trending/volatile/ranging) is unlikely to work properly in other market styles with the default setting.

- If a market is choppy, a setting has to be created to account for that, and that takes understanding of technical market dynamics.

The other world of automated trading is quantum/adaptive where it is not trading like a trader anymore and is using complex adaptive algorithms.

It's not fully known if this is more profitable or risky, or whether keeping it simple is more profitable. Simple systems can offer transparency. Complex systems come with validation challenges and opacity.

Personally I see markets as something that alternates primarily because of news and data releases. Both algorithms and manual traders react to that.

If a position is opened by a simple EA, the user must have due diligence and decide if the trade should sit there, or if it should be closed soon based on current news, and not the news that was published at the trade open time.

- An EA that was designed for a particular market style (trending/volatile/ranging) is unlikely to work properly in other market styles with the default setting.

- If a market is choppy, a setting has to be created to account for that, and that takes understanding of technical market dynamics.

The other world of automated trading is quantum/adaptive where it is not trading like a trader anymore and is using complex adaptive algorithms.

It's not fully known if this is more profitable or risky, or whether keeping it simple is more profitable. Simple systems can offer transparency. Complex systems come with validation challenges and opacity.

Personally I see markets as something that alternates primarily because of news and data releases. Both algorithms and manual traders react to that.

If a position is opened by a simple EA, the user must have due diligence and decide if the trade should sit there, or if it should be closed soon based on current news, and not the news that was published at the trade open time.

Conor Mcnamara

The answer is 2, it's still going down.

Because THAT is known as a liquidity trap which traps a lot of novice traders.

Because THAT is known as a liquidity trap which traps a lot of novice traders.

Conor Mcnamara

Trading quiz.

Where do you think the price is going?

1. Support is found, it's going up again

2. Still going down

Where do you think the price is going?

1. Support is found, it's going up again

2. Still going down

Conor Mcnamara

My next project is to create a system that allows you to buy and sell manually in the actual EA strategy tester. I don't even know if this works yet. But I think that if we could test our strategy AT SPEED it would be good.

Conor Mcnamara

パブリッシュされたコードIndicator loader for strategy testing

ストラテジーテスターで最大4つのインジケーターを同時にテストするシステム

ソーシャルネットワーク上でシェアする

95

372

Conor Mcnamara

パブリッシュされたコードZigzag Custom Timeframe

LTFチャート上にHTFジグザグを表示するために、時間枠を入力する古典的なジグザグです。

ソーシャルネットワーク上でシェアする · 1

112

406

Conor Mcnamara

パブリッシュされたコードOHLC Candles with extreme tick price tracking

これはOHLCローソク足チャートで、新しいバーごとにアスクの最高値とビッドの最安値を記録します。

ソーシャルネットワーク上でシェアする

116

271

Conor Mcnamara

パブリッシュされたコードOHLC Candles with Ask and Bid

アスク価格とビッド価格をローソク足の高値と安値で結んだローソク足チャート。

ソーシャルネットワーク上でシェアする · 1

99

247

Conor Mcnamara

Conor Mcnamara

2025.10.11

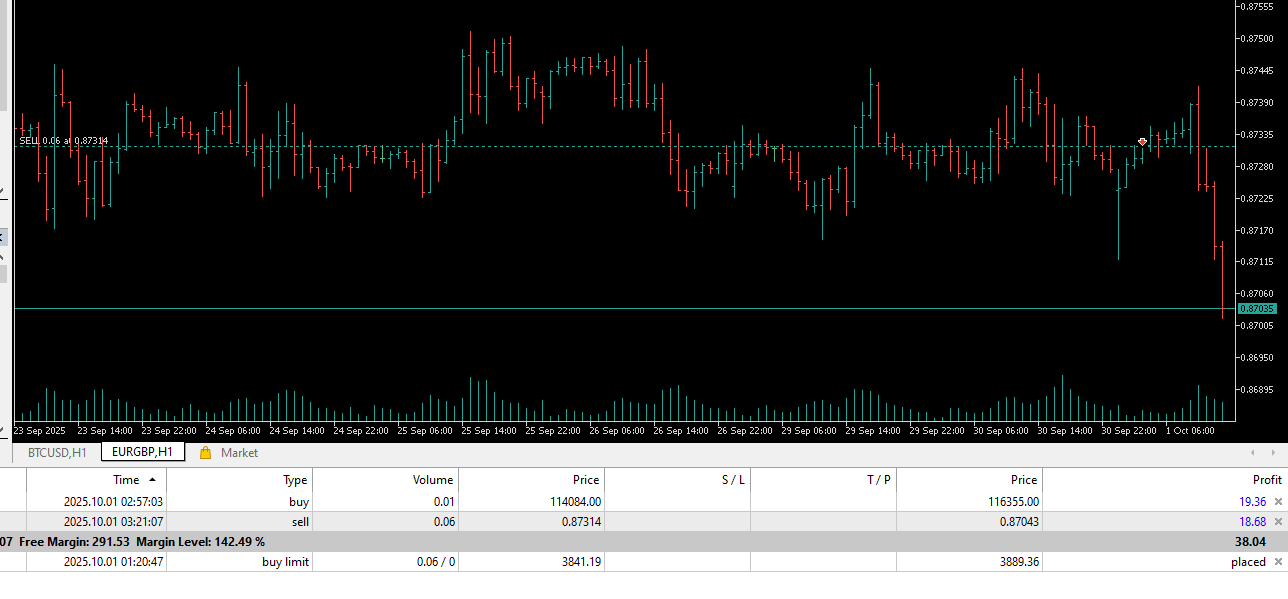

This was a manual trade. It was a Sell Limit placed at the daily vwap price when the dollar gained strength again. I would say this trade was a bit of luck too to get such a bid price

