Dynamic Momentum Oscillator System

- Indicatori

- AL MOOSAWI ABDULLAH JAFFER BAQER

- Versione: 1.0

- Attivazioni: 5

Dynamic Momentum Oscillator System: Trade with the Trend, Adapt to Volatility

Are you tired of oscillators that give false signals in choppy markets and lag behind strong trends? The Dynamic Momentum Oscillator System is a professionally engineered trading tool designed to overcome these exact challenges. It's not just another indicator; it is a complete trading system that provides clear, actionable signals by intelligently adapting to ever-changing market conditions.

The Logic: A Deeper Look Inside

This system is built on a sophisticated, multi-layered approach to market analysis. It combines a robust momentum calculation with a unique, self-adjusting band system that filters out market noise and keeps you on the right side of the trend.

1. The Core Momentum Engine

Unlike standard oscillators that rely solely on the closing price, our system calculates momentum using three key data points on every bar: the high, the low, and the close. This triple-analysis provides a far more comprehensive and stable view of market pressure. The values are then processed, sorted, and averaged to create a single, smooth momentum line that accurately reflects the true underlying energy of the market, reducing the impact of sudden, misleading spikes.

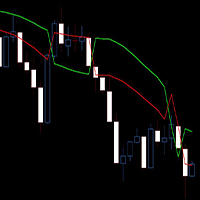

2. Dynamic, Volatility-Adjusted Bands

This is the feature that sets the system apart. Instead of using fixed overbought and oversold levels like a traditional RSI or Stochastics, our indicator calculates market volatility in real-time. It then uses this volatility data to create dynamic upper and lower bands.

-

In high-volatility markets: The bands automatically widen, giving the price more room to move and preventing you from being stopped out prematurely.

-

In low-volatility, quiet markets: The bands tighten, increasing sensitivity and allowing you to catch breakouts early.

3. Built-in Trend Following Intelligence

The bands are more than just boundaries; they are a core part of the trend-following logic.

-

Entering an Uptrend: When the momentum line breaks decisively above the upper band, the system confirms an uptrend. The upper band then disappears, and the lower band turns lime green. This green line now acts as a dynamic support level, rising with the trend but never moving down, effectively trailing your position and helping to lock in profits.

-

Entering a Downtrend: When the momentum line breaks below the lower band, a downtrend is confirmed. The lower band vanishes, and the upper band turns orange-red. This red line becomes your dynamic resistance level, falling with the trend but never moving up.

This intelligent mechanism ensures you are not just guessing the trend; you are following signals generated by the market's own momentum and volatility.

Key Features

-

Adaptive Bands: Automatically adjust to market volatility for more reliable signals.

-

Advanced Momentum Calculation: Uses High, Low, and Close prices for a more accurate reading of market strength.

-

Integrated Trend Filter: The color-changing bands provide a clear, visual confirmation of the current trend direction.

-

Fully Customizable: Adjust every parameter, including the momentum period, volatility period, band width, and smoothing method to fit your personal trading style.

-

Four Smoothing Methods: Choose between Simple, Exponential, Smoothed, and Linear Weighted moving averages to fine-tune the indicator's responsiveness.

How to Trade with the System

Trading with the Dynamic Momentum Oscillator is intuitive.

-

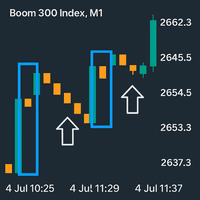

Buy Signal: Wait for the momentum line to cross above the upper band. The band will then turn lime green and act as your trailing support. Consider entering a long position, using the green line as a guide for your stop loss.

-

Sell Signal: Wait for the momentum line to cross below the lower band. The band will then turn orange-red and act as your trailing resistance. Consider entering a short position, using the red line as a guide.

-

Exit Signal: An exit signal is generated when the opposite signal occurs. For example, if you are in a long trade (with the green support line active), you would consider exiting when the momentum line breaks down and the red resistance line appears.

The Dynamic Momentum Oscillator System offers a clear and logical approach to trading. It helps you stay in profitable trends longer and avoid ranging, directionless markets. Elevate your trading today with a tool that thinks, adapts, and performs.