GraphicPatternsBuilder

- Indicatori

- Vladimir Utkin

- Versione: 2.0

- Aggiornato: 15 agosto 2025

- Attivazioni: 5

Description of the "GraphicPatternsBuilder" Indicator

Principle of Operation and Advantages:

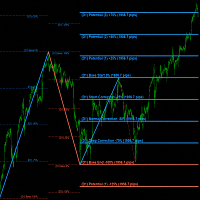

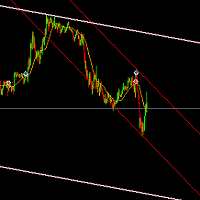

The indicator automatically plots support (green) and resistance (red) lines on the chart, identifying key price levels. Works on any asset (cryptocurrency, stocks, Forex) and all timeframes.

Key Advantages:

1. Automation of Routine Work – The indicator independently identifies significant extrema and draws lines.

2. Two Construction Algorithms :

- Type 1 : Line is built using two extrema (left and right).

- Type 2 : Line starts from an extremum and extends with minimal slope to the current zone.

3. Adaptability – Accounts for market volatility; does not redraw lines after bar formation.

4. Professional Visualization – Customize colors, thickness, and line styles to match your trading style.

Indicator Parameters

Basic Settings:

1. Line type :

- `By 2 extremums` – Classic construction via two extrema.

- `Extremum and delta` – Finds the line with minimal slope from the extremum.

2. Left extreme (default: 20):

- Number of bars *to the left* of the extremum confirming its significance.

3. Right extreme (for Type 1, default: 3):

- Number of bars *to the right* of the extremum for confirmation.

4. Offset from current bar (for Type 2, default: 3):

- Offset from the current bar to search for the endpoint of the line.

5. Consider the bar before the extreme (option for Type 2):

- Accounts for the bar preceding the extremum for more accurate calculation.

Display Settings:

- Color, thickness, and line style (dashed, solid, etc.).

- Auto-adjustment for dark/light chart themes.

Installation and Usage

Step 1: Installation in MT5

1. Download the file `GraphicPatternsBuilder.ex5`.

2. In MT5: File → Open Data Folder → MQL5 → Indicators.

3. Copy the file into the `Indicators` folder.

4. Restart MT5 or refresh the Navigator panel (Ctrl+N).

Step 2: Adding to Chart

1. Open an asset chart (e.g., BTCUSD).

2. In the Navigator panel, find the indicator under Custom Indicators.

3. Drag it onto the chart → configure parameters → click OK.

Step 3: Working with the Control Panel

- Apply: Apply new parameters (lines will rebuild).

- Hide: Hide the settings panel.

- Use the dropdown list to switch line types.

Trading Strategies for the Crypto Market

Strategy 1: Bounce from Levels

- Buy: When price touches support + confirmation signals (e.g., volume or "hammer" candlestick pattern).

- Sell: When testing resistance line + bearish patterns ("shooting star").

Strategy 2: Breakout of Level

- Support breakout → SELL signal. Stop-loss above the broken level.

- Resistance breakout → BUY signal. Stop-loss below the level.

Important for Cryptocurrencies:

- Lines are more accurate on H1+ timeframes.

- During high volatility (e.g., news), use Type 2: it accounts for trend "flatness".

- Combine with volume indicator: breakout with rising volume = strong signal.

Pattern Examples

1. Triangle:

- Support/resistance lines converge → breakout in trend direction.

2. Flag/Pennant:

- Correction to support line after sharp movement → trend continuation.

Key Notes

- Lines do not redraw after bar closure – eliminates false signals.

- For H4-W1 timeframes, reduce `Left extreme` (to 5–10).

- Use Type 1 in sideways markets, Type 2 in trends.

- Always apply the indicator to **major crypto pairs**: BTC/USD, ETH/USD, XRP/USD.

⚠️ Risk Management: Support/resistance lines are analysis tools, not guarantees. Always use stop-losses!

The indicator saves hours of manual work and helps you see the market through a professional trader’s eyes. For maximum efficiency, test parameters against your trading system!