Conor Mcnamara

パブリッシュされたコードTrading Session Mapping

取引セッション名をブローカーサーバーの時間と現地時間に合わせるツール

ソーシャルネットワーク上でシェアする

120

461

Conor Mcnamara

パブリッシュされたコードVolatility Step Channel

ローカル高値とローカル安値をボラティリティ調整済みラインで計算するチャンネル

ソーシャルネットワーク上でシェアする · 1

114

438

Conor Mcnamara

this was another entry on the VWAP price

the way I see it, whether you buy or sell at this price, there's some profit there eitherway

I am on a demo account performing these tests where I put indicators into live testing

the way I see it, whether you buy or sell at this price, there's some profit there eitherway

I am on a demo account performing these tests where I put indicators into live testing

Conor Mcnamara

this entry was the VWAP price at the time I placed the buy limit, it seems like a good indicator to me, and it's downloadable on the codebase

Conor Mcnamara

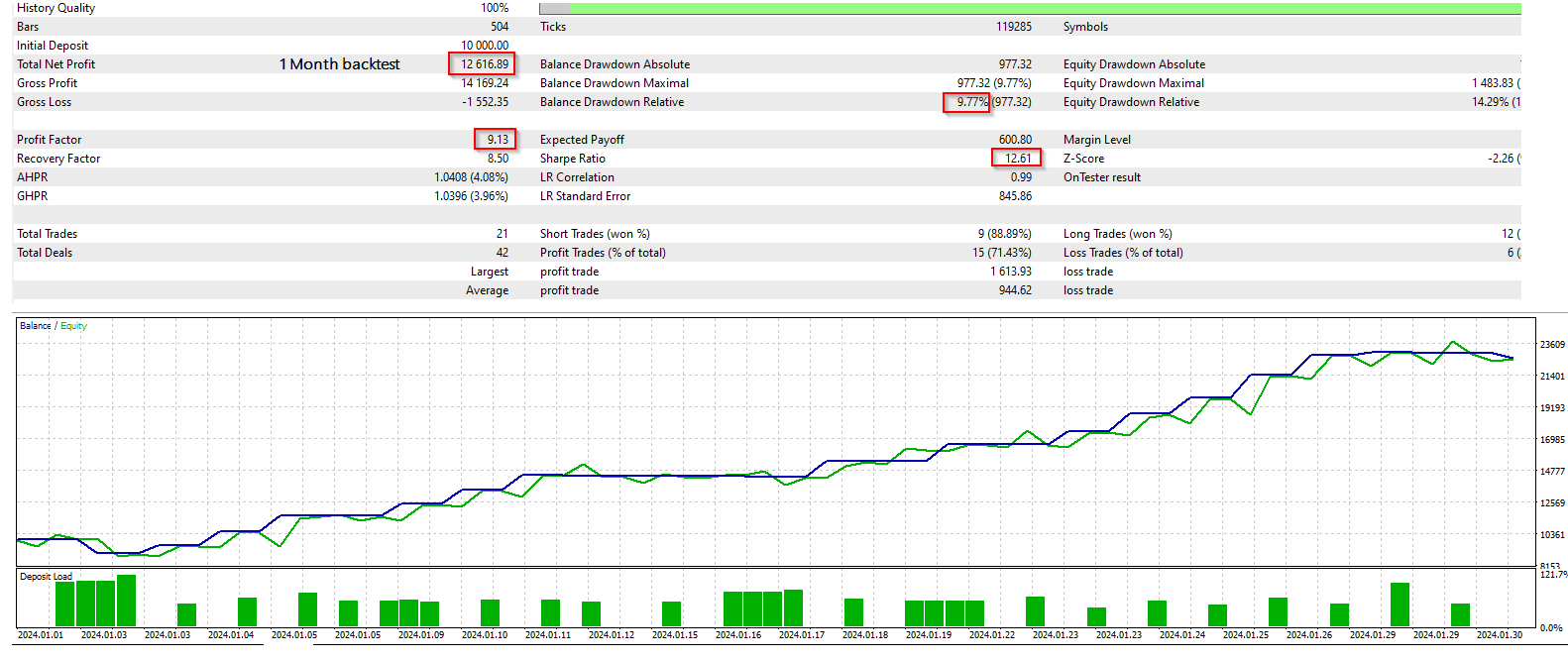

I used to think that from a 10K account and 1:33 leverage, a 1 month profit of 1 - 2K would be very good. But this current strategy is showing much greater alpha in one month.While I know that not every month can be the same, and that one month historical backtest means nothing for the future, it gives me an indication that this strategy has substance if it can show results like that. This is the power of ATR.

: