SnR Engine

- Indicatori

- Muhammad Tamimul Huda

- Versione: 1.0

- Attivazioni: 10

SnR Engine – Adaptive Volatility Structure

Technical Summary:

SnR Engine is a technical indicator that maps market structure (Support & Resistance) using an adaptive, volatility-based approach (ATR). It is designed to solve classic problems found in conventional fractal indicators, specifically visual clutter ("barcode effect") and false signals caused by market noise.

Problems Solved:

-

Visual Clutter: Standard SnR indicators often draw lines at every minor fractal point, obscuring candlesticks and complicating chart analysis.

-

Static Parameters: Using fixed distances (e.g., "20 Pips Zone") is ineffective across instruments with different volatility profiles (e.g., XAUUSD vs. EURUSD).

-

Zombie Levels: Old levels that have already been invalidated often remain on the chart, creating false visual bias.

Mechanism & Algorithm Logic:

The indicator operates through three stages of data processing:

-

Fractal Detection:

The algorithm scans for local Swing Highs and Swing Lows based on candle formations.

-

Smart Merging:

Instead of drawing every fractal individually, the indicator calculates the distance between levels using ATR (Average True Range). If multiple fractals appear near each other within a specific ATR tolerance radius (Input: Zone Merge ATR), these levels are merged into a single, solid zone. This drastically reduces noise.

-

Breakout Validation:

A zone is considered valid (active) as long as the price has not breached it. Breakout validation is strict: the price must Close beyond the zone limit plus a volatility buffer (Breakout ATR). This prevents false signals caused by candle wicks.

-

Resource Management:

An internal "Garbage Collection" system automatically removes invalid/dead zones from memory to ensure MT5 performance remains lightweight, even when applied to multiple charts.

How to Read the Indicator:

-

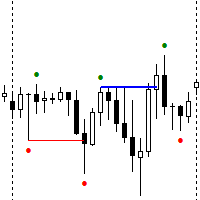

Solid Lines (Red/Blue):

Indicate Active Zones.

-

Red: Active Resistance. Price is expected to reject downward or stall in this area.

-

Blue: Active Support. Price is expected to bounce upward.

-

Note: Thicker lines indicate that multiple fractal points have been merged into that zone (higher strength).

-

-

Dotted/Gray Lines:

Indicate Broken Zones.

When a solid line turns into a dotted line, it serves as technical confirmation that the market structure has been breached. Breakout traders can use this transition moment as an entry signal or a warning of a trend change.

Use Cases:

-

Reversal Trading:

Place limit orders or look for reversal price action patterns when the price approaches a Solid Line. Use the line as an objective Stop Loss reference.

-

Breakout Trading:

Wait for a candle to validly close through a Solid Line (the line turns dotted). Enter positions in the direction of the breakout.

-

Trailing Stop Reference:

Use Solid Lines formed behind the current price as safe levels to trail your Stop Loss.

Key Input Parameters:

-

InpHistory: The number of past bars to analyze. (Recommended: 500-1000 for maximum efficiency).

-

InpZoneMergeATR: The tolerance threshold for merging zones.

-

High Value (e.g., 1.0 - 1.5): Produces a very clean chart; only major levels appear.

-

Low Value (e.g., 0.5): Displays more minor market structure details.

-

-

InpBreakoutATR: The minimum breakout distance. Determines how far the price must close beyond a zone to be considered a valid breakout.