Conor Mcnamara / Profile

- Information

|

2 years

experience

|

8

products

|

4

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I started learning C programming in 2010. From there I picked up many languages.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I'm currently studying epistemological degeneracy in financial markets.

Conor Mcnamara

If you started electronic music production years ago, there isn't a valid reason to stop, so this is another prison I'm stuck in. I'm putting my dark techno experiments here https://m.soundcloud.com/conor_sp/

Conor Mcnamara

Sometimes it feels like you are constantly plugging holes in the sinking ship which is the public codebase, but you're running out of aborted fetuses

Conor Mcnamara

while profits can be made, I wouldn't advise shorting the dax, as it can be like running down an escalator that's moving up

Conor Mcnamara

Inducement. The marked areas outline where people think it's a good time to buy, and as a result, they fall victim to the bull trap. The indicator is calculating all of the manipulation areas, with one mode for buy side liquidity, and another mode for sell side liquidity. More info on the indicator soon

Conor Mcnamara

Trying the "Premium Discount Array" strategy, and so far it seems reasonable. We sell at the premium prices, and buy at the discount prices. You have to wait for the correction at the premium/discount price before you enter the trade, otherwise you might have a loss if there's a trend continuation

Conor Mcnamara

2025.12.18

thanks, this strategy centers on the recent D1 candle where it is divided into quadrants, I am then viewing these quadrants on a lower timeframe. I'm growing more interested in this concept, and I might publish the indicator soon

Conor Mcnamara

Limit orders that are far away from the current price can get the position liquidated easily. Wait for momentum.. and don't idolize those screenshots people post sometimes of very clean buy and sell trades on the wick. Some of those screenshots could easily be fake.

Conor Mcnamara

Sometimes gambling can go in your favor, but the one time I gambled during the FTMO challenge, I lost a good 500 usd. The moment you feel confident that the resistance won't break, it will break. The support or resistance can break any time. Remember that.

I'm back up again by strictly following the strategy, and until now I kept my drawdown under 5%. Don't gamble

I'm back up again by strictly following the strategy, and until now I kept my drawdown under 5%. Don't gamble

Conor Mcnamara

the bitcoin direction in the immediate term is up, but the quadratic polynomial calculation is showing that it is ultimately in a bearish trend

Conor Mcnamara

We need to discuss the ambiguous nature of financial news publications. The broker is often releasing the news too us too late, after the fact, after the trend had already concluded (not always did it conclude, but sometimes!) So, as a retail trader, we have to ask what the news should be used for, and what purpose it serves us given that we get it too late. We can't use it for entries - not unless it is very high impact and a longterm policy change. I am now only using any incoming news as a tool to decide whether I could hold a trade or not that I had already entered. I cannot trust incoming news for entries. You will have more luck with a MACD signal than news for entries...because just look at what happened yesterday. They tell us the United States ISM services PMI was below expectations, and when they released this, EURUSD went DOWN instead of UP. Because it had already gone up you see. The trend already ended and bears came back into the market.

Anil Varma

2025.12.04

Hi Conar, With AI/ML general recommendation, technical indicators works best. In top ~30 filtered TA, news related filter could be just one, or it may not even qualify to the filtered list. I would suggest to ignore it at all.

Conor Mcnamara

2025.12.04

You're right, the indicators (especially momentum) find the structural changes before the news is released to us. I thought it was a myth before that the news has a delayed release for retail traders, but it is truth. This is an interesting video https://www.youtube.com/watch?v=I8F0chtO1is

