VWAP with Standard Deviation Bands

- Indicatori

- Michael Johnson

- Versione: 1.0

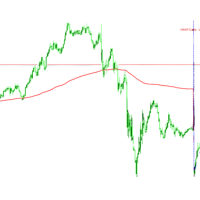

Volume Weighted Average Price is used by financial institutions to place large trades at what is considered the fair value for the session. Standard deviation channels around VWAP provide potential entry points for mean reversion or breakout strategies, and the VWAP itself can act as a high quality exit level.

If you've heard that volume-based analysis doesn't work for forex and CFDs, try looking at VWAP with standard deviation bands on a chart, and note the frequency with which price reacts to these levels. VWAP doesn't require centralized volume data; it only requires volume values that scale relative to the other values on the same chart. Because tick volume correlates closely with centralized trade volume, VWAP can be equally effective with forex and CFDs as it is with futures and stocks.

This implementation of VWAP has 6 inputs:

- Anchor time - hours: the hour at which the VWAP should reset

- Anchor time - minutes: the minute at which the VWAP should reset

- Period (days): the number of days between VWAP resets (typically 1 or 7)

- Band size (standard deviations): the width of the VWAP bands expressed in standard deviations of price (typically 2)

- Color: The color of the VWAP bands

- Applied volume: use "tick volume" for forex and CFDs and "real volume" for futures and stocks.

This indicator has 3 buffers:

- The VWAP price

- The upper band price

- The lower band price