Happy Tigris

- Indicatori

- Pui Yan Leung

- Versione: 1.0

- Attivazioni: 5

Overview

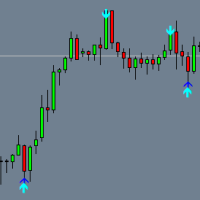

Happy Tigris is a technical analysis tool designed for medium-to-long-term trend following. Its core logic utilizes a dual-custom baseline system to filter market noise. The Fast Line reflects immediate price fluctuations and short-term reversals, while the Slow Line defines the overall trend direction. Depending on the price position relative to these baselines, candlesticks automatically change color and saturation based on market risk and trend strength, allowing traders to identify the current market state at a glance.

Key Features

- Dynamic Trend Baselines: Utilizes an algorithm based on the average of highs and lows, offering a more responsive reflection of support and resistance zones compared to traditional Moving Averages.

- Intelligent Risk Color Coding: Integrates ATR (Average True Range) percentile calculations. During periods of high volatility, colors become deeper and more saturated to alert traders of high-risk conditions.

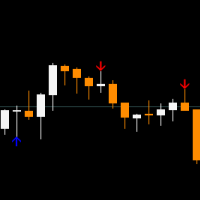

- Fast Line Visual Navigation: Acts as a short-term trend filter and provides entry reference points.

- Slow Line Visual Navigation: Serves as the long-term trend defense line, defining the macro bullish or bearish market sentiment.

- Automated State Filtering: When the price is within the "Transition Zone" (between the upper and lower baseline rails), colors turn neutral gray to help traders avoid over-trading during sideways markets.

Optimized Settings

- Best Timeframes: Most effective on 1-Hour (H1) or 4-Hour (H4) charts for swing trading.

- Applicable Markets: Performs best in markets with strong trending characteristics, such as Forex, Gold, or Cryptocurrencies.

Limitations

- Slow Line Lag: Due to its nature, the slow line may respond late during violent market reversals.

- Sideways Market Attrition: During horizontal consolidation, frequent price crosses over the fast line may result in "whipsaw" or false color signals.

- Volume Requirement: Since the indicator is primarily based on price action and volatility, it is highly recommended to use it alongside volume indicators to confirm the validity of breakouts.