Conor Mcnamara

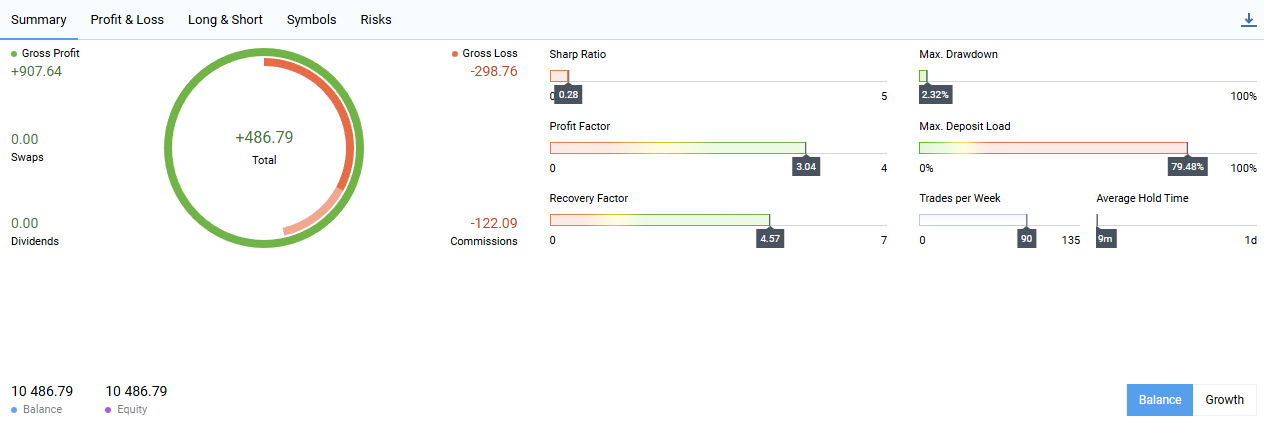

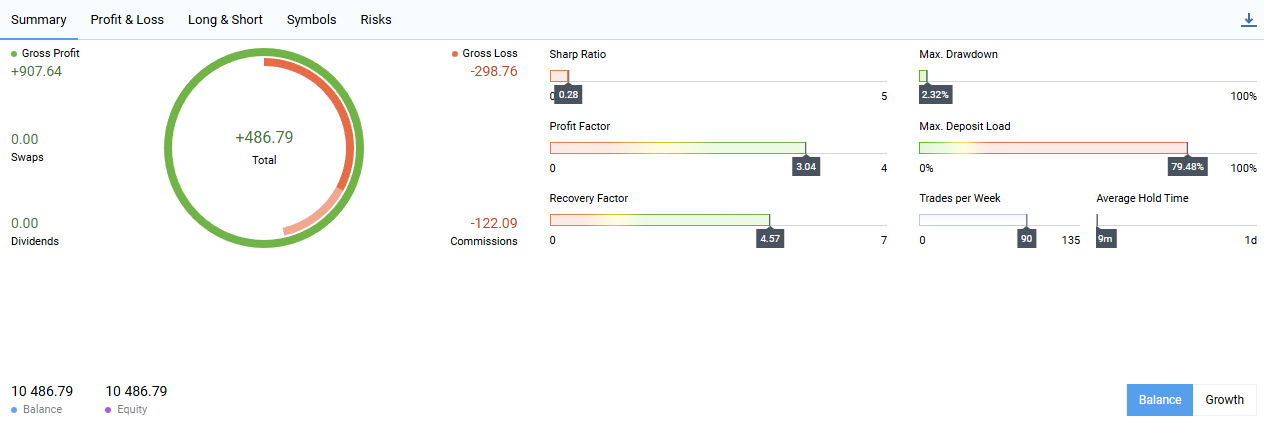

Week 1 of FTMOs Trading Challenge... 4 days trading, very bad week to trade, but I still found opportunities

Conor Mcnamara

I am a developer, but yet I might buy your products. The world is bigger than ourselves.

Conor Mcnamara

I have never tried prop firms until now where I took the FTMO trading challenge 3 days ago. So far so good, I don't think it is too difficult

Conor Mcnamara

Some people say that intraday scalping is for naive people who think it's profitable. It is profitable...but has to be done dexterously, and it is not for beginners. I am still trying to refine my approach all the time. I'm at a point where my entries are actually good, but I still don't trust them, so my error right now is to close positions too soon. Still trying to improve my trading.

