CRT Ghost Candle HTF Fractal

- Indicatori

- Ravi Gurung

- Versione: 4.1

- Aggiornato: 26 gennaio 2026

- Attivazioni: 8

An Institutional-grade CRT Ghost Candle & HTF Fractal framework that projects higher-timeframe structure, liquidity sweeps, and directional bias directly onto lower timeframes, built for serious discretionary traders.

Overview & Trading Concept

CRT Ghost Candle HTF Fractal is an advanced market structure and liquidity visualization indicator designed to compress higher timeframe logic directly onto your working chart without switching timeframes.

This indicator fuses Candle Range Theory (CRT), Higher Timeframe (HTF) ghost candles, fractal-based sweep logic, and a real-time bias dashboard into a single, clean, performance-optimized framework.

The objective is simple and professional: reduce chart switching, remove subjective bias, and expose where liquidity is engineered and executed.

Modern price delivery is range-driven and liquidity-dependent. The indicator is built around the idea that price reacts to higher-timeframe ranges and that liquidity sweeps often precede directional expansion. CRT Ghost Candle HTF Fractal makes these principles visible, measurable, and actionable directly on lower timeframes.

What the Indicator Displays on the ChartThe indicator displays the following visual elements directly on the chart: higher-timeframe ghost candles (user-selectable TF1 and TF2) projected on the right side, CRT High (CRT H) and CRT Low (CRT L) levels with state-based coloring, pending and confirmed liquidity sweep markers with “S” labels on TF1 and TF2, optional higher-timeframe reference levels based on current and previous candle ranges, and a compact market bias dashboard showing Daily and Weekly directional bias.

All objects are drawn using non-repainting, close-based logic and update only when confirmation conditions are met.

Key Components Explained

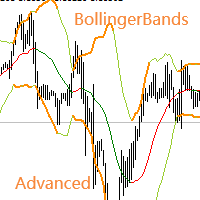

Higher Timeframe Ghost Candles

The indicator visually projects higher-timeframe candles such as H1 and H4 (user-selectable) onto the right side of the active chart. This eliminates constant timeframe switching, maintains higher-timeframe context while executing on lower timeframes, and preserves candle structure including open, high, low, and close.

Traders use these projections to identify higher-timeframe highs and lows acting as liquidity magnets, align entries with higher-timeframe candle direction, and anticipate expansion once higher-timeframe ranges are engaged. Ghost candles are dynamically spaced, auto-shifted, and optimized to avoid chart clutter.

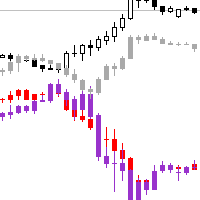

Candle Range Theory (CRT) Trap Levels

The indicator automatically detects CRT trap conditions where price sweeps a prior candle’s high or low, closes back inside the range, and leaves unfilled liquidity behind.

Pending CRT levels remain solid with orange color, while completed CRT levels convert to grey with a check-mark. Clear labeling distinguishes active versus mitigated zones. CRT traps often mark institutional entry zones, failed breakouts, and high-probability reversal or continuation points. Detection is fully rule-based with no repainting and no subjective marking.

Smart Sweep Detection (Fractal Logic)

Built-in fractal logic identifies internal and external liquidity sweeps between consecutive higher-timeframe candles. Sweep markers highlight high sweeps and low sweeps, using close-based validation to confirm only valid events.

This allows traders to filter fake breakouts, enter after liquidity is cleared, and trade with displacement rather than anticipation.

In addition to TF1 sweeps, the indicator also validates higher-timeframe (TF2) liquidity sweeps. When a TF2 sweep meets confirmation conditions, the sweep line transitions from dotted to solid and displays an “S” label, indicating a confirmed higher-timeframe liquidity event rather than a visual projection.

Institutional Bias Dashboard

A lightweight, non-intrusive dashboard displays Daily and Weekly bias along with the reason for bias, such as CRT sweep, failed break, range expansion, or inside-range conditions. Bias is calculated using objective rules rather than oscillators or lagging indicators.

This feature is valuable for intraday traders aligning with higher-timeframe direction, swing traders managing directional exposure, and traders avoiding overtrading during neutral conditions.

Standard Higher-Timeframe Levels (Optional)

For traders who prefer structured reference points, the indicator can optionally plot current candle highs and lows (C0), previous candle highs and lows (C1), and historical reference levels (C2). All levels are toggle-based, thickness-adjustable, and label-optional, allowing the tool to adapt to both minimalist and structure-heavy workflows.

Who This Indicator Is ForThis indicator is not designed for indicator stacking or signal chasing. It is ideal for traders who trade price action, liquidity, and market structure, use ICT, CRT, SMC, Wyckoff, or institutional models, execute on M1–M15 while respecting H1–H4 context, and prefer clarity over complexity.

It is suitable for Forex, indices, Gold, CFDs, and crypto markets (broker-dependent).

Key Advantages

The indicator uses non-repainting logic, avoids lagging indicators, and does not stack indicators within indicators. It is fully object-based for fast and stable performance, optimized for chart shifting and object recycling, and designed for real trading environments rather than screenshots.

Customization, Inputs & ControlAll major components are user-controlled, including timeframe selection and visibility for TF1, TF2, and higher-timeframe layers, enabling or disabling individual higher-timeframe projections, chart theme or chart scheme control with an option to keep the user’s existing chart settings, ghost candle count and spacing, CRT detection depth and sweep validation, visual styling and label controls, and dashboard positioning and density.

All inputs are optional and designed to adapt the indicator to different trading styles and chart preferences without altering core logic. Users can preserve their existing chart theme or apply a preferred chart scheme directly from the indicator input settings.

First-Time User Setup (Recommended)

For best experience, attach the indicator to a clean chart, start with default input settings, and choose appropriate timeframe combinations such as M5 with H1 and H4, or M15 with H4 and Daily. Adjust chart zoom or scale if higher-timeframe ghost candles extend beyond the visible area, and optionally customize colors and visual density from the Inputs tab. The indicator works correctly on both light and dark backgrounds and updates only on candle close for confirmation-based analysis.

Important Notes

The indicator is intended for analytical and educational purposes only. It does not provide trade signals or automated entries, offers no guarantees of profitability, and requires proper trader discretion and risk management.

Final Positioning

CRT Ghost Candle HTF Fractal is a context engine, not a signal generator. It shows where liquidity is taken, where higher-timeframe intent exists, and where price is most likely to react next. For traders focused on structure, range, and intent, it functions as a core decision-support tool rather than an overlay.

FAQs

Does this indicator repaint?

No. All CRT levels, ghost candles, and liquidity sweeps are confirmed using closed candles and historical validation.

Is this a signal or auto-entry indicator?

No. It is a discretionary, context-based decision-support tool.

Can this be used with ICT or SMC models?

Yes. The logic aligns directly with CRT, liquidity sweeps, and higher-timeframe structure.

Which timeframes work best?

Execution is typically performed on M5–M15 while structure and bias are derived from H1 and H4.

Why are some HTF ghost candles partially outside the chart on lower timeframes?

This is due to MetaTrader chart auto-scaling and does not indicate repainting or incorrect calculations.

Can I use this on a dark chart background?

Yes. Users can enable “Keep Your Chart Settings” to preserve their preferred background and colors.

Will this slow down my platform?

No. The indicator is performance-optimized and object-based.

Is this suitable for beginners?

It is best suited for traders with basic understanding of price action and market structure.

the CRT Ghost Candle indicator is a solid visual tool for identifying candle range behavior and potential momentum shifts. It helps simplify price action by clearly highlighting ghost candle formations without cluttering the chart. Best used with higher-timeframe bias and structure for confirmation rather than as a standalone signal. Overall, a useful addition for traders focusing on CRT and price-action concepts.