Conor Mcnamara

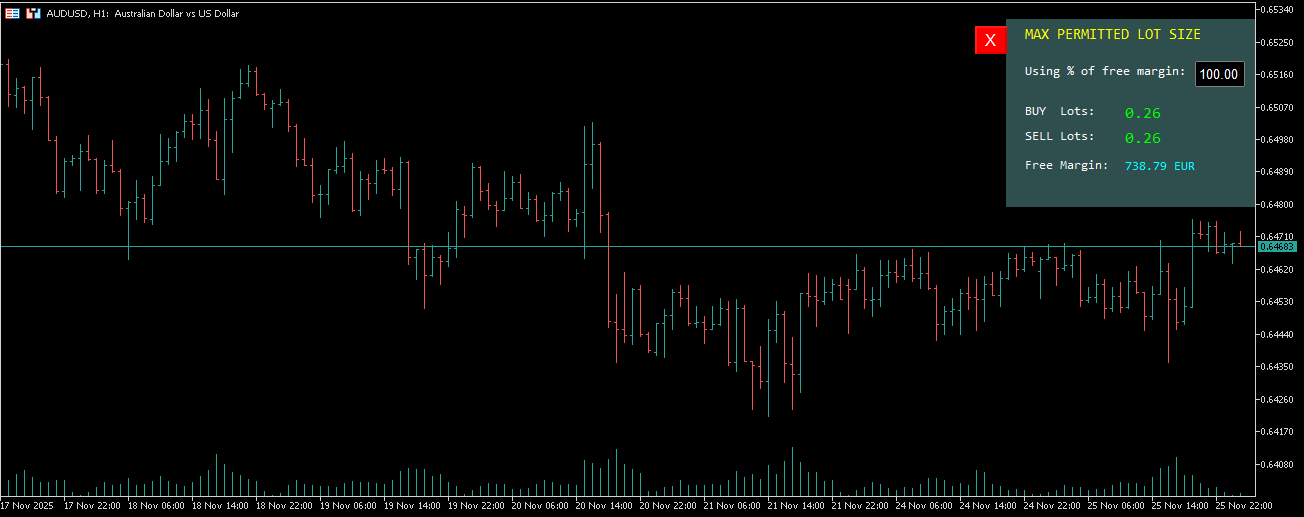

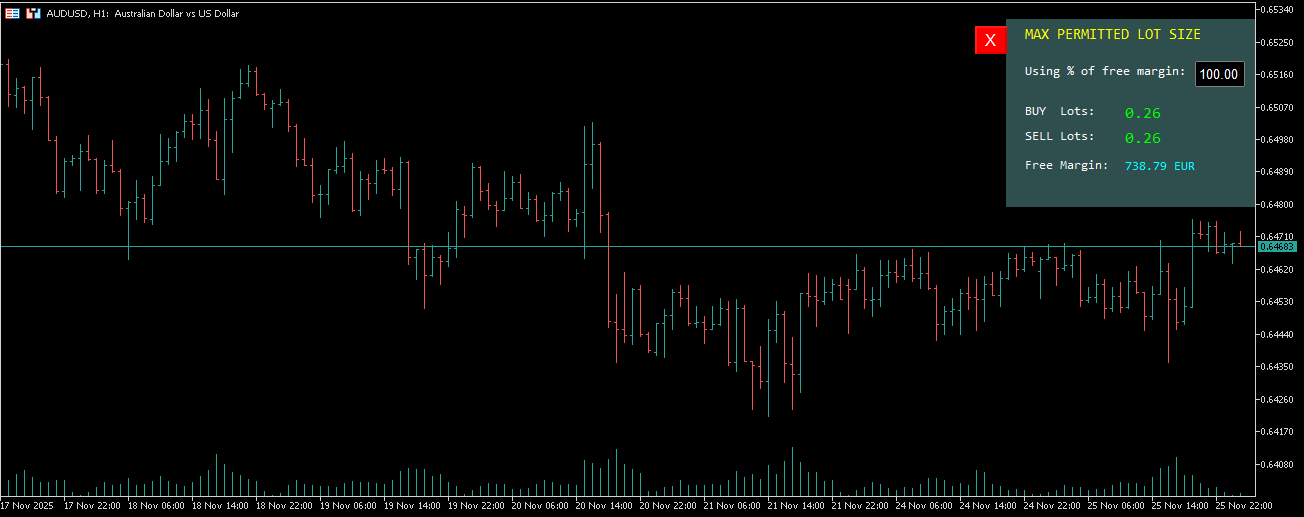

I made a new look and feel to the max lot script, which now includes percentage of max input. It's available for free on the seller page

Conor Mcnamara

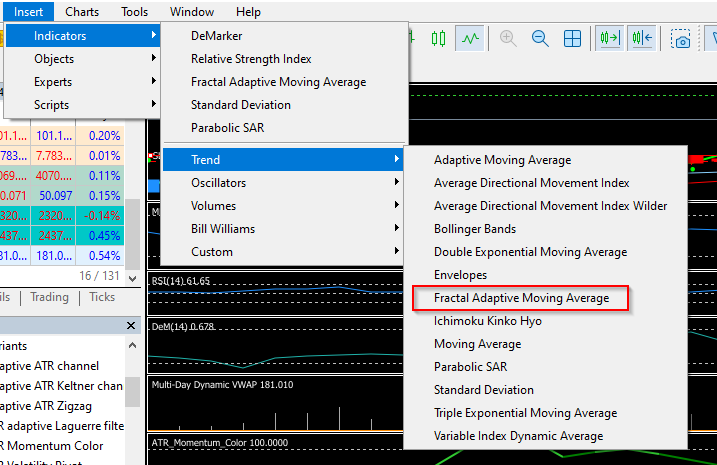

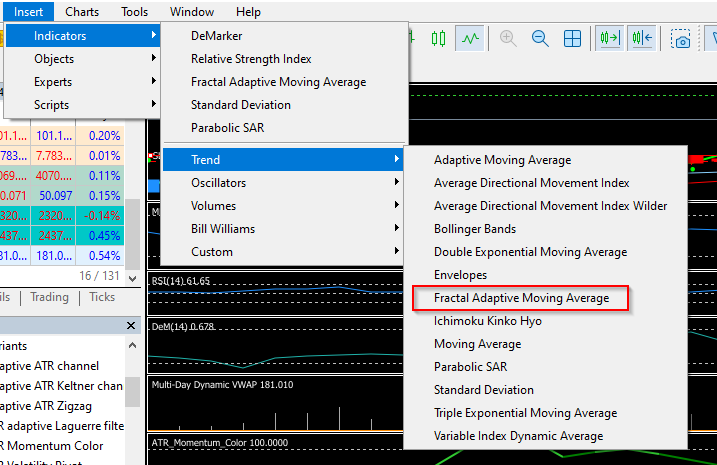

This is a nice trend indicator that comes with Metatrader. It may catch breakouts like CHoCH breakouts.

: